Our group aims for a "resilient and sustainable society" by 2030, and is working to achieve this through corporate activities that create "stories of value creation."

As a management foundation to support this, we will implement transparent and highly effective corporate governance in our medium-term management plan (2022 -2025).

- In line with its Corporate Philosophy (Mission), MS&AD, as a holding company overseeing all group businesses, has established a management framework that ensures transparent, fair, swift and decisive decision-making that takes into account the standpoint of all stakeholders. The Company's objectives are to sustain stability and consistent growth over the long term by using corporate resources efficiently and managing risks properly and ultimately, to further increase enterprise value.

- To this end, the “MS&AD Insurance Group Corporate Philosophy (Mission), Corporate Vision, and Values” were formulated as something all officers and employees of the Group should adhere to in all situations. In addition to working to disseminate these principles among all officers and employees of the Company and its Group companies, corporate governance, compliance, and risk management are positioned as important management issues in the medium-term management plan, and efforts shall be made to actively promote that plan.

※There is a movement to set "Purpose" as an expression of the raison d'etre of a company separate from the management philosophy. However, because our group's Management Philosophy (Mission), which expresses the raison d'etre of a company in a simple and easy to understand manner, has already permeated throughout the Group, our group has determined that "Purpose" is the same as the Management Philosophy.

- As a company with an Audit & Supervisory Board, the Company will endeavor to improve governance by ensuring that independently appointed Audit & Supervisory Board Members appropriately act in their auditing functions, in addition to ensuring that the Board of Directors appropriately acts in its oversight functions, while strengthening the functions of each and actively disclosing information.

- The Company has formed the Governance Committee (made up of all outside directors, the Chairman of the Board, the Vice Chairman of the Board and the President) in addition to the Nomination Committee and Remuneration Committee (a majority of the members and a chairperson each have been appointed from among the Outside Directors) as internal committees of the Board of Directors, thus building a highly effective and transparent corporate governance system.

- The Company has introduced an executive officer system and is proceeding to delegate authority over business execution to these executive officers to ensure swift execution.

- In addition to matters specified by law and the Articles of Incorporation, the Board of Directors discusses and decides upon important matters involving Group management strategy and corporate management, including the Group's management policies, management strategies and capital policy, in addition to overseeing the duties of directors and executive officers.

- The Board of Directors allocates management resources according to risk appetite controlled with a balance of risk, return and capital, and aims to increase enterprise value in the medium-to-long term by achieving sustainable growth and improvement in earnings and capital efficiency with a foundation of soundness.

- In addition to appointing executive officers, the Board of Directors aims to separate management decision making and oversight by the Board of Directors from business execution by executive officers by clarifying their respective roles.

- Executive officers are responsible for executing business in the respective areas of business entrusted to them by the Board of Directors, and report on the status of business execution to the Board of Directors.

Composition of the Board of Directors

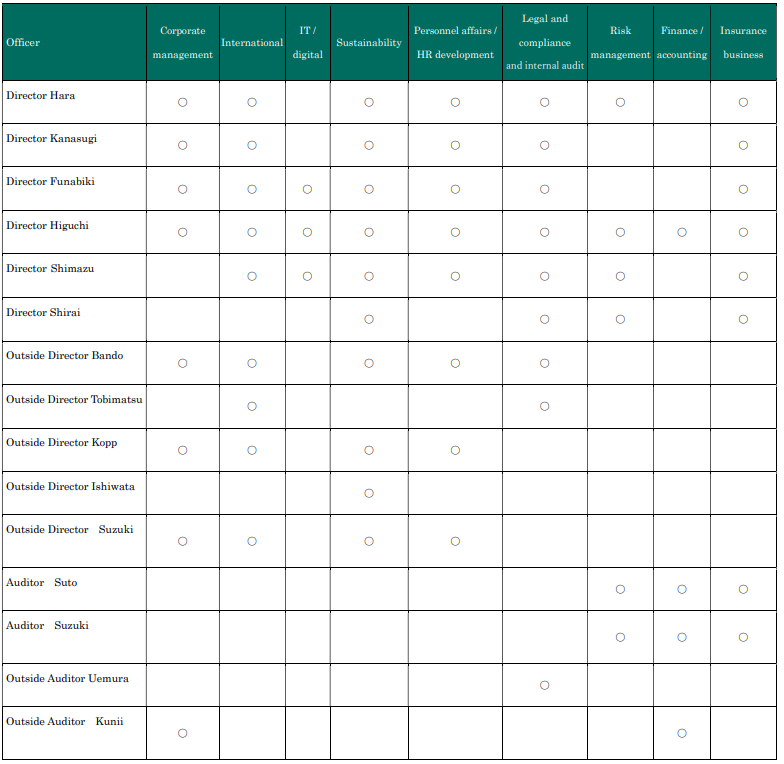

More than one-third of the Board of Directors which has eleven members (eight men and three women) are nominated as Outside Directors to incorporate perspectives independent from management, strengthen monitoring and oversight functions, and conduct highly transparent management. As shown below, we are striving to ensure diversity including gender, race, and nationality, while considering the balance of knowledge, experience and abilities of the Board of Directors as a whole. Please refer to Policies on the Board of Directors' Overall Balance of Expertise, Experience, Capabilities, Diversity, and Scale below.

Outside Directors are expected to perform the following roles:

- Provision of advice from a broad perspective on management policies and management improvement based on their knowledge and experience, with the aim of promoting sustainable corporate growth and increasing enterprise value over the medium-to-long term

- Supervising of management through important decision making at the board level

- Monitoring of conflicts of interest between the Company and related parties such as management* and/or major shareholders

- Realizing supervising from a standpoint independent of management by fulfilling accountability for stakeholders, including shareholders

* Collectively refers to the directors, Audit & Supervisory Board Members, and executive officers of the Company and domestic insurance companies in the Group in which the Company has a direct investment.

Aiming to enable Outside Directors to engage freely in constructive discussions and opinion exchanges, we have formed the following committee and meetings.

- Governance Committee (meets about twice a year)

- Outside Directors Council

- Outside Directors and Outside Audit & Supervisory Board Members Joint Council

Support for the activities of the Outside Directors is provided by the Corporate Planning Department, and support for the Outside Audit & Supervisory Board Members is supplied by the Internal Audit Department. The agenda for the Board of Directors' Meetings is explained to the Outside Directors and Outside Audit & Supervisory Board Members in advance of the meetings by the Corporate Planning Department, which acts as the secretariat for the Board of Directors. In addition, information, such as important risk information, is reported on an ongoing basis to all Directors and Audit & Supervisory Board Members, internal and external.

The Company has the following systems in place as required for Directors and Audit & Supervisory Board Members to effectively fulfill their roles and responsibilities:

- The Company has assigned a person in the secretariat of the Board of Directors to each of the Outside Directors and Outside Audit & Supervisory Board Members (hereinafter referred to as “Outside Officers”) to provide support in areas such as providing briefings in advance.

- The Company has established a system for ongoing provision of information and training at the time of appointment and during the term of Directors and Audit & Supervisory Board Members.

- The Company provides appropriate opportunities for Outside Officers to share information and exchange opinions with management and senior employees.

The Company bears the expenses required to enable Outside Officers to fulfill their roles.

In fiscal 2022, 8 seminars and study sessions were held for executives.

< Main themes >

"Natural capital", "Asset management strategies", the latest trends in IoT and AI, and "DE&I"

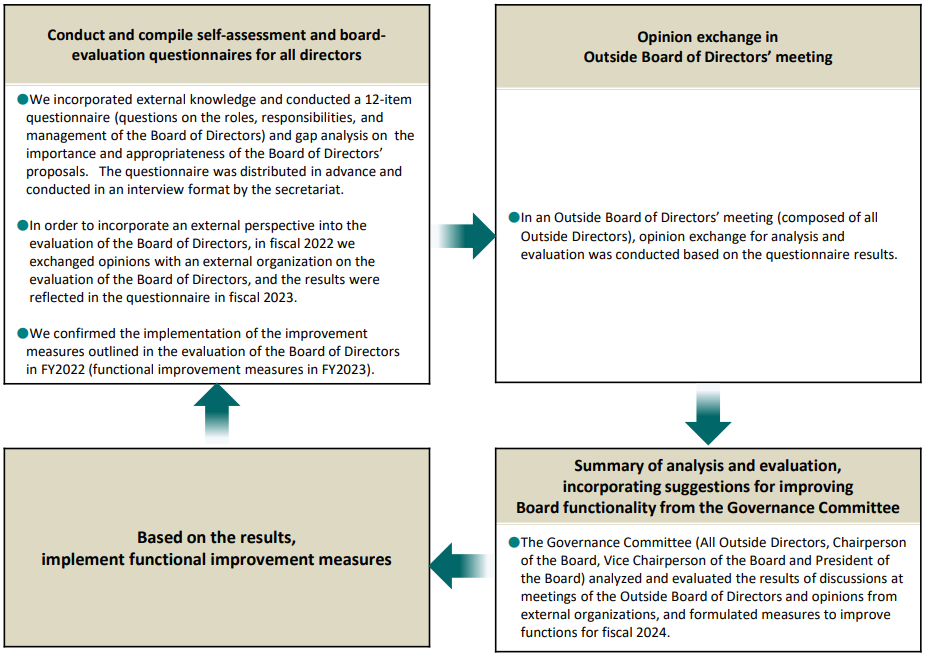

As noted in Chapter 3.5 of the “Basic Policies on Corporate Governance,” an analysis and evaluation of the overall effectiveness of the Board of Directors is conducted annually.

An outline of the analysis and evaluation of the effectiveness of the Board of Directors for FY 2022 is as follows.

(1) Questionnaires conducted for all Directors’ self-evaluation and board evaluation

- In order to incorporate external perspectives into the evaluation of the Board of Directors, we exchanged views with a consulting firm on the evaluation of the Board of Directors in fiscal 2021. A 12-item questionnaire reflecting the results of the exchange of views and a gap analysis on the importance and adequacy of the proposed Board of Directors meeting were distributed in advance, and the questionnaire was conducted in the form of an interview conducted by the secretariat.

- With regard to the improvement measures (measures to improve functions in FY 2022) outlined in the board evaluation for FY 2021, we also checked to see if initiatives were being implemented.

(2) Exchange of opinions at the Outside Director Council

- At a meeting of the Outside Director Council (consisting of all the Outside Directors), Outside Directors exchanged opinions about analysis and evaluation based on the results of the questionnaire.

(3) Summary of analysis and evaluation by the Governance Committee

- The Governance Committee (consisting of all the Outside Directors, Chairman & Director, Vice Chairman & Director and President) conducted analysis and evaluation based on the results of the exchange of views at the meetings of the Outside Directors. In addition, based on the opinions of the consulting firms, the committee compiled measures to improve the functions of the board in fiscal 2023.

(4) We will promptly commence and strengthen measures for improving capabilities in fiscal 2022, and link them to a PDCA cycle aimed at enhancing effectiveness.

Based on the content of discussions and the performance of functions at the Board of Directors meetings in fiscal 2022, as well as operational aspects and the training and information provided to outside officers, the performance of functions at the Board of Directors meetings was generally well received. The following is a summary of the activities and results of the evaluation of the Board of Directors in fiscal 2022 and the measures to improve functions in fiscal 2023.

|

Fiscal 2022 |

|

|---|

|

Measures to improve |

|

|---|

1.Roles and Responsibilities of Audit & Supervisory Board Members

- As an independent entity entrusted with authority by the shareholders, the Audit & Supervisory Board Members are responsible for ensuring the sound and sustainable growth of the Company and the Corporate Group, and establishing good corporate governance in response to the public trust by supervising the performance of duties of the Directors, and work to maintain an independent position and a fair and unbiased attitude, acting in accordance with their own beliefs.

- Each Audit & Supervisory Board Member shall appropriately exercise his/her legal investigating authority, including the authority to audit operations and assets, and supervises the performance of duties of the Directors by attending meetings of the Board of Directors and other important meetings, viewing important approval documents, investigating departments within the Company, and investigating subsidiaries in accordance with the auditing policies and plans stipulated by the Audit & Supervisory Board.

- Audit & Supervisory Board Members participate in joint meetings of Outside Directors and Auditors, etc. and work to share information with Outside Directors.

2.Composition and Roles of the Audit & Supervisory Board

- The Audit & Supervisory Board comprises a majority of Outside Audit & Supervisory Board Members. As independent officers, Outside Audit & Supervisory Board Members have independence, and a significant degree of expertise and knowledge. Full-time Audit & Supervisory Board Members also have sophisticated information gathering capabilities based on extensive operational experience, and the organic combination of the 2 serves to enhance audit effectiveness.

- The Audit & Supervisory Board receives reports from Audit & Supervisory Board Members on the status of the performance of their duties and reports from officers and employees, etc. on important matters related to auditing, and also makes decisions regarding auditing policies and auditing plans.

- The Company has established the “MS&AD Insurance Group Basic Policy for Internal Audits.” Under this basic policy, the Company and domestic Group insurance companies have formed the Internal Audit Department that acts as an independent body with auditing functions.

- The Company has established an internal audit department, the head of which reports directly to the Board of Directors on the outcome of its activities, thus sharing information with all Directors and Audit & Supervisory Board Members.

Audit & Supervisory Board Members also share opinions with the department on such matters as planned internal audits and/or their progress, in addition to collecting every audit report issued by the department.

- The Company has appointed KPMG AZSA LLC as its independent audit corporation. Please note that there are no special conflicts of interest between this company and MS&AD Holdings.

- The Board of Directors and the Audit & Supervisory Board endeavor to take appropriate action to ensure adequate auditing by the Accounting Auditors.

- The Audit & Supervisory Board makes decisions regarding proposals submitted to the General Shareholders' Meeting on the appointment or dismissal of Accounting Auditors. It also has the right to consent to decisions regarding remuneration of the Accounting Auditors.

- The Audit & Supervisory Board prepares criteria for appropriately selecting and evaluating Accounting Auditor. To promote appropriate accounting by the Accounting Auditors, measures are taken to confirm the independence, specialist capabilities, and other requisite characteristics of the Accounting Auditors.

| (¥ million) | ||||||||||||||||||||||||

|

||||||||||||||||||||||||

*Compensation for audit and attestation services at our company and consolidated subsidiaries includes compensation for voluntary audit contracts in preparation for adoption of International Financial Reporting Standards (IFRS).

The non-audit function in our company is to support compliance.The content of non-audit operations at consolidated subsidiaries includes agreed procedural operations.

For the purpose of maintaining high transparency, the Company has formed the Nomination Committee and Remuneration Committee as internal committees of the Board of Directors. Please note that these two committees comprise eight members each, and the chairpersons and other members are appointed from among members of the Board of Directors. With respect to each of the two committees, a majority of the members and the chairperson have been appointed from among the Outside Directors.

*In fiscal 2022, both the Nomination Committee and the Compensation Committee consisted of 5 outside directors and 8 members, including the Chairperson of the Board, the Vice Chairperson of the Board and the President.

- The Nomination Committee deliberates on major management personnel matters and provides advice on these matters to the Board of Directors. Such matters include the selection of candidates for the positions of Director, Audit & Supervisory Board Member, and Executive Officer of the Company as well as the selection of Directors and Audit & Supervisory Board Members for domestic insurance companies in which the Company has direct investments.

- With respect to the evaluation of candidates for Director and candidates for Executive Officer, evaluation items include performance evaluations (corporate performance and personal performance) and other items.

- The Board of Directors appoints candidates for Director as well as candidates for Audit & Supervisory Board Member and Executive Officers based on advice from the Nomination Committee. The consent of the Audit & Supervisory Board must be obtained for candidates for Audit & Supervisory Board Member. In fiscal 2022, the Committee has eight members made up of all five outside directors, the Chairman of the Board and the President.

- From the perspective of making effective discussions to strengthen corporate governance at the Nomination Committee, policy for selecting candidates for Directors and Audit & Supervisory Board Members is added to the deliberation items. It has been clarified that the Nomination Committee shall meets at least once a year.

- The committee met 3 times in fiscal 2022, and all committee members attended every meeting. Discussions were held regarding consideration of candidates for outside directors.

- This committee advises the Board of Directors regarding the remuneration of Directors and Executive Officers of the Company as well as the remuneration systems for management of domestic insurance companies in which the Company has direct investments.

- From the perspective of making effective discussions to strengthen corporate governance at the Remuneration Committee, policy for remuneration of Directors and Executive Officers is added to the deliberation items. It has been clarified that the Remuneration Committee shall meet at least once a year.

- In fiscal 2022, the Remuneration Committee met three times.

The Board of Directors of the Company passed the following resolution on policies for determining the content of individual remuneration for Directors, etc. at its meetings held on February 14, 2019, May 20, 2019, May 20, 2021 and December 27, 2022 after deliberation by the Remuneration Committee of which a majority of the members are Outside Directors.

a. Basic policy

- The purpose is to strengthen governance and enhance the medium- to long-term corporate value of the Group.

- The officer remuneration system shall function as an appropriate incentive for sustainable growth, linking with the business performance of the Company.

- The level of remuneration shall be competitive as a global company.

b. Decision process

(a) Remuneration for Directors

- To ensure transparency, it shall be decided by resolution of the Board of Directors after deliberation by the Remuneration Committee, of which a majority of the members are Outside Directors, within a range determined by resolution of the Shareholders Meeting.

- The Remuneration Committee provides advice to the Board of Directors on the amount of remuneration for Directors and policies regarding decisions on the determination of officer remuneration.

- The Board of Directors respects the advice of the Remuneration Committee to the maximum possible extent. And the amount of remuneration is determined after confirmation that it is in line with the remuneration system established by resolution of the Board of Directors.

Furthermore, the Board of Directors has confirmed that, in regard to the individual remuneration of Directors for the relevant fiscal year, the advice of the Remuneration Committee has been respected to the maximum possible extent and it is in line with the remuneration system established by resolution of the Board of Directors. The Board of Directors has therefore judged that it is in line with this basic policy for determining the remuneration of Directors.

(b) Remuneration for Audit & Supervisory Board Members

- It shall be decided by discussion among Audit & Supervisory Board Members within a range determined by resolution of the Shareholders Meeting, taking into consideration full-time/part-time, audit operation assignment, the details and level of Directors’ remuneration.

c. Overview of remuneration

(a) Composition of remuneration

| Fixed remuneration | Performance-linked remuneration | ||

| Monetary remuneration | Stock-based remuneration |

||

| Directors (excluding Outside Directors) | 〇 | 〇 | 〇 |

| Outside Directors | 〇 | ― | ― |

| Audit & Supervisory Board Members | 〇 | ― |

― |

- Composed of fixed remuneration and performance-linked remuneration. Outside Directors and Audit & Supervisory Board Members shall be provided only fixed remuneration.

- Fixed remuneration is determined in accordance with officers’ position.

- Performance-linked remuneration is determined based on business performance.

- Performance-linked remuneration is composed of monetary remuneration and stock-based remuneration.

- Fixed remuneration is paid on a monthly basis, and performance-linked remuneration is paid after the end of each fiscal year.

- The standard proportions of the components of officer remuneration differ depending on the officer’s position, as shown below. (This excludes Outside Directors and Audit & Supervisory Board Members.)

<President & Director>

The proportion of performance-linked remuneration is higher than for other positions.

(Standard ratios)

|

[Fixed remuneration] |

[Performance-linked remuneration] |

[Performance-linked remuneration] |

<Other positions>

The composition is such that the proportions of fixed remuneration and performance-linked remuneration differ depending on the officer’s position

(Standard ratios)

|

[Fixed remuneration]

|

[Performance-linked remuneration] Monetary remuneration Approx. 20% |

[Performance-linked remuneration] |

(b) Contents of stock-based remuneration

- Restricted stock shall be provided as stock-based remuneration and in principle, the Transfer Restrictions shall be released upon retirement of the related Director.

- If it is found that a Director was involved in a fraudulent act while in office, the Company acquires the restricted stock for free during the Transfer Restriction Period or the Director is made to return it after the transfer restriction is released. (Malus Clawback Clause)

|

Overview of restricted stock remuneration plan |

|

| Eligible Directors | Directors excluding Outside Directors |

| Amount of monetary remuneration to be provided (maximum) | 200 million yen per year |

| Type of shares to be allotted | Common shares (with transfer restrictions under a restricted stock allotment agreement) |

| Number of shares to be allotted (maximum) | 130,000 shares per year |

| Transfer restricted period | Period from the allotment date to the date on which the related Eligible Director resigns or retires as the Company’s Director or from another position which the Board of Directors has determined. |

d. Key performance indicators pertaining to performance-linked remuneration

- Performance-linked remuneration shall be linked with the business performance of the Company and determined based on financial and non-financial indicators.

- Financial and non-financial indicators have been selected after taking into consideration the Group’s Medium-Term Management Plan, “FY 2022-25,” and the details of indicators and reasons for their selection are as follows.

(a) Financial indicators

- Financial indicators are indicators that are used to reflect business performance in a single fiscal year in officer remuneration.

|

Indicator |

Reasons for selection |

| GroupAdjustedProfit(*1) | The selected indicators were Group Adjusted Profit as a measure of shareholder returns, Group Adjusted ROE as a measure of capital efficiency, and Consolidated Net Income as a key performance indicator for the Group. * After the adoption of IFRS, the indicators at the left will be changed to “IFRS net income” and “Adjusted ROE” on an IFRS basis. |

| Consolidated Net Income | |

| Group Adjusted ROE (*2) |

*1: Group Adjusted Profit

Consolidated net income + provision for catastrophe loss reserve and others - other incidental factors (amortization of goodwill and other intangible fixed assets, and others) + equity in earnings of the non-consolidated group companies

*2: Group Adjusted ROE

Group Adjusted Profit ÷ average of beginning and ending amounts on BS of adjusted net assets (consolidated net assets + catastrophe reserves, and others - goodwill and other intangible fixed assets)

(b) Non-financial indicators

- Non-financial indicators are indicators that are used to reflect initiatives contributing to medium- to long-term business performance in officer remuneration.

| Evaluation item | Reasons for selection | |

| Basic strategies | 〇 Value (creating value) 〇 Transformation (business transformation) 〇 Synergy (demonstrating Group synergy) |

“Basic strategies” and “Platforms” that support the basic strategies have been selected as non-financial indicators in order to realize “A corporate group that supports a resilient andsustainable society,” which is an aspiration of the Group’s Medium-Term Management Plan (2022-2025). |

| Platforms | 〇 Sustainability 〇 Quality 〇 Human resources 〇 ERM |

(c) Application methods for financial and non-financial indicators

- The standard ratio between financial and non-financial indicators used in the calculation of performance-linked remuneration shall be “50:50.”

- The application coefficients for financial and non-financial indicators shall vary within ranges of 0 to 3.0 and 0.5 to 1.5, respectively, with 1.0 as the standard.

- The monetary remuneration and stock-based remuneration components of performance-linked remuneration shall each be calculated as follows, based on standard amounts for each position.

Monetary remuneration: Standard amount per position × business performance coefficient (financial indicators × 80% + non-financial indicators × 20%)

Stock-based remuneration: Standard amount per position × business performance coefficient (financial indicators × 20% + non-financial indicators × 80%)

- Monetary remuneration is structured such that it more strongly reflects business performance in a single fiscal year, by having a higher ratio for financial indicators than non-financial indicators.

- Stock-based remuneration is structured such that it more strongly reflects an evaluation of initiatives contributing to the enhancement of corporate value over the medium- to long-term, by having a higher ratio for non-financial indicators than financial indicators.

(d) Actual financial and non-financial indicators in the fiscal year under review

<Financial indicators>

| Actual | Target | Vs. target | |

| Group Adjusted Profit | ¥172.7 billion | ¥167.4 billion | 103.2% |

| Consolidated Net Income | ¥161.5 billion | ¥138.3 billion | 116.8% |

| Group Adjusted ROE | 4.8% | 4.6% | 0.2 point |

<Non-financial Indicators>

| Evaluation item | Results of evaluation |

| Basic strategies | As a result of evaluation based mainly on the following points, performance is evaluated to be at a standard level: ・ Developing and providing products and services that offer new value leading to solutions to social issues ・Transforming the business, product, and risk portfolios ・Implementation of the One Platform Strategy and Group synergies, etc. |

| Foundations | As a result of evaluation based mainly on the following points, performance is evaluated to be at a standard level: ・ Initiatives related to the key sustainability issues of coexistence with the global environment, a safe and secure society, and the well-being of diverse people ・Quality improvement initiatives such as product and service improvements based on customer feedback ・Initiatives related to human assets, such as building an optimal human asset portfolio and creating a workplace environment that maximizes employees’ abilities, skills, and motivation, including implementation of DE&I ・Initiatives related to ERM, such as improving profitability and capital efficiency and reducing strategic equity holdings, etc. |

e. Resolutions related to officer remuneration at the Shareholders Meeting

<Remuneration of Directors>

| Shareholders Meeting held on June 25, 2018 [10th Annual Shareholders Meeting] Resolved that the maximum amount of remuneration of Directors in total (exclusive of wages as an employee payable to a Director also serving as an employee) shall be 500 million yen per year (of which remuneration for Outside Directors shall be no more than 100 million yen per year). The number of Directors was twelve (12) (including five (5) Outside Directors) as at the close of the Annual Shareholders Meeting. |

| Shareholders Meeting held on June 24, 2019 [11th Annual Shareholders Meeting] Resolved to introduce a new restricted stock remuneration plan with delayed delivery and that the total amount of monetary remuneration receivables to be paid for the allotment of restricted stock to Directors other than Outside Directors shall be up to 200 million yen per year. The number of Directors other than Outside Directors was seven (7) as at the close of the Annual Shareholders Meeting. |

<Remuneration of Audit & Supervisory Board Members>

| Shareholders Meeting held on June 25, 2009 [1st Annual Shareholders Meeting] Resolved that remuneration shall be up to 110 million yen per year. The number of Audit & Supervisory Board Members was four (4) as at the close of the Annual Shareholders Meeting. |

- The Company has introduced performance-based remuneration (linked to corporate and personal performance) into its corporate officer remuneration system.

- In order to realize a director remuneration system functioning as an appropriate incentive for improving linkage between director remuneration and business performance and achieving sustainable growth for the purpose of strengthening governance and increasing medium term corporate value of the Group, the Company has introduced a restricted stock remuneration plan for Directors (excluding Outside Directors). The plan involves granting treasury stock or new stock (allotment of restricted stock) by replacing a portion of the Company’s performance-based monetary remuneration with monetary remuneration receivables provided by means of contribution in kind.

- The Company introduced the same system as mentioned above and granted treasury stock or new stock (allotment of restricted stock) to the Company’s executive officers and the Directors (excluding Outside Directors) and Executive Officers of Group domestic insurance companies in which the Company has direct investments, by replacing a portion of the Company’s performance-based monetary remuneration with monetary remuneration receivables provided by means of contribution in kind.

We disclose the total amounts of remuneration to all Directors and to all Audit & Supervisory Board Members according to the category (Directors/Audit & Supervisory Board Members) and according to the types of remuneration. We also disclose total amounts of consolidated remuneration to officers amounting to 100 million yen or more.

|

|

Our company has established the Guidelines for Ownership of Treasury Shares in order to enhance corporate value over the medium to long term by encouraging directors and executive officers (excluding outside officers) to own treasury stock and further raising the motivation and morale of directors and executive officers.

1. Policies on the Board of Directors' Overall Balance of Expertise, Experience, Capabilities, Diversity, and Scale

- Five of the eleven Directors (eight men and three women) and two of the four Audit & Supervisory Board Members (2 men and 2 women) have been appointed from outside the Company to incorporate perspectives independent from management, strengthen monitoring and oversight functions, and conduct highly transparent management. Please note that there are no concerns that the interests of these Outside Directors and Outside Audit & Supervisory Board Members of the various companies will be in conflict, in terms of human, capital, transactions, or other relationships, with the interests of shareholders in general. These Directors and Audit & Supervisory Board Members are independent, and their names as independent outside officers have been filed with the Tokyo Stock Exchange Co., Ltd., and Nagoya Stock Exchange Co., Ltd.

- Outside Director candidates must satisfy the eligibility requirements as defined in the Companies Act and the Insurance Business Act. In addition, with the goal of selecting candidates able to accurately and fairly supervise the overall management of insurance companies, candidates are selected based on consideration of specialized expertise such as that stemming from experience working as a general business company corporate officer, government administration officer, lawyer, and academic as well as specialized expertise regarding social, cultural, and consumer issues.

- Director candidates other than Outside Director candidates must meet legal eligibility requirements. In addition, with the goal of selecting candidates able to accurately and fairly supervise the overall management of insurance companies, candidates are selected based on consideration of specialized expertise, such as that stemming from extensive experience working as a manager in an insurance company as well as on consideration of varied experience, highly specialized experience, and the ability to exercise leadership in accordance with the Company's corporate philosophy.

- At least one candidate for Audit & Supervisory Board Member must have sufficient knowledge of accounting or finance.

2. Criteria for the Selection of Director Candidates and Audit & Supervisory Board Member Candidates and Criteria for Determining the Independence of Outside Corporate Officers

- Outside Director candidates must satisfy the eligibility requirements as defined in the Companies Act and the Insurance Business Act. In addition, with the goal of selecting candidates able to accurately and fairly supervise the overall management of insurance companies, candidates are selected based on consideration of specialized expertise such as that stemming from experience working as a finance-related government administration officer, general business company corporate officer, lawyer, and academic as well as specialized expertise regarding social, cultural, and consumer issues.

- Director candidates other than Outside Director candidates must meet legal eligibility requirements. In addition, with the goal of selecting candidates able to accurately and fairly supervise the overall management of insurance companies, candidates are selected based on consideration of specialized expertise, such as that stemming from extensive experience working as a manager in an insurance company as well as on consideration of varied experience, highly specialized experience, and the ability to exercise leadership in accordance with the Company's corporate philosophy.

- In addition, the Company has instituted the “Criteria for the Selection of Director Candidates and Audit & Supervisory Board Member Candidates” below. The determination of “independence” when selecting Outside Director candidates is undertaken in accordance with the criteria described in section “1. (3) Independence” below.

1. Outside director candidates and outside Audit & Supervisory Board Member candidates

Candidates must meet the following requirements.

- Must not be disqualified from serving as a director or Audit & Supervisory Board Member pursuant to the Companies Act.

- Must not be disqualified from serving as a director or Audit & Supervisory Board Member of an insurance holding company pursuant to the Insurance Business Act.

- Must have a sufficient level of public credibility.

- An outside Audit & Supervisory Board Member must satisfy the eligibility requirements for an Audit & Supervisory Board Member pursuant to the Insurance Business Act.

Additionally, candidates must satisfy the following three requirements

(1) Eligibility

A candidate must have the qualities listed below that are necessary to monitor the overall management of the company and provide advice, based on a general knowledge of company management and a basic understanding of the roles of the directors and board of directors.

- Ability to discern facts from materials and reports

- Capability to detect problems and risks and apply own knowledge to solve them

- Capacity to appropriately monitor business strategy and provide advice

- Mental independence to openly question, debate, re-examine, continuously deliberate, and propose ideas in opposition to a resolution

(2) Expertise

Must have knowledge in a specialized field such as management, accounting, finance, law, administration, or social/cultural affairs, and have a record of achievement in that field.

(3) Independence

The following persons are ineligible.

[1] An executing person of the Company or a subsidiary of the Company.

[2] A director or Audit & Supervisory Board Member of a subsidiary of the Company.

[3] A person for whom the Company is a major business partner (i.e. a person who received payments from the Company or subsidiaries of the Company that represent 2% or more of annual consolidated sales for the most recent fiscal year), or an executing person thereof (in the case of a consulting firm, auditing firm or law firm, a consultant, accounting professional, or legal professional who belongs to said corporation, partnership, etc.).

[4] A major business partner of the Company (i.e. a person who made payments to subsidiaries of the Company representing 2% or more of the Company consolidated direct premiums written excluding deposit premium from policy holders for the most recent fiscal year), or an executing person thereof.

[5] Any of the Company's top 10 largest shareholders (or, if the shareholder is a corporation, an executing person thereof).

[6] An executing person of a company to which the Company or a subsidiary of the Company has appointed a director.

[7] A consultant, accounting professional, or legal professional who has received, other than officer compensation, average cash or other financial benefits of at least 10 million yen per year for the past three years from the Company or subsidiaries of the Company.

[8] A person falling under any of the items [2] through [7] during the past five years.

(Note) “During the past five years” means five years from the time the content of a proposal to the General Shareholders Meeting to elect the outside director or outside Audit & Supervisory Board Member was resolved by the Board of Directors.

[9] An individual who was an executing person of the Company or subsidiaries of the Company in the past (in the case of an outside Audit & Supervisory Board Member, including an individual who has been a director of the Company or a subsidiary of the Company.)

[10] A spouse or second-degree or closer relative of a person listed in items [1] through [9] above (an executing person means an executive director, executive officer or an employee in a position of general manager or higher.)

(4) Term limits

The total terms of office for newly elected outside directors and outside Audit & Supervisory Board Members from April 1, 2015 onwards are as listed below.

[1] For outside directors, the expectation is 4 terms, 4 years, renewable for a maximum of 8 terms, 8 years.

[2] For outside Audit & Supervisory Board Members, in principle the total term is 1 term, 4 years, but this is renewable for a maximum of 2 terms, 8 years.

2. Candidates for director other than outside director and candidates for Audit & Supervisory Board Member other than outside Audit & Supervisory Board Member

Candidates must meet the following requirements.

- Must not be disqualified from serving as a director or Audit & Supervisory Board Member pursuant to the Companies Act.

- Must not be disqualified from serving as a director or Audit & Supervisory Board Member of an insurance holding company pursuant to the Insurance Business Act.

- Must satisfy the eligibility requirements for a director or Audit & Supervisory Board Member who engages in daily business at an insurance company pursuant to the Insurance Business Act.

Additionally, a candidate must have varied experience as well as highly specialized experience and must embody our corporate philosophy in the exercise of leadership.

|

* The number of Board of Directors' meetings attended during fiscal 2022.

|

* The number of Board of Directors' meetings and Audit & Supervisory Board meetings attended during fiscal 2022.

In order to promote debate from diverse viewpoints in our efforts to reach the goal of achieving growth strategy for the MS&AD Group, the Group deliberated regarding skills necessary to assure the effectiveness of the Board of Directors (knowledge, experience, and capability), and from the standpoint of supervising the decisions made and execution of duties on matters required for management strategy, we set forth the following.

(1) Base skills that are generally required

“Corporate management,” “human resources and human asset development,” “legal affairs and compliance,” “risk management,” and “finance and accounting”

(2) Skills complementing the fact that the core business of the MS&AD Group is insurance, and that we engage in business globally

“Insurance business” and “internationality”

(3) Skills that take into account our current business environment and that are necessary to address business reform and issues considered important by the market

“IT and digital” and “sustainability”

Furthermore, regarding Audit & Supervisory Board Members, we also consider “finance and accounting” to be important skills.