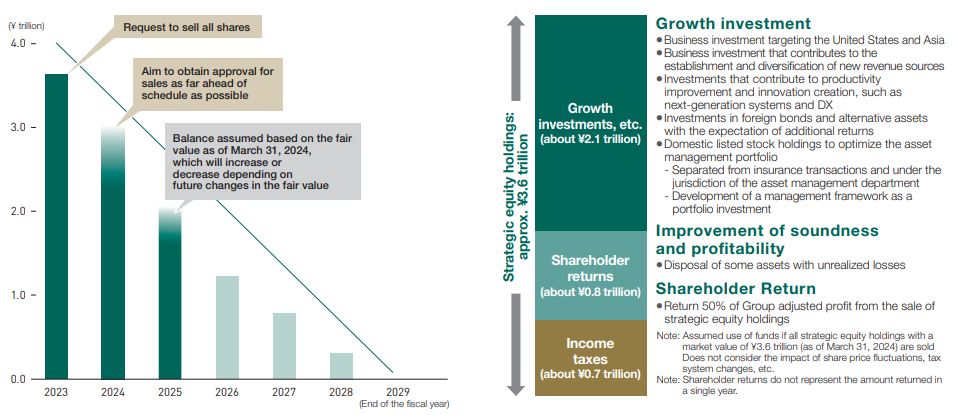

We have committed to reduce the balance of strategic equity holdings to zero by the end of FY2029. We believe that the most important issue for our financial and capital strategy for the time being is how we can promote the sale of strategic equity holdings as far in advance of the schedule as possible, rather than evenly over a six-year period, and

smoothly allocate the funds generated from these sales to investments for growth.

Our main targets for growth investments include business investments to accelerate the growth of the international business, DX investments to improve productivity and create innovation, and investments in domestic listed stocks and other high-return assets as portfolio investments under the jurisdiction of the asset management department.

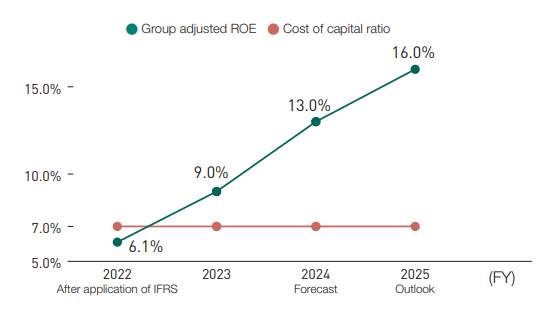

To sustainably increase corporate and shareholder value, we have maintained a target of achieving a stable Group adjusted ROE of 10% or more, and we have made progress to the point where we can achieve this goal from FY2024 onward.

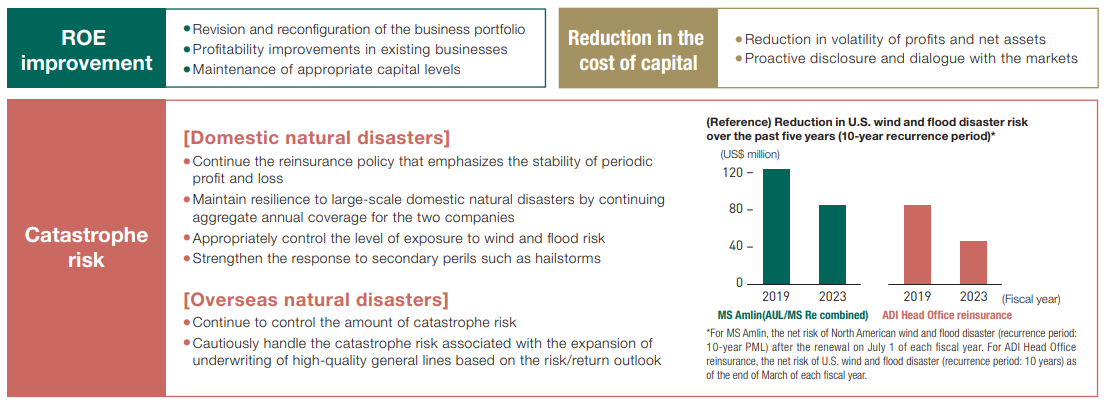

At the same time, we believe that we will be able to control the volatility of profits and net assets, and reduce the cost of equity ratio, by accelerating the sale of strategic equity holdings, which has been the Group’s biggest risk factor,

by continuing to appropriately control catastrophe risk in Japan

and overseas, and other measures.

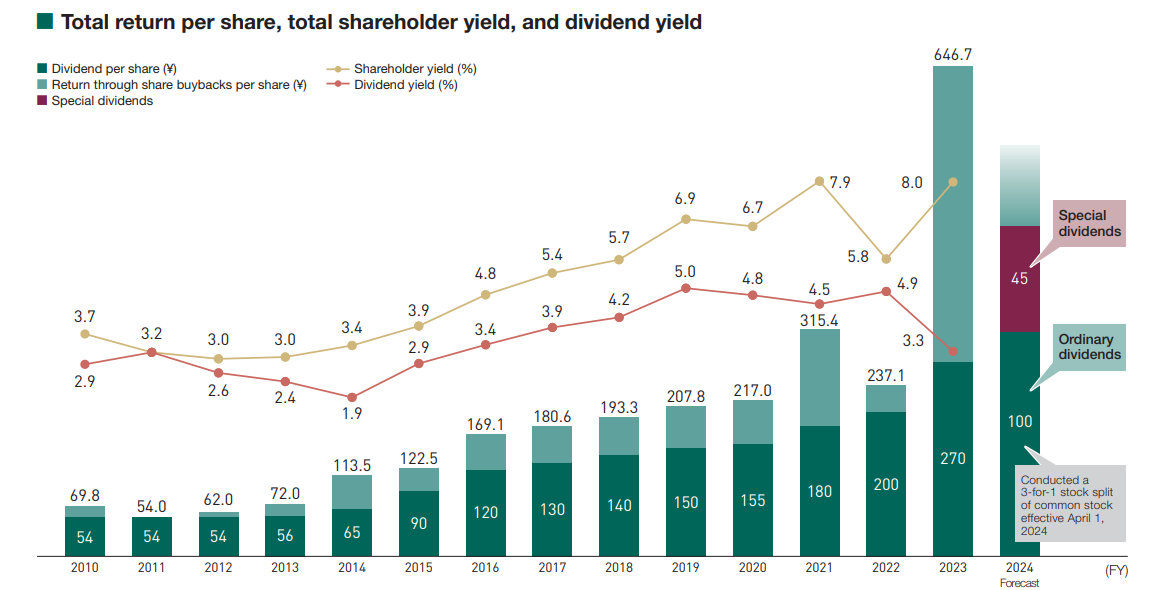

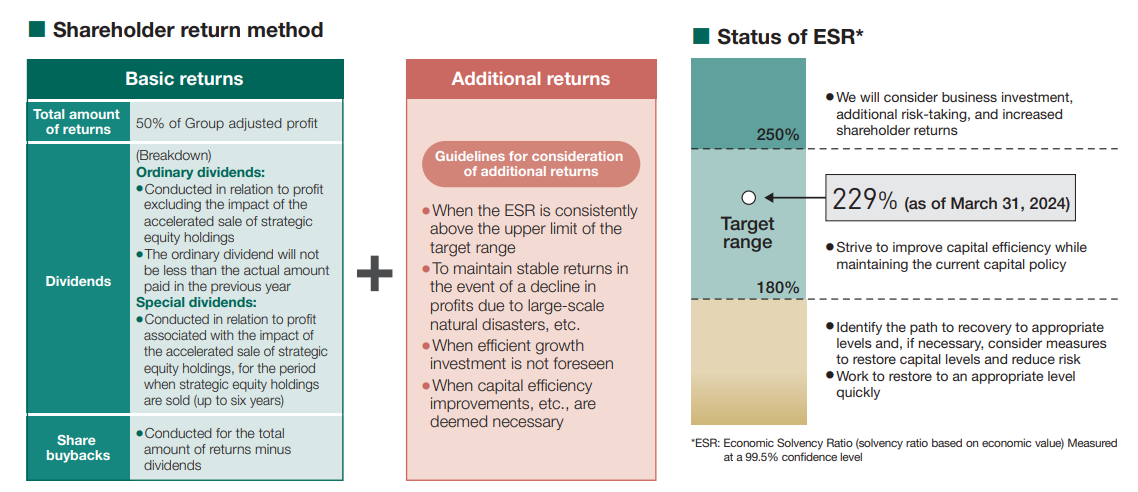

We conducted a stock split on April 1, 2024, but the Shareholder Return Policy in the Medium-Term Management Plan remains unchanged. Our basic policy is to return 50% of Group adjusted profit to shareholders, and we will conduct returns through dividends and share buybacks. In addition, the Company will monitor ESR levels and flexibly implement additional returns as needed. We will return profits from the accelerated sale of strategic equity holdings through special dividends and share buybacks.

We have set the shareholder return for FY2023 at ¥270 (¥90 after the 3-for-1 stock split), an increase of ¥70 from the previous fiscal year. In addition, the Company decided to repurchase up to ¥200 billion of its own shares, including ¥150 billion as a capital level adjustment. After the 3-for-1 stock split, the Company expects to pay an annual dividend of ¥145 per share for FY2024 and will endeavor to continue to provide attractive shareholder returns.