The MS&AD Insurance Group will fulfil its responsibilities as an asset owner with the aim of ensuring the payment of policyholder claims and benefits and the satisfaction of all other liabilities, as well as contributing to business continuity and the sustainable growth of shareholder value.

Specifically, to maintain the financial soundness of the business, paying attention to the safety and adequate liquidity of asset holdings, and to exercise integrated asset liability management (ALM) after analyzing and understanding the characteristics of liabilities.

In addition, the objective is to pursuit a sustainable increase in net asset value over the long term, taking into account the periodic profit/loss, within under an appropriate risk management framework, and to take the asset management risks such as market risks and credit risks based on management decisions to the extent that this does not have a detrimental effect on financial soundness.

When asset management risks are taken, the characteristics of such risks (risks inherent to structure, etc.) are fully analyzed and understood. Risks that have been taken are monitored and addressed appropriately.

Also develop necessary asset management systems encompassing administrative functions and risk management adapted to their own actual business operations and the size, frequency and characteristics of the risks to be taken.

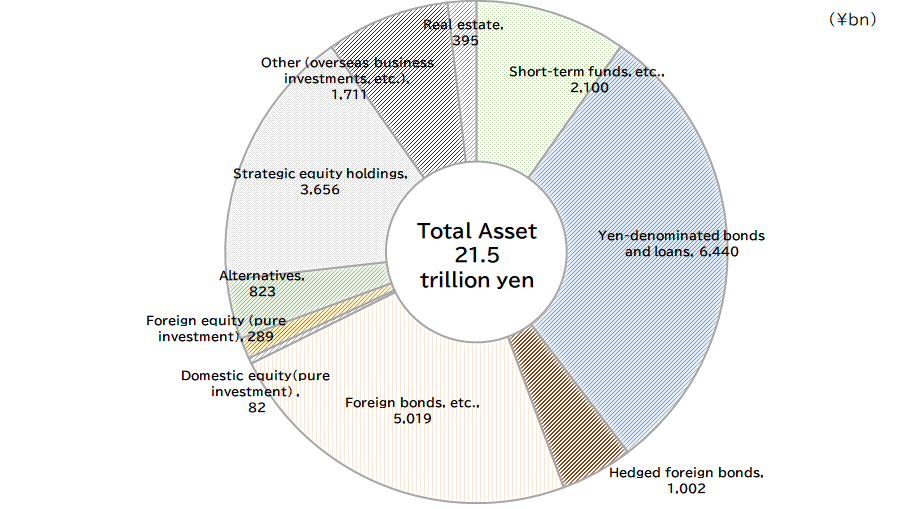

Non-consolidated total of five domestic companies (End of March 2024)

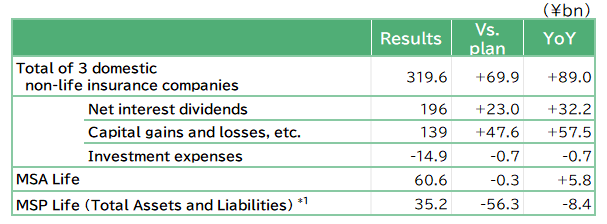

*1: Investment profit/loss (general account) total assets and liabilities for management accounting

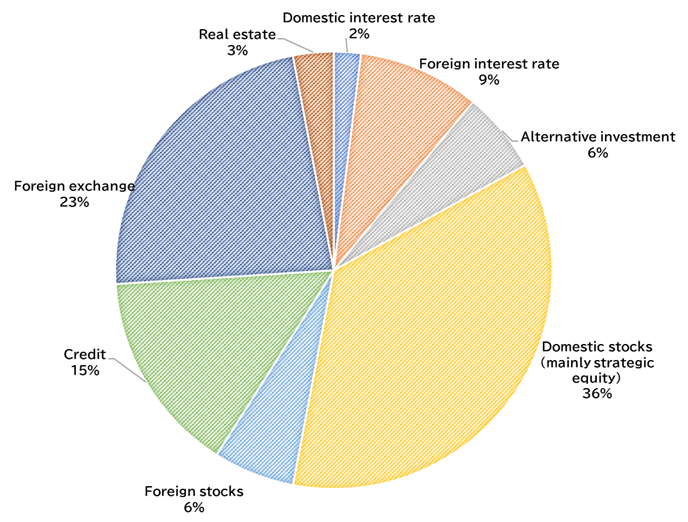

*2: 99.5%tile VaR.

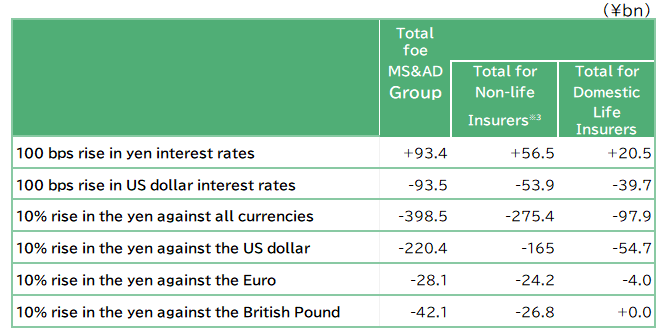

※3: Includes overseas subsidiaries

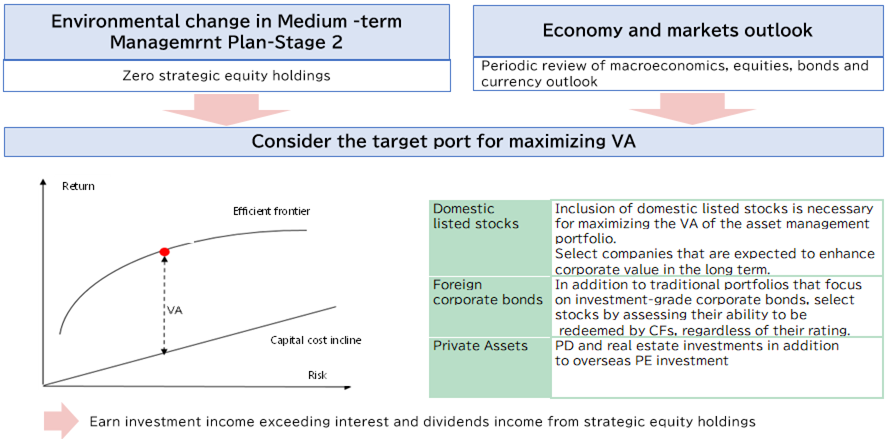

- Promoting diversified investment in assets with relatively high expected returns coupled with appropriate risk control through comprehensive asset and liability management (ALM).

- Aim to increase fair value's net assets over the long term, assuming periodic profit/loss, ALM, and liquidity.

- Focus on investments concentrating on the intrinsic value of companies and assets (=the ability to generate long-term cash flows), and strengthen the framework for such investment.

- From the perspective of the Group's ERM cycle*4, the status of risk-taking including asset management is regularly monitored and asset management risk is acquired on the assumption that the ESR*5 is at a healthy level.

*4: Integrated management of risk (integrated risk volume), return (Group adjusted profit) and capital (market capitalisation) to ensure soundness and improve capital efficiency and return relative to risk.

*5: ESR stands for Economic value-based Solvency Ratio, calculated as net asset value divided by the amount of integrated risk. The target range is 180%~250%.

- Complement and strengthen investment skills required through human resource development, external promotion, and capital tie-up

- Position adjustments based on macroeconomic and financial market outlook to limit the impact of short-term market volatility.

- Strengthen management of crisis warning signs in private assets

- To further strengthen our efforts to share investment opportunities, information, and technology and demonstrate Group synergies, we will utilize MSR*6 as a common platform for the expansion of higher-return assets and Group investment (asset management), and will nurture professional human resources with discerning abilities in foreign asset management.

*6: Management subsidiary established in US in January 2022 by Mitsui Sumitomo Insurance with the joint investment of LGT, a Swiss management company

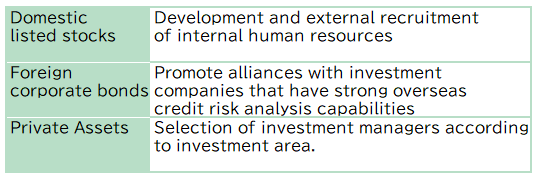

*7: The Calcurations besed on the balance ad of March 2024 and the forecast of investment plan.

*8: Simple sum of 5 domestic group companies on a non-consolidated basis, assuming tax and shareholder return of 1.5 trillion yen (from March 31, 2024 to March 31, 2030)

*9: MSP Life accounts only for assets exceeding liabilities.

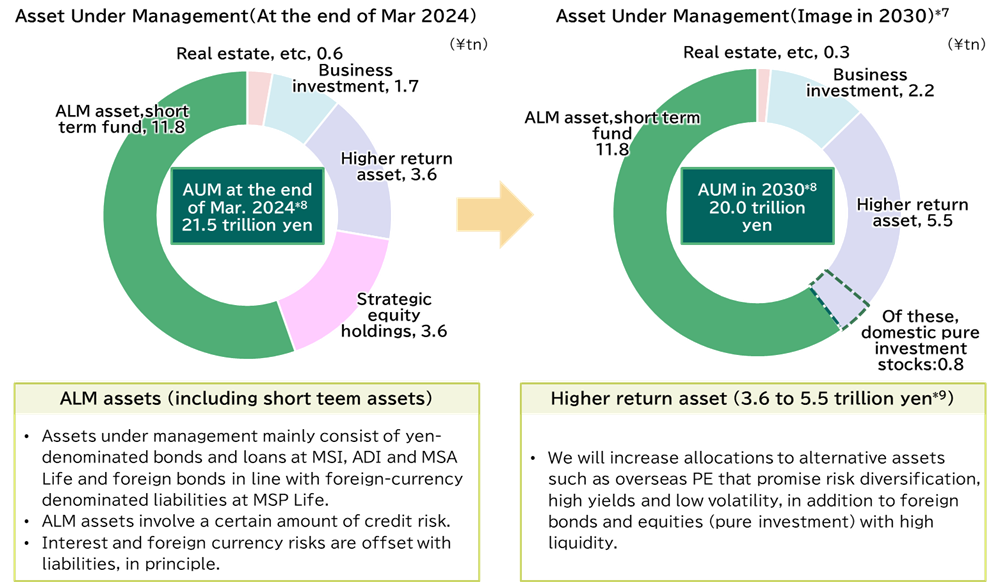

- As a signatory of principles for responsible investment (PRI), we have established investment and loan processes that take ESG factors into consideration and engaged in constructive dialogue. In addition, profitability is committed to high-quality investments and loans that contribute to the environment and society.

*10: Excludes cash and deposits, real estate holdings, and funds with investment funds of other investors