Contribute to the Development of a Vibrant Society and

Help Secure a Sound Future for the Planet

The MS&AD Insurance Group was formed with three groups of insurance companies being integrated with the mission “to contribute to the development of a vibrant society and help secure a sound future for the planet, by enabling safety and peace of mind through the global insurance and financial services businesses.”

To realize our vision of society, we need to face those social issues that impede this vision and promptly identify various risks stemming from the issues. Then, through a variety of products and services, we need to prevent risks from occurring or minimize the impact of those risks and to reduce the economic burden when those risks materialize. By doing so, we help create an environment where customers can live and conduct business in a secure manner. That is our story of value creation.

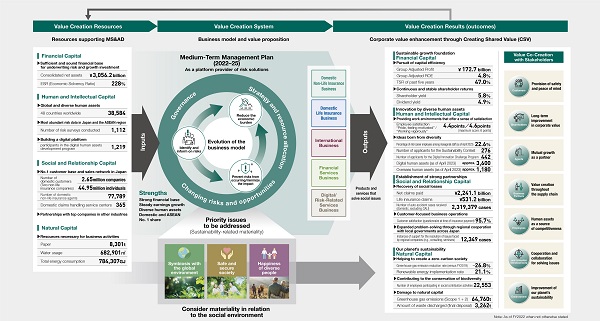

Resources supporting MS&AD

Resources

Financial Capital

● Sufficient and sound financial base

for underwriting risk and growth investment

Consolidated net assets ¥3,056.2 billion

ESR (Economic Solvency Ratio) 228%

Human and Intellectual Capital

● Global and diverse human assets

48 countries worldwide 38,584

● Most abundant risk data in Japan and

the ASEAN region

Number of risk surveys conducted 1,112

● Building a digital platform

Participants in the digital human assets development program 1,219

Social and Relationship Capital

● No. 1 customer base and sales network in Japan

Number of domestic customers (Two non-life insurance companies)

2.65million companies

44.95million individuals

Number of domestic non-life insurance agents 77,789

Domestic claims handling service centers 365

● Partnerships with top companies in other industries

Natural Capital

● Resources necessary for business activities

Paper 8,301 t

Water usage 682,901 m3

Total energy consumption 784,307GJ

Corporate value enhancement through Creating Shared Value (CSV)

Outcomes

Sustainable growth foundation (Financial Capital)

● Pursuit of capital efficiency

Group Adjusted Profit ¥172.7 billion

Group Adjusted ROE 4.8%

TSR of past 5 years 47.0%

●Continuous and stable shareholder returns

Shareholder yield 5.8%

Dividend yield 4.9%

Innovation by diverse human assets (Human and Intellectual Capital)

●Providing work environments that offer a sense of satisfaction

Employee satisfaction (“Pride, feeling motivated” /

“Working vigorously”) 4.4pt /4.6pt(maximum score: 6 points)

●Ideas born from diversity

Percentage of mid-career employees among managerial staff (as of April 2023) 22.6%

Number of applicants for the Sustainability Contest 276

Number of applicants for the Digital Innovation Challenge Program Approx. 442

Digital human assets (as of April 2023)

approx. 3,600

Overseas human assets (as of April 2023)

approx. 1,180

Establishment of strong partnerships(Social and Relationship Capital)

● Recovery of social losses

Net claims paid ¥2,241.1 billion

Life insurance claims ¥531.2 billion

Number of auto accident cases received (domestic, excluding CALI)

2,319,379 cases

● Customer-focused business operations

Customer satisfaction (questionnaire at time of insurance payment)

95.7%

● Expanded problem-solving through regional cooperation with local governments across Japan

Instances of support for the resolution of issues faced by regional companies (e.g., consulting, seminars) 12,349 cases

Our planet's sustainability (Natural Capital)

● Helping to create a zero-carbon society

Greenhouse gas emission reduction rate (versus FY2019) -26.8%

Renewable energy implementation rate 21.1%

● Contributing to the conservation of biodiversity

Number of employees participating in social contribution activities 22,553

● Damage to natural capital

Greenhouse gas emissions (Scope 1 + 2) 64,760t

Amount of waste discharged (final disposal) 3,262t