In achieving a resilient and sustainable society, we believe that MS&AD Insurance Group should build trust as a social entity by supporting people to live in stability and encouraging companies to develop their business. We believe that this is the basis of insurance business and our value to become a trusted and reliable partner.

In order to earn the trust from the society, we always consider tax compliance. The environment surrounding taxation has changed significantly in recent years, with the increasing focus on securing transparency in taxation as a corporate responsibility and strengthening of the international tax framework. Our Group believes it is important, as a responsible insurer, to fully recognize the importance of fair and transparent taxation and to disclose the Group's approach to and initiatives for tax matters both throughout the Group and to the outside.

■MS&AD Insurance Group Tax Policy

In order to ensure that each and every employee of the Group has high ethical standards concerning taxation, and to implement appropriate tax practice and procedures, all employees are expected to work in accordance with the "MS&AD Insurance Group Tax Policy" adopted by the Board of Directors in April 2018.

Pursuant to the “Tax Management Principles” (please see below), MS&AD Insurance Group will aim to enhance our awareness of tax compliance in conducting our business activities, to contribute to the development of society through proper tax payments, and to build trust from all stakeholders."

Basic Policies (“Tax Management Principles”)

- MS&AD Group values the trust and confidence of its stakeholders and is committed to managing tax matters with integrity and responsibility while recognizing the importance and social significance of appropriate tax payments.

- MS&AD Group, in performing our business operations, complies with all applicable tax laws and the relevant regulations of each jurisdiction in which it operates.

- MS&AD Group is committed to both optimizing tax-related costs as well as making appropriate tax filings and tax payments.

- MS&AD Group does not conduct any transactions only intended to avoid tax without business purposes in a way contrary to the national and local tax laws.

- MS&AD Group develops and maintains trusting relationships with the tax authorities in each jurisdiction in which it operates through sincere and transparent behavior in a timely and appropriately cooperative manner.

■Our Approaches Underpinned by “MS&AD Insurance Group Tax Policy”

"MS&AD Insurance Group Tax Policy" is managed and operated by the Group's tax department under the responsibility of the Director/Senior Executive Officer in charge of tax and practical management of global tax governance.

Based on the "MS&AD Insurance Group Basic Policy Pertaining to System for Internal Controls", the Group’s tax department annually inspects whether a system has been developed in accordance with the "MS&AD Insurance Group Tax Policy" and appropriately operated and report to the responsible Director/Senior Executive Officer and the Board of Directors.

- Global tax governance framework

Our Group is working to strengthen its tax governance framework on a global level by creating a system in which the Group's tax department monitors the status of tax compliance and tax risks at major Group companies on a regular basis and checks tax treatment prior to the execution of important transactions.

Moreover, for manage tax risks appropriately, we carry out any necessary due diligence and consult with external experts and tax authorities. - Tax compliance

We endeavor to make all appropriate tax filings and tax payments in compliance with tax-related laws and regulations in the countries and regions where we operate, as well as the standards published by international organizations such as the OECD. - Tax transfer pricing

We understand the purpose of the OECD’s BEPS (Base Erosion and Profit Shifting) project. We are committed to ensuring that we meet our tax obligation in the jurisdictions where we engage in business activities. Intragroup transactions are conducted at appropriate prices determined on an arm’s length basis under the group transfer pricing policy. We pay a fair allocation of taxes corresponding to profits reported to the tax authorities in the jurisdictions where value is created within commercial activity. - Optimizing tax-related costs

In order to optimize tax-related costs and improve corporate value, we utilize tax incentives within the scope of rational business activities and apply tax treaties in each country to avoid double taxation. - Tax planning

We do not conduct tax planning only intended to avoid tax, such as through the transactions or organizations without business purposes or economic substance, using tax-free or low tax jurisdictions (known as tax havens). - Relationship with tax authorities

We endeavor to reduce unexpected tax risks by developing sound relationships with the tax authorities in each country through sincere behavior, such as providing appropriate information in response to requests from the tax authorities in each country.

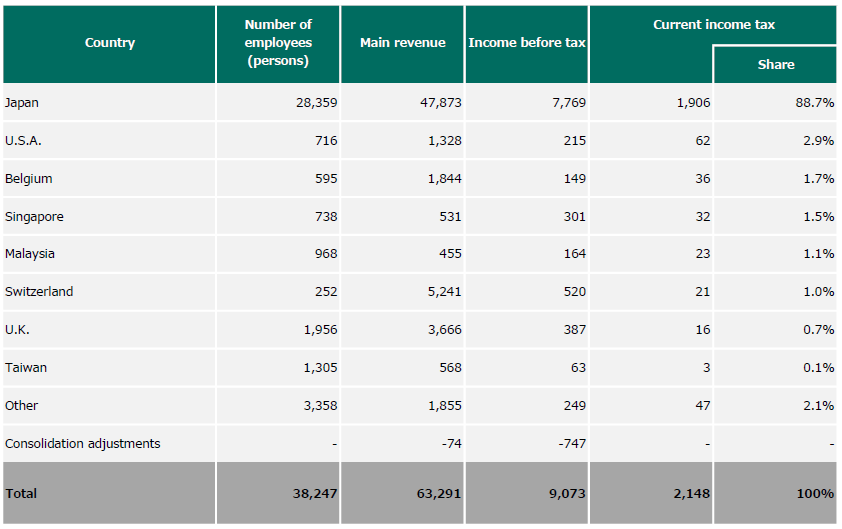

Current income tax by country (FY2024)

(Unit : 100 million yen)

*Country by country data is aggregated by country where headquarters of group companies are located.

*"Main revenue" represents the total of net premiums written for non-life insurance business and premium income for life insurance business.

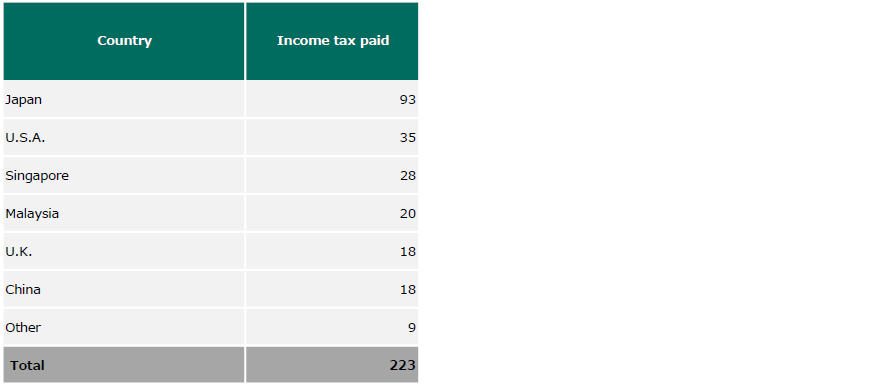

*Income tax paid for major countries (FY2023, The figures shown are based on the Country-by-Country Report (CbCR))

(Unit : 100 million yen)