Business Performance during the Fiscal Year under Review

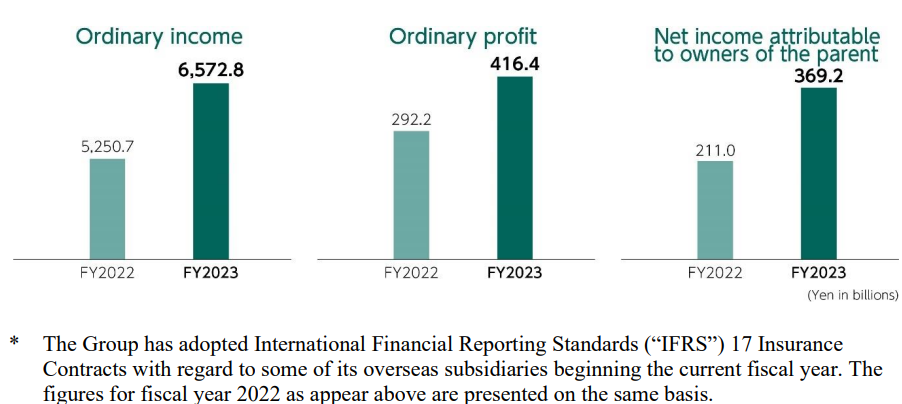

The Group’s consolidated business performance for the current fiscal year was as follows.

With regard to cash flows in the fiscal year under review, the cash flows from operating activities was ¥549.4 billion, increased by ¥355.3 billion year-on-year mainly due to an increase in premium income. The cash flows from investing activities was ¥(276.8) billion, decreased by ¥757.7 billion year-on-year due in part to an increase of outflow for the purchase of securities and a decrease of inflow from redemption / sale of securities. Lastly, the cash flows from financial activities was ¥(231.5) billion, increased by ¥82.9 billion year-on-year mainly due to an absence of outflow for redemption of bonds in previous fiscal year. As a result, cash and cash equivalents at the end of the fiscal year under review amounted to ¥2,733.7 billion, increased by ¥87.3 billion from the end of the previous fiscal year.

For long-term investment funds, the Group utilizes its own funds and raises funds from outside sources through issuing corporate bonds and long-term borrowing from financial institutions. With regard to the liquidity, in preparation for the possibility that cash flow may worsen due to the large catastrophe claims, or due to the financial market turmoil etc., the Group exercises the appropriate cash flow management by maintaining sufficient liquidity and evaluating it from both asset and liability perspectives, taking into account the trends of inflows and outflows.

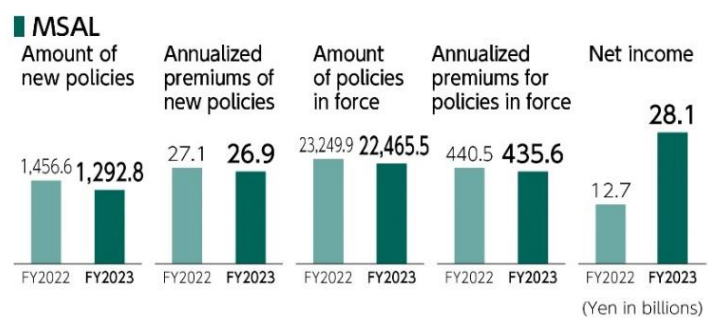

Mitsui Sumitomo Aioi Life Insurance Co., Ltd. (“MSAL”)

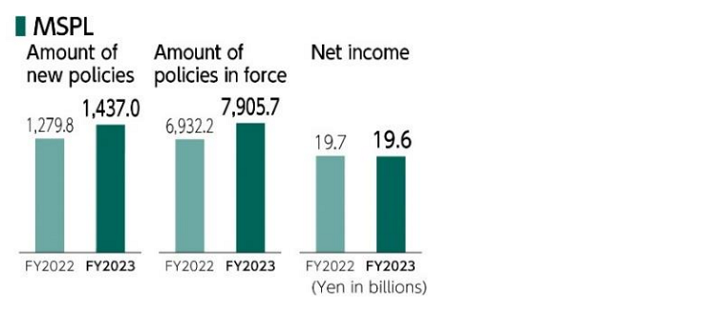

Mitsui Sumitomo Primary Life Insurance Co., Ltd. (“MSPL”)

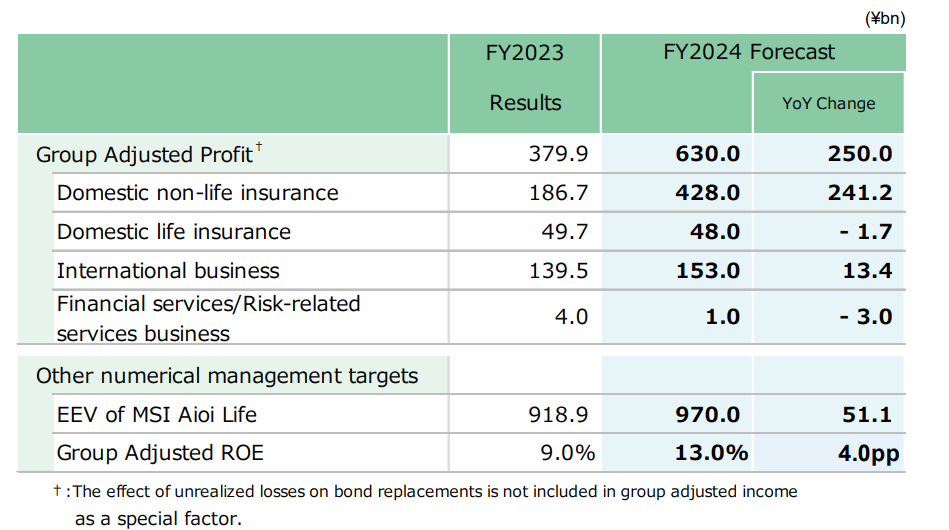

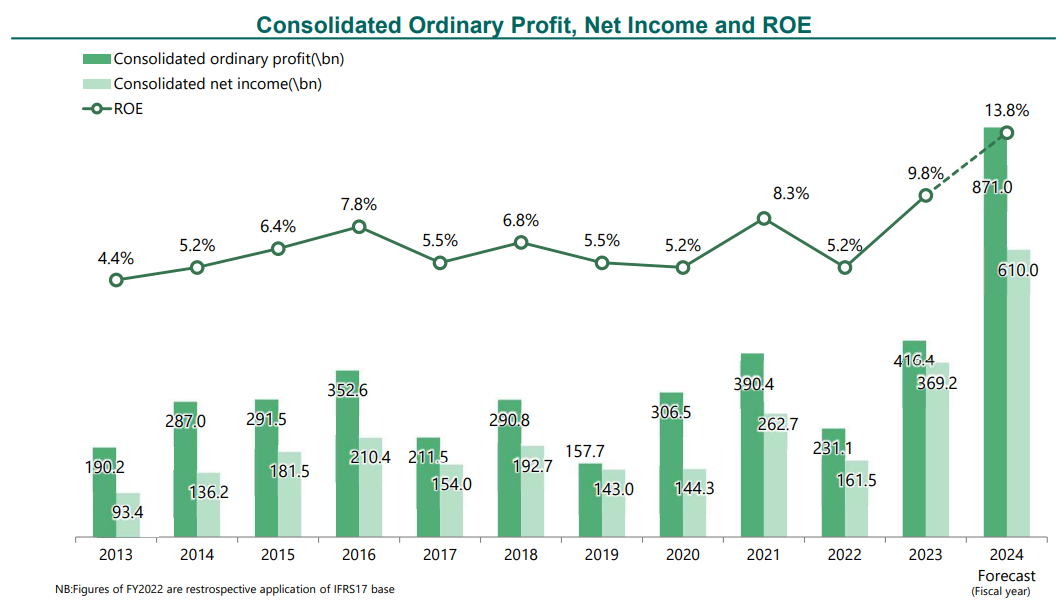

Progress Toward Numerical Management Targets and Forecasts

Group Adjusted Profit is expected to increase by 250.0 billion yen to 630,0 billion yen mainly due to an increase of strategic equity holdings sales profit.