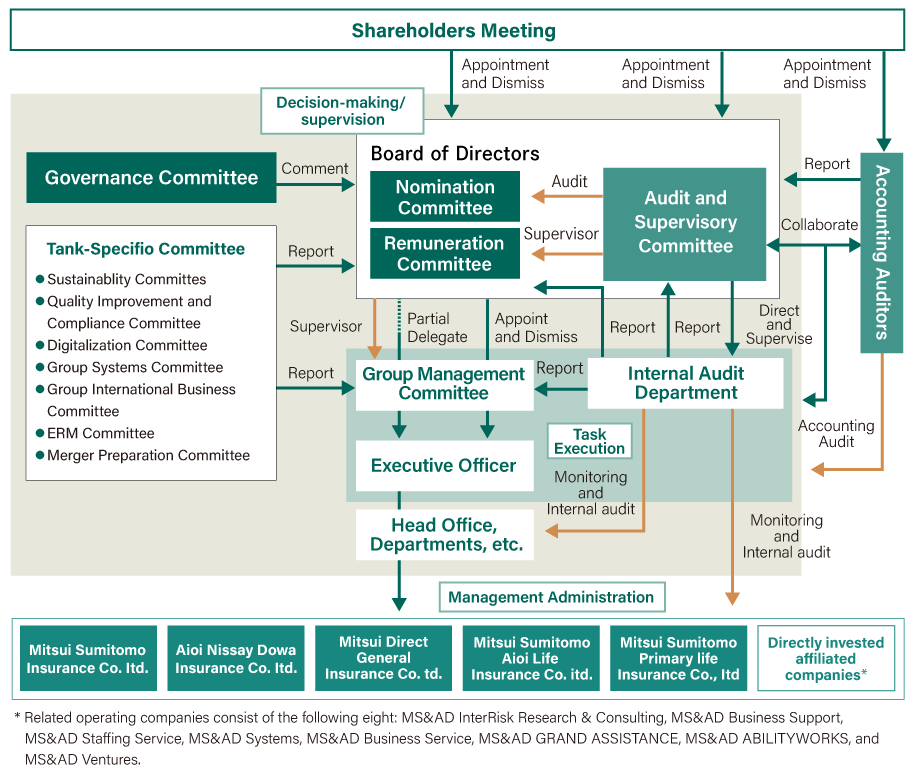

Following approval at the 17th Annual Shareholders Meeting held on June 23, 2025, MS&AD Insurance Group Holdings transitioned from a Company with an Audit & Supervisory Board to a Company with an Audit and Supervisory Committee. The Board of Directors is now composed of a majority of Outside Directors, and a portion of decision-making authority regarding important business execution has been delegated to Directors.

Through this change in governance structure, the Company aims to strengthen the supervisory and checking functions of its Board of Directors, enhance the objectivity of management decisions, and facilitate swifter decision-making and business execution. In addition, the Company is working to further enhance its governance through proactive information disclosure. In the area of sustainability, a governance structure has been established that includes the Board of Directors, the Group Management Committee, and task-specific committees.

The Board of Directors deliberates and makes decisions on important sustainability-related matters in the Group’s management strategy — including its management policies, strategies, and capital policies — as well as other key matters related to corporate management. It also monitors the progress of initiatives and supervises the execution of duties by Directors and Executive Officers.

The Board appoints Executive Officers and clarifies the scope of their authority, thereby ensuring a separation between the management decision-making and supervisory functions of the Board of Directors on the one hand, and the business execution functions of the Executive Officers on the other. The Executive Officers are responsible for executing operations within the scope delegated by the Board of Directors and reporting on the status of their activities to the Board.

The Group Management Committee deliberates on key matters related to the management of the Group, such as management policies and strategies, while monitoring the execution of specific business operations.

Task-specific committees have been established with the aim to deliberate on various key issues in management when executing operations as well as to coordinate perspectives across various departments. Sustainability-related issues and initiatives are primarily discussed within the Sustainability Committee and the Enterprise Risk Management (ERM) Committee, both of which are task-specific committees. The outcomes of these discussions are reported to both the Board of Directors and the Group Management Committee for final decision-making.

The Sustainability Committee is led by the Group Chief Sustainability Officer (CSuO), who is responsible for its operation. The committee discusses policies, plans, and strategies for addressing sustainability issues, including the setting of KPIs for relevant risks and opportunities. All discussion outcomes are reported to the Board of Directors.

Topics Discussed

|

The ERM Committee, chaired by the Group CFO and the Group CRO, is responsible for discussing and coordinating key matters related to enterprise risk management (ERM). It also monitors the status of risk management efforts, including those related to sustainability. The outcomes of discussions held by the ERM Committee are reported to the Board of Directors.

Topics Discussed

|

A system is in place to provide directors and other executives with ongoing information and training once they are appointed and throughout their tenure. Additionally, arrangements are made to facilitate information sharing and opinion exchanges between external directors and top management, as well as executive employees. The aim is to establish the internal framework necessary for fulfilling their roles and responsibilities effectively.

In May 2025, the Company held an executive study session with guest speaker Sakon Kuramoto, Managing Attorney at Kuramoto International Law Office.

- 拡大

- Guest Speaker: Sakon Kuramoto,

Attorney at Law, Kuramoto International Law Office

Study Session Overview

When: May 2025

Format: In-person

Guest Speaker: Sakon Kuramoto, Attorney at Law, Kuramoto International Law Office

Participants: Members of MS&AD Holdings’ Board of Directors, Executive Officers, and management team members from the Group’s five insurance companies

Topic: Business and Human Rights — Understanding the Basics and Learning About Human Rights Risks Through Actual Corporate Case Studies

Presentation Overview

With global awareness of human rights growing in recent years, companies are increasingly expected to respond to this shift. As a global enterprise seeking to deepen its understanding of business and human rights, we invited Mr. Sakon Kuramoto — a prominent expert in the field — to deliver a talk on the latest developments in corporate responsibility. Drawing on real-world cases of human rights violations in corporate settings, Mr. Kuramoto provided expert insights from a legal and professional perspective. The study session offered the executive participants a valuable opportunity to enhance their understanding of the roles and responsibilities companies bear with respect to human rights.

- 拡大

- Executive Study Session

With the goal of becoming a corporate group supporting a resilient and sustainable society by 2030, the Group is advancing various initiatives toward creating shared value with society (CSV initiatives). Helping to solve societal challenges through our business activities requires that every Group employee enhances their understanding of CSV and the SDGs. We believe it is essential for each employee to feel that their daily work contributes to the sustainability of society and work together with customers to address sustainability challenges.

Since 2018, the MS&AD Insurance Group has held the Sustainability Contest with the aim of instilling an understanding of our story of value creation and CSV initiatives in our daily operations. The contest recognizes efforts that help solve societal and Group sustainability issues and promote CSV. To date, we have received approximately 2,200 applications from Group companies in Japan and overseas. The contest has contributed to solving sustainability issues while also sharing excellent initiatives within the Group.

In the 6th edition of this contest held in FY2023, a total of 340 submissions were received, and one Grand Prize, five Excellence Awards, and ten other prizes were awarded. The presentations took place at the Shinkawa headquarters and were live-streamed, with 490 employees participating. For the Grand Prize selection, the employees cast their votes along with the directors to determine the winner.

Grand Prize Winner: InterRisk Research & Consulting

Development and sharing of a global Future Flood Hazard Map enabling quantitative assessment of climate change risks

In response to increasing needs for the quantitative analysis of future flood risks due to the growing severity of disasters caused by climate change, InterRisk identified a limited source of available tools and developed the Global Future Flood Hazard Map. The map has been available free of charge since April 2023, alongside new services for companies adopting the framework of the Task Force on Climate-related Financial Disclosures (TCFD).

Next Sustainability Contest

For the FY2024 Sustainability Contest, the aim is to create a space for many employees to participate and reflect on the cycle of sustainability initiatives. The contest will feature new theme-specific awards to recognize diverse approaches to sustainability, such as initiatives by young employees and senior employees, collaboration with external parties, and inter-group cooperation.

In addition to the group-wide Sustainability Contest, Group companies also hold their own competitions. In addition to the annual “Sustainability CSV × DX Awards” at Aioi Nissay Dowa Insurance, and the Sustainability Contest at InterRisk, the first-ever sustainability contest at MSI Aioi Life is being launched in FY2024.

We believe these contests help every employee understand the connection between their daily work activities and sustainability and promote CSV initiatives across the entire Group as they offer tailored products and services that leverage the unique characteristics of each Group company.

Principal Approaches

|

Study sessions for sustainability transformation (SX) |

Mitsui Sumitomo Insurance is holding study sessions to promote employee understanding and awareness of the importance of Sustainability Transformation (SX) — a management shift aimed at balancing corporate and societal sustainability. Targeting employees in departments involved in sales, claims services, and contact center activities, the training sessions present specific SX initiatives from various divisions of the company. These include using dashcams for insurance services, adopting digital technologies, utilizing chatbots and recycled parts, and tailoring communication to customer needs. To inspire new insights and ideas among employees, SX study sessions are planned for every company site across Japan. |

|---|

|

Customer dialogue on GHG emissions reduction |

To help achieve carbon neutrality by 2050, Aioi Nissay Dowa Insurance is providing employees with information and various tools to promote decarbonization, along with study sessions. It is also encouraging all employees to obtain Carbon Accounting Advisor certification. This will enable them to propose and provide products and services that support optimal carbon neutrality measures for customers through conversations with them on GHG emissions reduction, thereby assisting customers with their decarbonization efforts. |

|---|

|

Employee-participation initiatives |

・As part of its carbon reduction initiatives, Mitsui Direct General Insurance is implementing a roadmap with specific GHG emissions control measures and numerical targets. It is also encouraging employee participation in community-based social contribution activities and exchanges with nearby schools. The efforts include multifaceted programs, such as environmental protection efforts, traffic accident prevention, and donation drives to support disaster recovery organizations. |

|---|

|

Departmental goals for sustainability initiatives |

・At Mitsui Sumitomo Primary Life Insurance, each department has designated a sustainability officer responsible for promoting sustainability initiatives, facilitating internal collaboration on sustainability efforts, and enhancing employee awareness and understanding. Specifically, departments set goals for sustainability initiatives, review midyear and fiscal year-end progress, and encourage employees to consider how their daily tasks connect to priority sustainability issues and what actions are needed. |

|---|