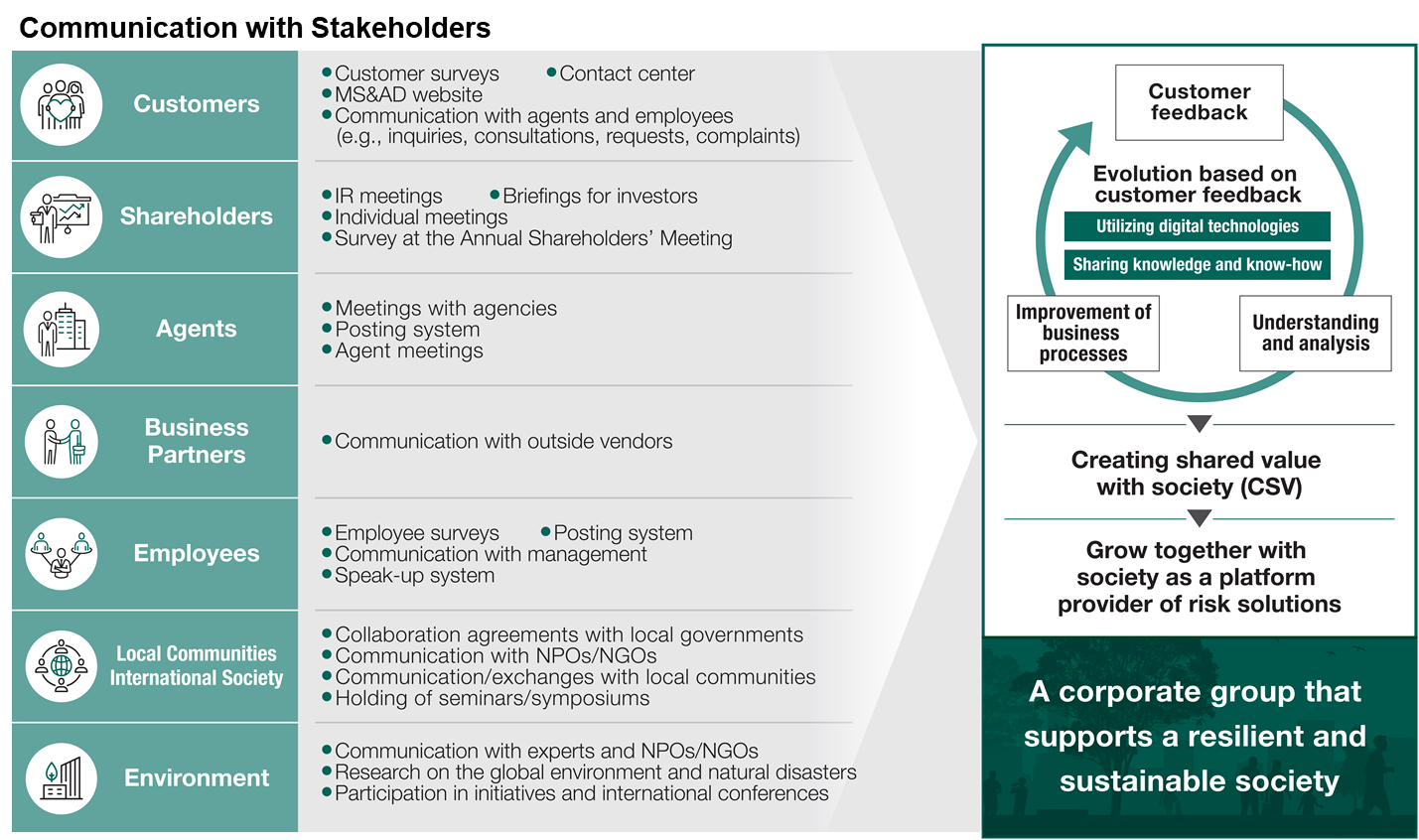

The MS&AD Insurance Group believes it important to pay close attention to the expectations and needs of customers and other stakeholders and to put information derived from this in to good use in improving the quality of its products/services in order to continue being a corporate group needed by society.

By putting in place a variety of schemes to solicit the views of stakeholders, we are continuing to improve our quality and operations through executive-level discussions to prove ourselves worthy of the public’s trust. For example, we provide easy-to-understand product explanations, use advanced technology to make procedures more convenient, adopt approaches that meet the needs of a diverse range of customers, including the elderly and people with disabilities, and work to improve the skills of employees.

The Group has established the “MS&AD Insurance Group Basic Policy for Responding to Customer Communications” and provided a scheme and opportunity to listen to the voice of customers and other stakeholders for quality improvement of products and services, as well as compliance, respect for human rights and environmental initiatives.

The MS&AD Insurance Group has formulated a Basic Policy for Responding to Customer Communications and is receiving a wide range of feedback from customers including through consultations, requests, and complaints. The received feedback is then used for quality improvements. In line with the aforementioned policy, Domestic Group insurance companies utilize the customers’ views to improve their business processes so they can provide products and services that better satisfy customers.

We disclose the substance and results of the improvement activities on our website so that the customers can see the status of the improvements.

We listen to a wide range of customer feedback and are making company-wide improvements to provide better insurance products and services.

Customer feedback is all feedback received from customers, including inquiries, consultations, requests, complaints, disputes, compliments and words of thanks, etc. Of this feedback, complaints are defined as an expression of dissatisfaction from the customer.

|

*Combined number received in fiscal 2023 for Mitsui Sumitomo Insurance and Aioi Nissay Dowa Insurance

The five Group insurance companies in Japan have formulated and published customer-first policy in the business operations based on the Financial Services Agency’s Principles for Customer-oriented Business Conduct. These policies align with the framework for consumer-oriented voluntary declarations advocated by the consumer-oriented management promotion organization composed of the Consumer Affairs Agency and other members.

Please see individual companies’ official websites for further information regarding these policies.

Customer-First Policy in the Business Operations (in Japanese only)

The five Group insurance companies in Japan have formulated and published customer-first policy in the business operations based on the Financial Services Agency’s Principles for Customer-oriented Business Conduct. These policies align with the framework for consumer-oriented voluntary declarations advocated by the consumer-oriented management promotion organization composed of the Consumer Affairs Agency and other members.

Please see individual companies’ official websites for further information regarding these policies.

Customer-First Business Operations — FY2023 Overview (in Japanese only)

|

Initiatives to enhance customer convenience in obtaining policies |

We have been developing and adopting more convenient and comprehensible procedural methods to provide information on insurance and services to a variety of customers ・Customers can now change account information online (MSI Aioi Life) (in Japanese only) ・Procedures for claims settlement online (MSI Aioi Life) (in Japanese only) |

|---|

|

Prompt and courteous customer service during natural disasters |

We are helping to rebuild customers’ livelihoods as promptly as possible by increasing manpower and improving administration at our Accident Claims Center and Insurance Claim Payment Center in line with the scale of disasters and the types of disasters, such as earthquakes, typhoons, flooding, and heavy snowfall, and through rapid claims settlement. |

|---|

|

Screening of insurance payments |

Claims determined not to be eligible for insurance payments but which nevertheless satisfy certain conditions are examined by a Screening Committee comprising outside attorneys and other experts.

Insurance Payment Screening Committee (MSI) (in Japanese only) |

|---|

|

Operational improvements utilizing customer suggestions |

In accordance with MS&ADI Insurance Group Basic Policy for Responding to Customer Communications, customers’ opinions that are received through consultations, requests and complaints are collected, centrally managed and analyzed, then actively implemented to improve business operations. The details and outcomes of these improvement initiatives are disclosed on the website in sequence.

MS&AD Insurance Group Basic Policy for Responding to Customer Communications |

|---|

|

Use of customer satisfaction based on customer questionnaire surveys as a KPI |

Among the indicators used for measuring the level the five Group insurance companies in Japan have continued their initiatives in customer-first business operations, customer satisfaction from customer questionnaires (completed by customers when signing up for policies or being paid insurance money) has been designated as one of the indicators for Group sustainability that earns the trust of society

|

|---|

|

Integrating customer-focused values among employees and agents |

We have been fostering a suitable corporate climate by integrating customer-first values into our operations through education for employees and agents. |

|---|

To satisfy a variety of customer needs to a high degree, we develop products/services utilizing cutting-edge ICT and other technology and employ new technologies such as artificial intelligence (AI), Big Data, and voice recognition to revamp our operational flow.

|

Improvement of customer convenience |

We have developed and provided support apps and services using AI in order to provide insurance products and services more quickly. |

|---|

|

Improving the quality of customer service |

By utilizing the incoming call classification system, we can automatically classify and sort 1 million customer voices annually by category. We conduct analysis efficiently and effectively and promote initiatives to improve quality across the company.

Leveraging our marketing system, we provide optimal product proposals and services based on the attributes of each individual customer and the contact information obtained from our websites, emails, and customer centers, etc.

|

|---|

|

Enhancement of accident responses |

We have introduced a system that uses AI and telematics technologies to automatically and accurately explain accident situations through text and diagrams. This reduces the burden on customers and we have made the handling of claims more efficient (accident response).

We have launched an initiative for analyzing satellite images using AI and visualizing the average amount of damage to buildings in each region within three days after a disaster, at the earliest, in the event of a typhoon equivalent to a severe disaster.

Upon receipt of an accident report from a customer, the business automation system instantly determines various factors such as “details of policy” and “accident characteristics” to select the most appropriate insurance claims settlement center and the person in charge.

|

|---|

|

Enhancement of claim settlement operations |

We developed a fraud detection system that utilizes AI to eliminate fraudulent claims for auto repairs, strengthening our damage investigation system by ascertaining repair claim trends for each auto repair shop.

|

|---|

|

Strengthening of information security management |

In line with MS&AD Insurance Group Information Security Management Basic Policy, we have been pursuing consistent system security management across the Group to ensure that service can be reliably provided in the face of rising cyber risks stemming from technological advances. We are also working to develop more robust information management system through activities such as establishing in-house regulations and educating employees.

|

|---|