The MS&AD Insurance Group always consider sustainability in terms of the environment, society, and governance (ESG) issues in all Group business activities, including the development of products and services, underwriting and investments.

ESG-related impacts include infringements of human rights that threaten respect for basic human rights, deforestation due to illegal logging, and corruption and bribery that undermine economic growth and stability. Our company’s business activities could influence ESG factors, and our company itself could be influenced by ESG factors. While we respond to such ESG-related risks to ourselves, we have been discovering business opportunities in addressing ESG concerns, e.g. offering automotive insurance with driving protection services to support safe driving, and thereby, reduce accidents, and using Big Data to present preventative measures against natural disaster. It is essential that we carefully assess ESG-related risks and opportunities, and reflect them in our business activities. We recognize the wide-ranging ESG risks such as legal risks, reputational risks, quality-related risks, business continuity risks, operational risks, transition risks, financial risks, etc., and these could potentially have a major impact on our company’s business activities and our stakeholders. Accordingly, we carefully identify such ESG-related risks to control them across our entire business activities.

We give an overview of these approaches in our “Perspective of Sustainability of the MS&AD Insurance Group” that describes our policies on addressing ESG concerns.

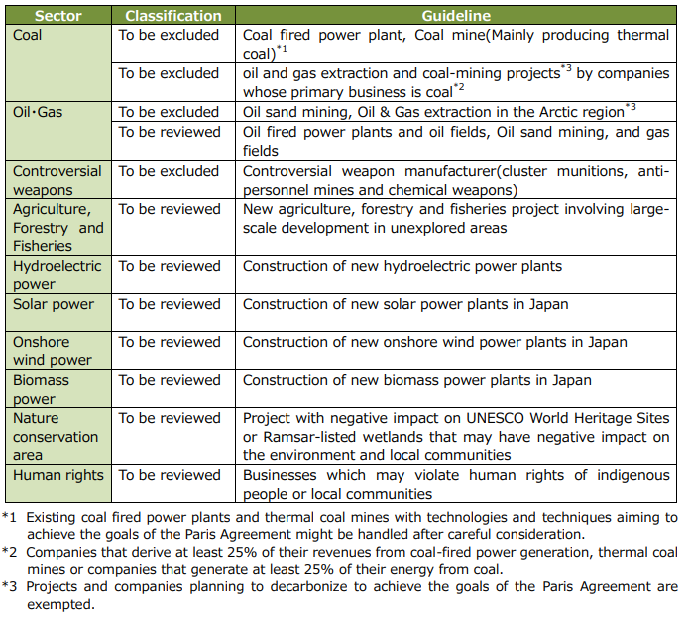

In May 2019, we committed that it would consider sustainability in all of our business activities in line with our ESG policy “Business Activities with Consideration”. In September 2020, we announced a detailed process, and we have been conducting underwriting and investments while reviewing the content in light of environmental changes.

[ESG Guideline]

Process for Underwriting*

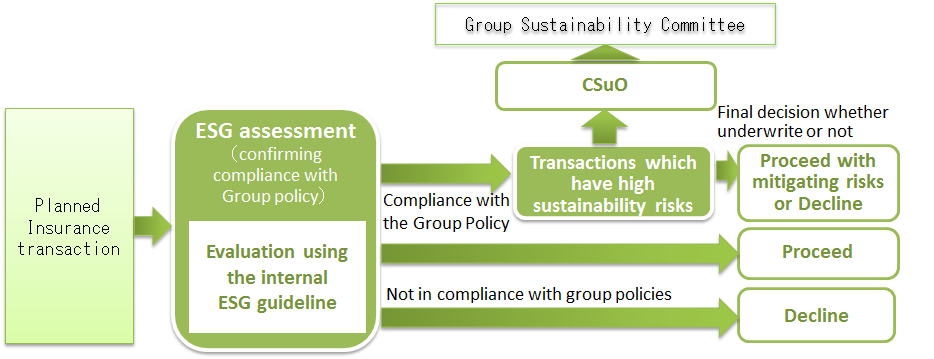

In underwriting insurance, we have established an escalation process for projects that are considered to be in compliance with the Group's policies, but are deemed to have high sustainability risks (ESG risks). Since September 2020, we have reported such transactions to the Group Sustainability Committee based on the judgment of the senior management of the responsible sections for ESG. When formulating and revising policies, we hold dialogues with our company's client companies and share an understanding of the need for initiatives to move toward decarbonization.

*For the investment and financing process, please refer to "Investment and financing considering ESG issues" and "ESG evaluation process" below.

The MS&AD Insurance Group has been seeking out what are the best practices for financial institutions that take into account environmental and social sustainability, and it has been participating in the United Nations Environment Programme Finance Initiative (UNEP FI) to disseminate and promote these best practices.

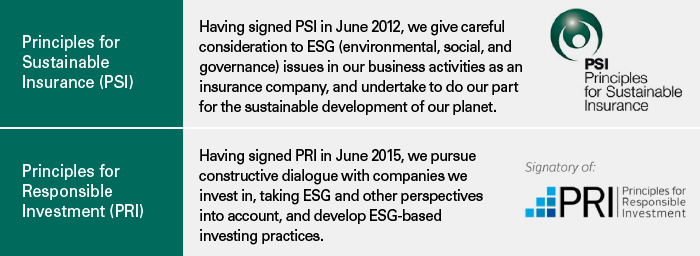

Our company has also signed up to the Principles for Sustainable Insurance (PSI) and the Principles for Responsible Investment (PRI) published by UNEP FI. We have been working on activities such as a pilot project for considering climate change-related and nature-related risk analyses and information disclosure carried out by UNEP FI or PSI.

The MS&AD Insurance Group has underwriting criteria adapted for respective product and service as part of risk assessment process. In each process, certain ESG criteria are considered such as natural catastrophe risks, involvement with anti-social forces or ethical risks, based on the nature of the risk. Comprehensive process including system verification are properly implemented. Underwriting decision including the Board’s approval are made based on these risk evaluations.

In association with underwriting products and services, we discuss general policy to handle ESG risks at the Sustainability Committee, and we evaluate and manage individual ESG risk at the ERM Committee. Both committees shall report their decisions and conclusions to the Group Management Committee and the Board of Directors.

In developing products and services, we examine the value to society and the value for our company generated by our products and services from various angles, and we strive to create value shared with society in providing these products and services. We have also developed a variety of sustainable products and services such as insurance or risk consulting services that support renewable energy projects, discounts to drivers who take a safe driving lecture aiming at reducing traffic accidents, and automotive insurance policies that allow the same-sex partner to be beneficiaries to support diversity.

In underwriting these products and services, all employees and agencies deepen their understanding of sustainability issues, including ESG risks, through trainings and other means, and to promote initiatives to realize a resilient and sustainable society with customers through dialogue.

Additionally, in reviewing factors to be considered, we have referred to the UN Global Compact, the Universal Declaration of Human Rights, the Guiding Principles on Business and Human Rights, the International Labour Organization Standards, the UN Convention against Corruption, and the OECD Guidelines for Multinational Enterprises.

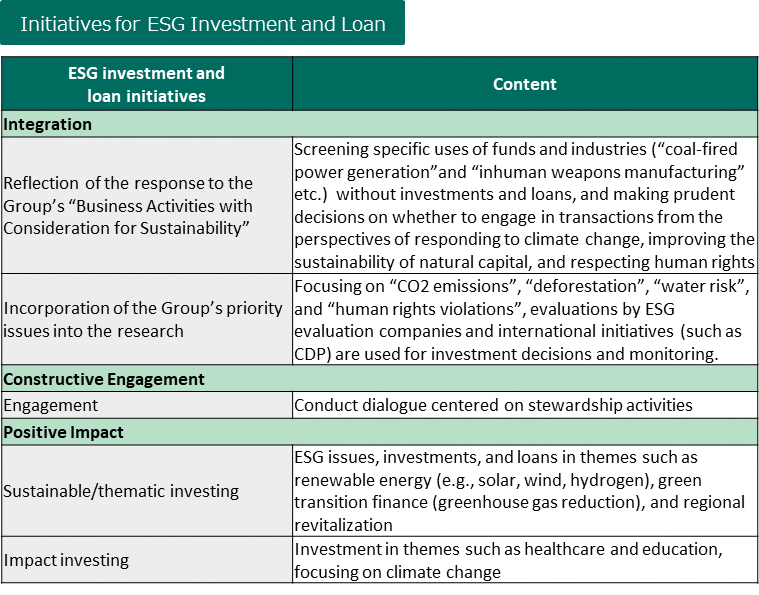

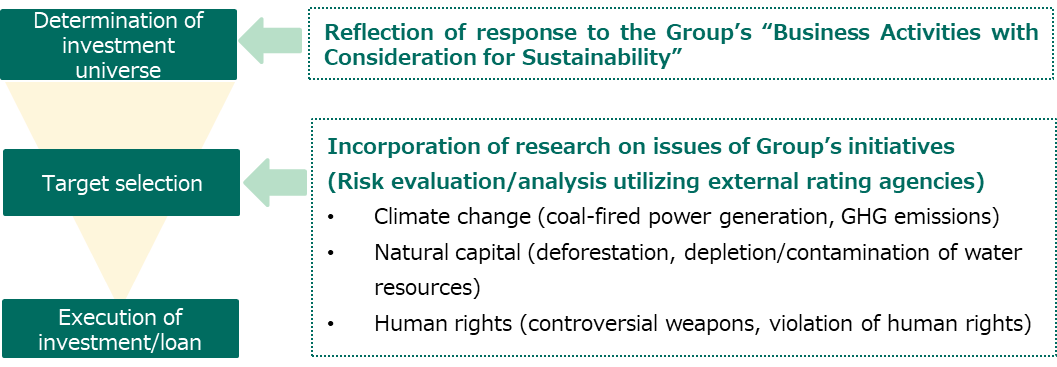

As a signatory to the Principles for Responsible Investment (PRI), the MS&AD Insurance Group takes ESG issues into account for investment and loan.

Specifically, we incorporate ESG factors into investment/loan processes and promote ESG-themed investment (Sustainability-themed investment/loan, impact investment) on the basis of profitability, taking into consideration the MS&AD Insurance Group’s sustainability priorities. In addition, MSI and ADI declared their acceptance of Japan’s Stewardship Code, and have since engaged in constructive dialogue in line with ESG perspectives with investee companies, to encourage them to take appropriate actions to increase medium-term corporate value by raising their awareness over ESG.

From the perspective of fulfilling their social responsibility as institutional investors, Mitsui Sumitomo Insurance (MSI) and Aioi Nissay Dowa Insurance (ADI) have announced their support for Japan’s Stewardship Code, a code of behavior laid out for institutional investors. In line with the Code, we carry out a constructive dialogue with investee companies to encourage them to enhance their medium- and long-term value and sustainable growth, and, through the dialogue, we focus on understanding their management issues, their shareholder return policy, ESG, and other non-financial information. From July, 2023 to June, 2024, MSI and ADI conducted such dialogue with a total of 342 companies.

In addition, through constructive dialogue (engagement) with our investee companies, we are encouraging them to reduce GHG emissions and disclose information in accordance with the TCFD recommendations, aiming for realization of a net-zero society, Specific matters to be confirmed include organizational structure in relation to addressing climate change, their efforts toward GHG emission reduction targets, their plans for technological innovation, and any challenges they face.

|

Example 1 |

Example 2 |

|---|

|

We reviewed the progress made and challenges remaining for a company in the wholesale sector with high GHG emissions. This included the company’s coal business exit plan, new businesses contributing to GHG emission reduction, and value chain initiatives. We confirmed that they are progressing as planned toward their goals and are actively pursuing new businesses as opportunities for additional revenue. |

We reviewed the status and challenges of climate change initiatives for a company handling construction products. We confirmed that the company is progressing smoothly as planned toward its sales targets for climate-friendly products that help reduce customer GHG emissions. We suggested that, going forward, they disclose the proportion of sales accounted for by their climate-friendly products and provide quantitative disclosures on the GHG reduction impact. |

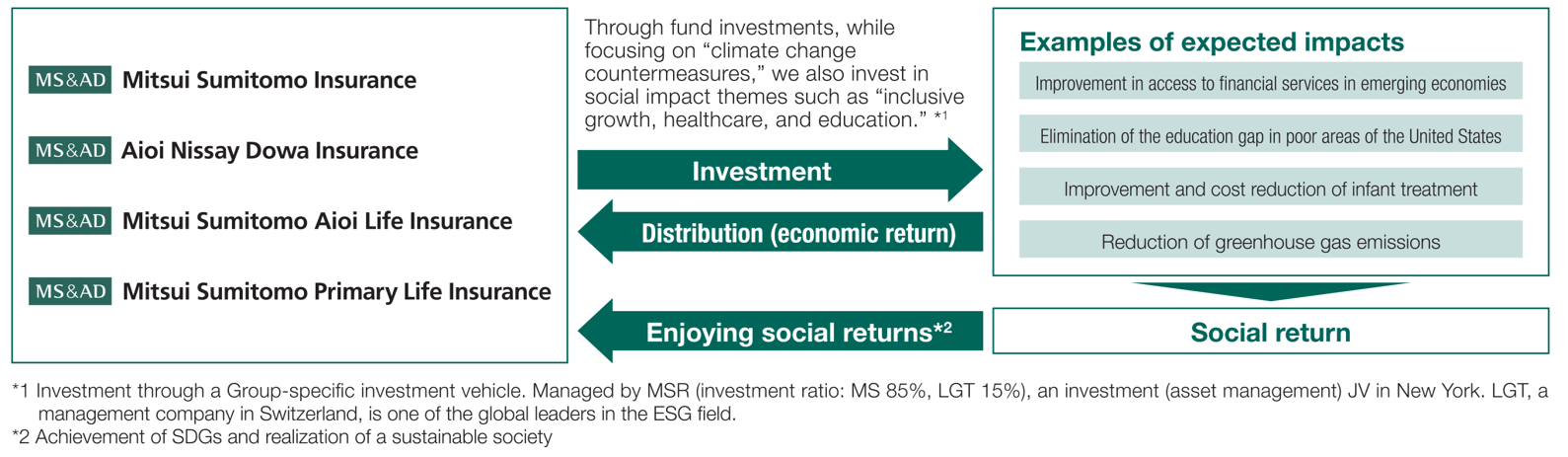

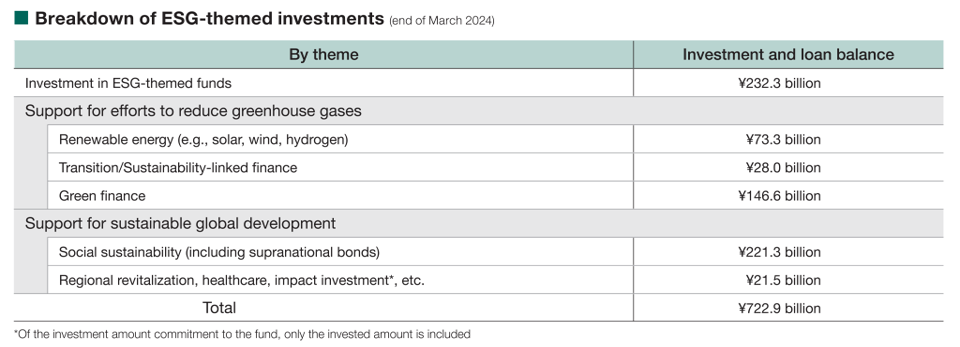

Net-zero transition requires technological innovation and capital investment toward a drastic reduction of GHG emissions. Factors such as growth of demand for funding and needs for new financial products and services in relevant industries will likely bring about opportunities for financial institutions. The Group is working on ESG-themed investing on the premise of ensuring profitability, such as investment in projects with themes of developing solutions for social issues, including climate change.

As part of our mission as an insurance company that manages insurance funds deposited in the form of premiums, we will continue, with an emphasis on quality, to invest in projects, including those that are profitable and can contribute to both the environment and society.

The Group’s mission is “To create a world-leading insurance and financial services group that consistently pursues sustainable growth and enhances corporate value”. Through this investment activity, we will aim to create positive and measurable impacts on the environment/society while earning financial returns. In addition, we will contribute to attainment of SDGs and creation of a sustainable society by accumulating findings through evaluation/management of impacts on the environment/society while earning financial returns.

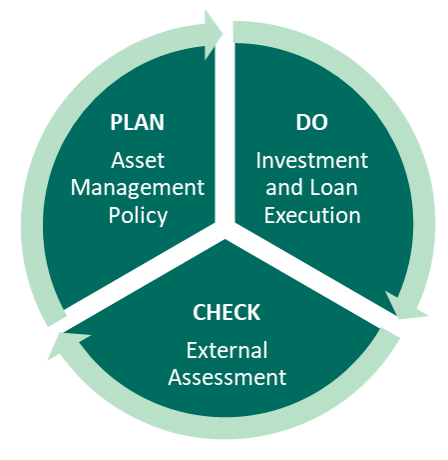

As a signatory to the Principles for Responsible Investment (PRI), global standards for responsible investment, we have been reporting to FRI the status of our ESG investment/loan activities and progress, and we have received annual evaluation of our ESG initiatives.

Utilizing the results of the annual evaluation under PRI, we aim to improve our level of ESG initiatives.

|

The Group joint investment in overseas impact funds |

Through funds investment and with a focus on “climate change solutions,” invest in social impact themes such as “inclusive growth, healthcare, education” as well. |

|---|

|

Investment in social impact bonds |

Investment aimed at addressing social/environmental issues in such fields as medical/nursing care that the region is facing, in collaboration with Japanese local government. Investment In Next Rise Social Impact Funds (in Japanese only) |

|---|

|

Investment in a bio-healthcare fund |

Investment in startups within the bio-healthcare sector. |

|---|

|

Investment in a climate and nature transition fund |

Investment aimed at increasing the value of fund portfolio companies and thereby helping to achieve a sustainable society by promoting solutions to challenges related to climate change and natural capital preservation. Investment in a Climate and Nature Transition Fund (in Japanese only) |

|---|

|

Investment in a forest fund |

Investment focused on forest conservation and management, with the aim of not only gaining economic returns but also creating social and environmental value through carbon credit acquisition. |

|---|

|

Joint investigation of a business initiative for the development of sustainable finance |

Launched collaborative discussions with institutional investors in Japan on a business initiative related to sustainable finance. The aim is to create a digital platform connecting asset managers and portfolio companies to promote mutual understanding and information disclosure on ESG matters. |

|---|

|

Investment in Green/Social/Sustainable Bonds |

Invested in green bonds and social bonds, etc. issued by domestic and foreign companies. |

|---|

|

Investment in sustainable development bonds |

Invested in sustainable development bonds issued by World Bank which aim to supports a wide range of projects in education, health, infrastructure, public administration, agriculture, and the environment to reduce poverty and support development in developing countries. The MS&AD Insurance Group Invests in World Bank’s Sustainable Development Bond |

|---|

|

Incorporation of ESG guidelines into the investment/loan processes for externally entrusted funds |

Incorporated ESG guidelines into the investment process of an overseas bond fund entrusted to Guggenheim, a close partner. |

|---|

|

Investment in SDGs funds |

Among companies making positive contributions to attaining SDGs through their products and/or services, invested in those companies with potential to improve corporate value through their business activities. |

|---|

|

Financing for renewable energy power plants |

Financing and fund investment in solar, wind, and biomass power generation to promote the spread of renewable energy. |

|---|

|

Investment in Future Creation Fund |

Invested in companies or projects that have positioned intelligent technologies, robotics, technologies useful in bringing about a hydrogen society, motorization, and new materials as core technologies, processing innovative technologies in these fields. |

|---|

|

Transition Finance |

Supporting corporate efforts to reduce greenhouse gas emissions. |

|---|

|

Investment in Japan Climate Transition Bonds |

Invested in a fund aimed at promoting renewable energy adoption through financing for solar, wind, and biomass power generation, as well as investment in related funds. |

|---|

|

Investment in startups that can contribute to a sustainable society |

Invested in startups with innovative business models or technologies that can help achieve a sustainable society. Investment in startups that can contribute to a sustainable society (in Japanese only) |

|---|

|

Investment in Japan International Cooperation Agency’s Peacebuilding Bonds |

Supporting projects contributing to peace, stability and rehabilitation of countries, regions, etc. affected by conflicts and/or civil wars.

|

|---|

The MS&AD Insurance Group utilizes assessments from global ESG rating agencies to enhance its sustainability initiatives. It has been recognized by various ESG indices through index inclusion.