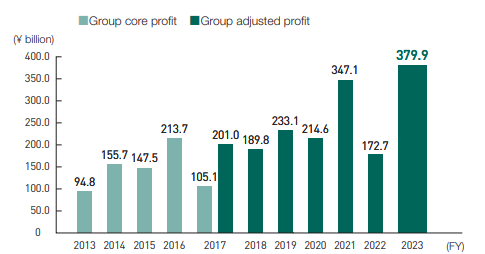

This is profit that serves as a source of shareholder returns and is the numerical management target in the Medium-Term Management Plan.

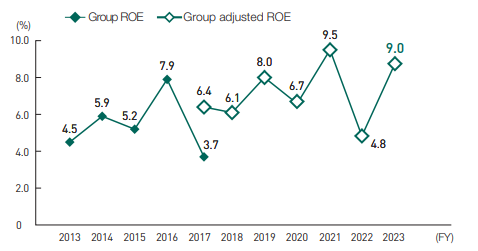

This is one of the numerical management targets in the Medium-Term Management Plan and indicates the ratio of Group core profit/Group adjusted profit, as shown to the left, in respect to consolidated net assets.

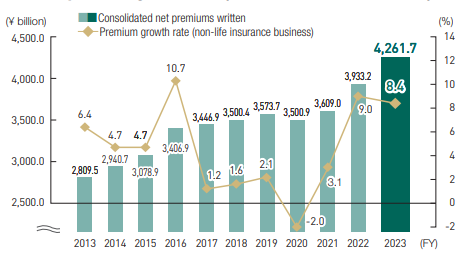

Consolidated net premiums written is one of the numerical management targets in the Medium-Term Management Plan. The premium growth rate indicates growth potential in premium income for the domestic non-life insurance business and international non-life insurance business.

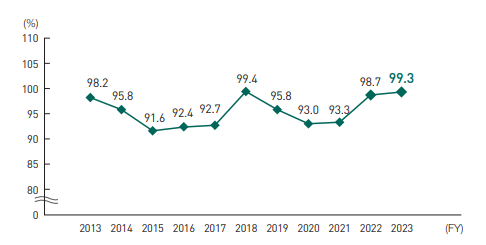

The combined ratio is a key indicator of profitability for underwriting in the non-life insurance business. Profitability is negative when this indicator exceeds 100% and positive when this indicator falls below 100%.

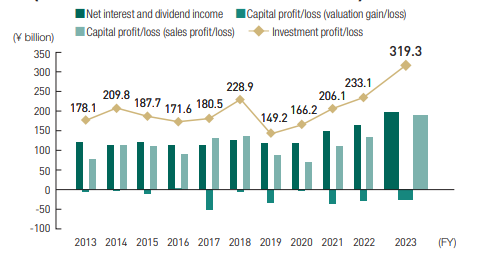

For non-life insurance companies, this is a major source of earnings, next to insurance underwriting profit, and consists of components such as interest and dividend income and gains/losses on sales of securities.

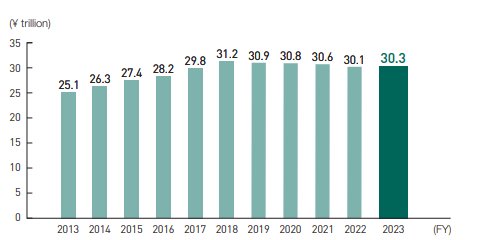

Policies in force is one of the basic indicators of the performance of life insurance companies. It represents the total amount of money guaranteed to policyholders of valid policies at the end of a fiscal year.

1. The definitions for adjusted profit and adjusted ROE, which have been identified as numerical management targets, are being reviewed under the Medium-Term Management Plan “Vision 2021,” which was initiated in FY2018.

2. Excludes the Good Results Return premiums of “ModoRich” voluntary auto insurance product.

3. Simple sum of non-consolidated figures for Mitsui Sumitomo Insurance and Aioi Nissay Dowa Insurance.

4. Total amount of policies in force for individual insurance and individual annuity insurance at MSI Aioi Life and MSI Primary Life.

A checkmar (✔) indicates that FY2023 figures have been assured by KPMG AZSA Sustainability Co., Ltd.

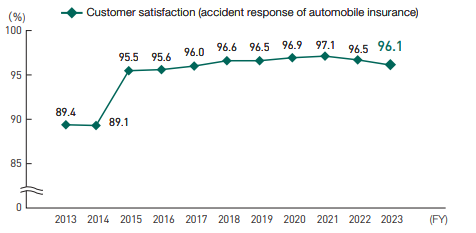

Our growth potential depends on improving customer satisfaction. Along with these indicators, customer opinions are helpful in improving quality.

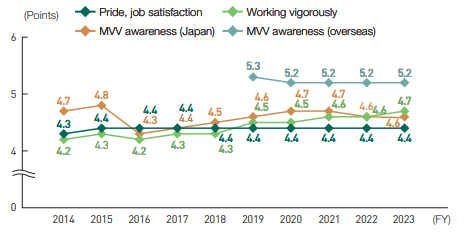

Scope: Domestic Group companies. All-employee average on a 6-point scale.

We consider “mission/vision/value (MVV) awareness” and “pride, job satisfaction” on the part of Group employees to be important elements in achieving sustainable growth in corporate value and always aim to improve these areas.

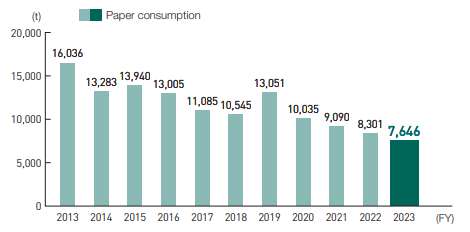

Paperless meetings, PDF-format pamphlets, and portable device and tablet use are being actively incorporated to help reduce paper consumption through various measures including increased application of RPA. FY2019 saw a temporary increase in printed materials due to the change in Japan’s era name and product revisions.

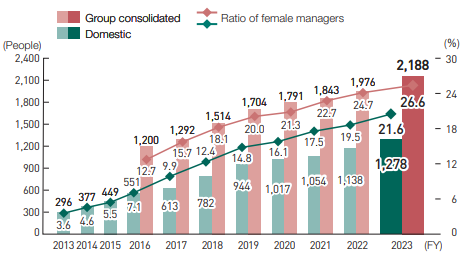

By promoting diversity in the manager position (section managers and above), we believe that we will allow for strategies, product development, and organizational management that incorporate diverse perspectives and sense of values, leading to higher customer satisfaction and growth potential.

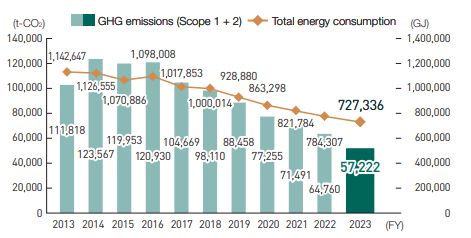

Reducing GHG emissions will contribute to mitigating climate change, which is a risk to the insurance business. It also contributes to a reduction in business expenses related to energy use.

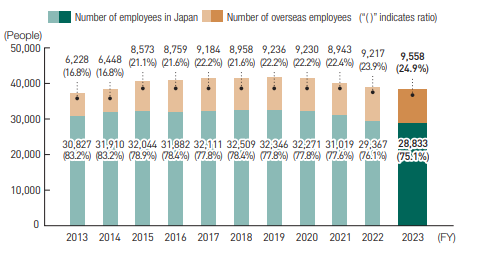

Increasing the number of employees from different cultures and with a diverse sense of values, and deepening mutual understanding among employees, leads to stronger organizational capacity for the Group and is a driving force especially in international business development.

5. Customer survey choices were streamlined from five options to four in FY2015 and unified within the Group. This figure indicates the ratio of customers who chose the top two options (Mitsui Sumitomo Insurance and Aioi Nissay Dowa Insurance).

6. For FY2013 to FY2016, GHG emissions resulting from tenant use of rental properties were included in our own GHG emissions. Moreover, emissions for FY2013 to FY2015 were calculated before the acquisition of MS Amlin, etc., and thus its emissions are not included in these figures. Total energy consumption is calculated based on the energy conversion coefficient from the Law Concerning the Promotion of Measures to Cope with Global Warming. Electric power energy use, however, is 3.6 GJ/MWh.

7. As of April 1 of the subsequent fiscal year for domestic Group companies and as of December 31 for overseas Group companies.