Our group aims for a "resilient and sustainable society" by 2030, and is working to achieve this through corporate activities that create "stories of value creation."

As a management foundation to support this, we will implement transparent and highly effective corporate governance in our medium-term management plan (2022 -2025).

- In line with its Corporate Philosophy (Mission), MS&AD, as a holding company overseeing all group businesses, has established a management framework that ensures transparent, fair, swift and decisive decision-making that takes into account the standpoint of all stakeholders. The Company's objectives are to sustain stability and consistent growth over the long term by using corporate resources efficiently and managing risks properly and ultimately, to further increase enterprise value.

- To this end, the “MS&AD Insurance Group Corporate Philosophy (Mission), Corporate Vision, and Values” were formulated as something all officers and employees of the Group should adhere to in all situations. In addition to working to disseminate these principles among all officers and employees of the Company and its Group companies, corporate governance, compliance, and risk management are positioned as important management issues in the medium-term management plan, and efforts shall be made to actively promote that plan.

※There is a movement to set "Purpose" as an expression of the raison d'etre of a company separate from the management philosophy. However, because our group's Management Philosophy (Mission), which expresses the raison d'etre of a company in a simple and easy to understand manner, has already permeated throughout the Group, our group has determined that "Purpose" is the same as the Management Philosophy.

- As a Company with an Audit and Supervisory Committee, the Company aims to expedite decision making and business execution by appropriately exercising the supervisory function of the Board of Directors and delegating part of important business execution decisions to Directors. In addition, the Audit and Supervisory Committee has the function of auditing the execution of duties by Directors as part of the Board of Directors, and will endeavor to improve governance through strengthening of each functions and actively disclosing information.

- The Company forms the Nomination Committee, the Remuneration Committee, and the Governance Committee (The majority of each committee’s members and each chairperson have been appointed from among the Independent Outside Directors) as internal committees of the Board of Directors, thus building a highly effective and transparent corporate governance system.

- The Company has introduced an Executive Officer System and is proceeding to delegate authority over business execution to these Executive Officers to ensure rapid execution.

- In addition to matters specified by laws and regulation and the Companys articles of in corporation, the Board of Directors discusses and decides upon important matters involving Group management strategy and corporate management, including the Group’s management policies, management strategies and capital policy, in addition to overseeing the duties of Directors and Executive Officers.

- The Board of Directors allocates management resources according to risk appetite controlled with a balance of risk, return and capital, and aims to increase corporate value in the medium to long term by achieving sustainable growth and improvement in profitability and capital efficiency with a foundation of soundness.

- The Board of Directors determines the extent to which some decisions related to the execution of important business operations are delegated to Directors. In addition to appointing Executive Officers, the Board of Directors aims to separate management ecision making and oversight by the Board of Directors from business execution by Executive Officers by clarifying their respective roles.

- Executive officers are responsible for executing business in the respective areas of business entrusted to them by the Board of Directors, and report on the status of business execution to the Board of Directors.

A majority of the Board of Directors which has thirteen members (nine men and four women) are nominated as Outside Directors to incorporate perspectives independent from management, strengthen monitoring and oversight functions, and conduct highly transparent management. As shown below, we are striving to ensure diversity including gender, race, and nationality, while considering the balance of knowledge, experience and abilities of the Board of Directors as a whole. Please refer to Policies on the Board of Directors' Overall Balance of Expertise, Experience, Capabilities, Diversity, and Scale below.

Outside Directors are expected to perform the following roles:

- Provision of advice from a broad perspective on management policies and management improvement based on their knowledge and experience, with the aim of promoting sustainable corporate growth and increasing enterprise value over the medium-to-long term

- Supervising of management through important decision making at the board level

- Monitoring of conflicts of interest between the Company and related parties such as management* and/or major shareholders

- Realizing supervising from a standpoint independent of management by fulfilling accountability for stakeholders, including shareholders

* Collectively refers to the directors, Audit & Supervisory Board Members, and executive officers of the Company and domestic insurance companies in the Group in which the Company has a direct investment.

Aiming to enable Outside Directors to engage freely in constructive discussions and opinion exchanges, we have formed the following committee and meetings.

- Governance Committee (meets about twice a year)

- Outside Directors Council (meets about multiple times a year)

Outside Directors (excluding those who are Audit Committee members) are supported by the General Planning Department, and Outside Directors who are Audit and Supervisory Committee Members are supported by the Internal Audit Department.

Regarding proposals to be submitted to the Board of Directors, a person in charge of each Outside Director is assigned to the General Planning Department, which is the secretariat of the Board of Directors, to provide advance explanations and provide necessary information in an appropriate manner.

In addition, important risk information, etc. is reported to all Directors regardless of whether they are internal or external.

The Company has the following systems in place as required for Directors to effectively fulfill their roles and responsibilities:

- The Company has assigned a person in the secretariat of the Board of Directors to each of the Outside Directors to provide support in areas such as providing briefings in advance.

- The Company has established a system to provide continuous information and training on the business environment surrounding the Company, risk management, etc. to Directors upon their assumption of office and during their term of office.

- The Company provides appropriate opportunities for Outside Directors to share information and exchange opinions with management and senior employees.

- The Company shall bear the expenses necessary for Outside Directors to fulfill their roles.

In fiscal 2024, 9 seminars and study sessions were held for directors.

< Main themes >

“Exchange of views with overseas management,” “Trends in overseas insurance markets (including reinsurance),” “Use of generated AI,” “Extreme weather,” “IFRS,” etc.

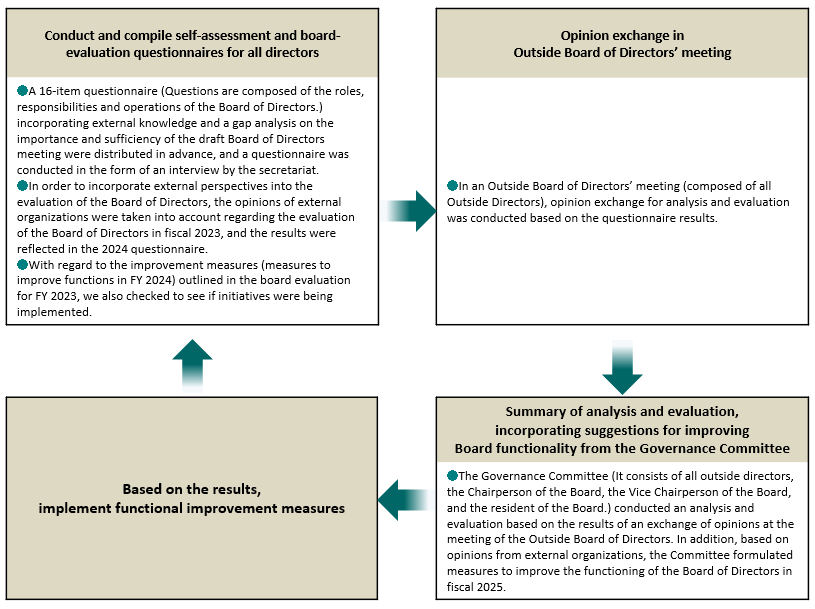

(1) Conduct and compile self-assessment and board-evaluation questionnaires for all directors

- A 16-item questionnaire (Questions are composed of the roles, responsibilities and operations of the Board of Directors.) incorporating external knowledge and a gap analysis on the importance and sufficiency of the draft Board of Directors meeting were distributed in advance, and a questionnaire was conducted in the form of an interview by the secretariat.

In order to incorporate external perspectives into the evaluation of the Board of Directors, the opinions of external organizations were taken into account regarding the evaluation of the Board of Directors in fiscal 2023, and the results were reflected in the 2024 questionnaire. - With regard to the improvement measures (measures to improve functions in FY 2024) outlined in the board evaluation for FY 2023, we also checked to see if initiatives were being implemented.

(2) Opinion exchange in Outside Board of Directors’ meeting

- In an Outside Board of Directors’ meeting (composed of all Outside Directors), opinion exchange for analysis and evaluation was conducted based on the questionnaire results.

(3) Summary of analysis and evaluation, incorporating suggestions for improving Board functionality from the Governance Committee

- The Governance Committee (It consists of all outside directors, the Chairperson of the Board, the Vice Chairperson of the Board, and the resident of the Board.) conducted an analysis and evaluation based on the results of an exchange of opinions at the meeting of the Outside Board of Directors. In addition, based on opinions from external organizations, the Committee formulated measures to improve the functioning of the Board of Directors in fiscal 2025.

(4) Based on the results, implement functional improvement measures.

Based on the content of discussions and the performance of functions at the Board of Directors meetings in fiscal 2024, as well as operational aspects and the training and information provided to outside officers, the performance of functions at the Board of Directors meetings was generally well received. The following is a summary of the activities and results of the evaluation of the Board of Directors in fiscal 2024 and the measures to improve functions in fiscal 2025.

|

Fiscal 2024 |

|

|---|

|

Measures to improve |

|

|---|

1.Responsibilities of Audit and Supervisory Committee

As a statutory independent organization, the Audit and Supervisory Committee is entrusted by shareholders to audit the execution of duties by Directors. It is responsible for establishing a good corporate governance system that meets the trust of society by properly executing its duties, and plays a part in the supervisory function of the Company in cooperation with the Board of Directors.

2.Composition and Roles of the Audit and Supervisory Committee

- The number of Directors who are Audit and Supervisory Committee Members is a majority of which shall be Outside Directors in accordance with the law. Candidates for Directors who are Audit and Supervisory Committee Members are nominated by the Board of Directors with the approval of the Audit and Supervisory Committee, based on the “Criteria for the Selection of Director Candidates”.

- The Audit and Supervisory Committee makes decisions regarding auditing policies and auditing plans.

- The Audit and Supervisory Committee makes decisions regarding proposals to be submitted to the General Shareholders Meeting on the appointment or dismissal of Accounting Auditors, and the non reappointment of Accounting Auditors. It also has the right to consent to decisions regarding remuneration of the Accounting Auditors.

- The Audit and Supervisory Committee determines the opinions regarding the appointment, dismissal, and resignation of Directors (excluding those who are Audit and Supervisory Committee Members.)

- The Audit and Supervisory Committee determines the opinions regarding the renumeration, etc. of Directors (excluding those who are Audit and Supervisory Committee.

3.Organizational Auditing

- The Audit and Supervisory Committee exercises its audit and supervisory functions by utilizing internal audits by the Internal Audit Division under an organizational audit structure that has the authority to direct and command the Internal Audit Division. The Audit and Supervisory Committee ensures the effectiveness of audits by having the authority to give prior consent when formulating or revising important policies, internal audit rules, and internal audit plans of the Internal Audit Division and instructing the Internal Audit Division to conduct internal audits and monitoring as necessary.

- The Company has established the “MS&AD Insurance Group Basic Policy for Internal Audits.

Under this basic policy, the Company and domestic Group insurance companies have formed the Internal Audit Department that acts as an independent body with auditing functions.

This department conducts internal audits encompassing a wide range of risks arising from business activities.

The internal auditors, who are members of the internal audit department, are continuously committed to maintaining and improving their professional competence.

The department formulates annual internal audit plans, taking into account management objectives and risk assessments based on internal and external information. These plans encompass risks arising from business activities, including ERM and data governance such as privacy policies. In addition to implementing these plans on an annual basis, the department may also take proactive measures to address significant risks. The results of these activities are provided as feedback to the audited organization, contributing to improvement efforts. - Under the direction and direction of the Audit and Supervisory Committee, the Internal Audit Division of our company supervises the internal audit divisions of the Group's domestic insurance companies and affiliated companies, and flexibly examines important Group risks. The results of internal audits are regularly reported to the Group Management Committee, the Audit and Supervisory Committee, and the Board of Directors to ensure the sharing of information among all directors.

- The Company has appointed KPMG AZSA LLC as its independent audit corporation. Please note that there are no special conflicts of interest between this company and MS&AD Holdings.

- The Board of Directors and the Audit & Supervisory Committee endeavor to take appropriate action to ensure adequate auditing by the Accounting Auditors.

- The Audit & Supervisory Committee makes decisions regarding proposals submitted to the General Shareholders' Meeting on the appointment or dismissal of Accounting Auditors. It also has the right to consent to decisions regarding remuneration of the Accounting Auditors.

- The Audit & Supervisory Committee prepares criteria for appropriately selecting and evaluating Accounting Auditor. To promote appropriate accounting by the Accounting Auditors, measures are taken to confirm the independence, specialist capabilities, and other requisite characteristics of the Accounting Auditors.

| (¥ million) | ||||||||||||||||||||||||

|

||||||||||||||||||||||||

*Compensation for audit and attestation services at our company and consolidated subsidiaries includes compensation for voluntary audit contracts in preparation for adoption of International Financial Reporting Standards (IFRS).

The non-audit function in our company is to support compliance.The content of non-audit operations at consolidated subsidiaries includes agreed procedural operations.

For the purpose of maintaining high transparency, the Company has formed the Nomination Committee and Remuneration Committee as internal committees of the Board of Directors. Please note that these two committees comprise eight members each, and the chairpersons and other members are appointed from among members of the Board of Directors. With respect to each of the two committees, Five of the members and the chairperson have been appointed from among the Outside Directors. (However, there must be at least one audit and supervisory committee member, including the chairman of the audit and supervisory committee.).

*In fiscal 2025, both the Nomination Committee and the Compensation Committee consisted of 5 outside directors and 8 members, including the Chairperson of the Board, the Vice Chairperson of the Board and the President.

- The Nomination Committee deliberates on major management personnel matters and provides advice on these matters to the Board of Directors. Such matters include the selection of candidates for the positions of Director and Executive Officer of the Company as well as the selection of Directors and Audit & Supervisory Board Members for domestic insurance companies in which the Company has direct investments.

- With respect to the evaluation of candidates for Director and candidates for Executive Officer, evaluation items include performance evaluations (corporate performance and personal performance) and other items.

- The Board of Directors appoints candidates for Director as well as candidates for Executive Officers based on advice from the Nomination Committee.

- From the perspective of making effective discussions to strengthen corporate governance at the Nomination Committee, policy for selecting candidates for Directors is added to the deliberation items. It has been clarified that the Nomination Committee shall meets at least once a year.

- The committee met 5 times in fiscal 2024. Discussions were held regarding consideration of candidates for outside directors.

- This committee advises the Board of Directors regarding the remuneration of Directors and Executive Officers of the Company as well as the remuneration systems for management of domestic insurance companies in which the Company has direct investments.

- From the perspective of making effective discussions to strengthen corporate governance at the Remuneration Committee, policy for remuneration of Directors and Executive Officers is added to the deliberation items. It has been clarified that the Remuneration Committee shall meet at least once a year.

- In fiscal 2024, the Remuneration Committee met 5 times.

The Board of Directors of the Company passed the following resolution on policies for determining the content of individual remuneration for Directors, etc. at its meetings held on February 14, 2019, May 20, 2019, May 20, 2021, December 27, 2022 and March 28, 2025 after deliberation by the Remuneration Committee of which a majority of the members are Outside Directors.

a. Basic policy

- The purpose is to strengthen governance and enhance the medium- to long-term corporate value of the Group.

- The officer remuneration system shall function as an appropriate incentive for sustainable growth, linking with the business performance of the Company.

- The level of remuneration shall be competitive as a global company.

b. Decision process

(a) Remuneration for Directors

- To ensure transparency, it shall be decided by resolution of the Board of Directors after deliberation by the Remuneration Committee, of which a majority of the members are Outside Directors, within a range determined by resolution of the Shareholders Meeting.

- The Remuneration Committee provides advice to the Board of Directors on the amount of remuneration for Directors and policies regarding decisions on the determination of officer remuneration.

- The Board of Directors respects the advice of the Remuneration Committee to the maximum possible extent. And the amount of remuneration is determined after confirmation that it is in line with the remuneration system established by resolution of the Board of Directors.

Furthermore, the Board of Directors has confirmed that, in regard to the individual remuneration of Directors for the relevant fiscal year, the advice of the Remuneration Committee has been respected to the maximum possible extent and it is in line with the remuneration system established by resolution of the Board of Directors. The Board of Directors has therefore judged that it is in line with this basic policy for determining the remuneration of Directors.

(b) Remuneration for Directors who are Audit and Supervisory Committee Members

- It shall be decided by discussion among Directors who are Audit and Supervisory Committee Members within a range determined by resolution of the Shareholders Meeting, taking into consideration full-time/part-time, operation assignment, the details and level of Directors’ who are not Audit and Supervisory Committee Members’ remuneration.

c. Overview of remuneration

(a) Composition of remuneration

| Fixed remuneration | Performance-linked remuneration | ||

| Monetary remuneration | Stock-based remuneration |

||

| Directors (excluding Outside Directors and Directors who are Audit and Supervisory Committee Members) | 〇 | 〇 | 〇 |

| Outside Directors | 〇 | ― | ― |

| Directors who are Audit and Supervisory Committee Members | 〇 | ― |

― |

- Composed of fixed remuneration and performance-linked remuneration. Outside Directors and Directors who are Audit and Supervisory Committee Members shall be provided only fixed remuneration.

- Fixed remuneration is determined in accordance with officers’ position.

- Performance-linked remuneration is determined based on business performance.

- Performance-linked remuneration is composed of monetary remuneration and stock-based remuneration.

- Fixed remuneration is paid on a monthly basis, and performance-linked remuneration is paid after the end of each fiscal year.

- The standard proportions of the components of officer remuneration differ depending on the officer’s position, as shown below. (This excludes Outside Directors and Directors who are Audit and Supervisory Committee Members.)

<Chairman & Director・Vice Chairman & Director・President & Director>

The proportion of performance-linked remuneration is higher than for other positions.

(Standard ratios)

|

[Fixed remuneration] |

[Performance-linked remuneration] |

[Performance-linked remuneration] |

<Other positions>

The composition is such that the proportions of fixed remuneration and performance-linked remuneration differ depending on the officer’s position

(Standard ratios)

|

[Fixed remuneration]

|

[Performance-linked remuneration] Monetary remuneration Approx. 25% - approx.30% |

[Performance-linked remuneration] |

(b) Contents of stock-based remuneration

- Restricted stock shall be provided as stock-based remuneration and in principle, the Transfer Restrictions shall be released upon retirement of the related Director.

- If it is found that a Director was involved in a fraudulent act while in office, the Company acquires the restricted stock for free during the Transfer Restriction Period or the Director is made to return it after the transfer restriction is released. (Malus Clawback Clause)

|

Overview of restricted stock remuneration plan |

|

| Eligible Directors | Directors excluding Outside Directors and Directors who are Audit and Supervisory Committee Members. |

| Amount of monetary remuneration to be provided (maximum) | 200 million yen per year |

| Type of shares to be allotted | Common shares (with transfer restrictions under a restricted stock allotment agreement) |

| Number of shares to be allotted (maximum) | 390,000 shares per year |

| Transfer restricted period | Period from the allotment date to the date on which the related Eligible Director resigns or retires as the Company’s Director or from another position which the Board of Directors has determined. |

d. Key performance indicators pertaining to performance-linked remuneration

- Performance-linked remuneration shall be linked with the business performance of the Company and determined based on financial and non-financial indicators.

- Financial and non-financial indicators have been selected after taking into consideration the Group’s Medium-Term Management Plan, “FY 2022-25,” and the details of indicators and reasons for their selection are as follows.

(a) Financial indicators

- Financial indicators are indicators that are used to reflect business performance in a single fiscal year in officer remuneration.

|

Indicator |

Reasons for selection |

| GroupAdjustedProfit(*1) | The selected indicators were Group Adjusted Profit as a measure of shareholder returns, Group Adjusted ROE as a measure of capital efficiency, and Consolidated Net Income as a key performance indicator for the Group. * After the adoption of IFRS, the indicators at the left will be changed to “IFRS net income” and “Adjusted ROE” on an IFRS basis. |

| Consolidated Net Income | |

| Group Adjusted ROE (*2) |

*1: Group Adjusted Profit

Consolidated net income + provision for catastrophe loss reserve and others - other incidental factors (amortization of goodwill and other intangible fixed assets, and others) + equity in earnings of the non-consolidated group companies

*2: Group Adjusted ROE

Group Adjusted Profit ÷ average of beginning and ending amounts on BS of adjusted net assets (consolidated net assets + catastrophe reserves, and others - goodwill and other intangible fixed assets)

(b) Non-financial indicators

- Non-financial indicators are indicators that are used to reflect initiatives contributing to medium- to long-term business performance in officer remuneration.

| Evaluation item | Reasons for selection | |

| Basic strategies | 〇 Value (creating value) 〇 Transformation (business transformation) 〇 Synergy (demonstrating Group synergy) |

“Basic strategies” and “Platforms” that support the basic strategies have been selected as non-financial indicators in order to realize “A corporate group that supports a resilient andsustainable society,” which is an aspiration of the Group’s Medium-Term Management Plan (2022-2025). |

| Platforms | 〇 Sustainability 〇 Quality 〇 Human resources 〇 ERM |

(c) Application methods for financial and non-financial indicators

- The standard ratio between financial and non-financial indicators used in the calculation of performance-linked remuneration shall be “50:50.”

- The application coefficients for financial and non-financial indicators shall vary within ranges of 0.5 to 1.5, respectively, with 1.0 as the standard.

- The monetary remuneration and stock-based remuneration components of performance-linked remuneration shall each be calculated as follows, based on standard amounts for each position.

Monetary remuneration: Standard amount per position × business performance coefficient (financial indicators × 80% + non-financial indicators × 20%)

Stock-based remuneration: Standard amount per position × business performance coefficient (financial indicators × 20% + non-financial indicators × 80%)

- Monetary remuneration is structured such that it more strongly reflects business performance in a single fiscal year, by having a higher ratio for financial indicators than non-financial indicators.

- Stock-based remuneration is structured such that it more strongly reflects an evaluation of initiatives contributing to the enhancement of corporate value over the medium-to long-term, by having a higher ratio for non-financial indicators than financial indicators.

(d) Actual financial and non-financial indicators in the fiscal year under review

<Financial indicators>

| Actual | Target | Vs. target | |

| Group Adjusted Profit | ¥731.7 billion | ¥670.0 billion | 109.2% |

| Consolidated Net Income | ¥691.6 billion | ¥630.0 billion | 109.8% |

| Group Adjusted ROE | 15.7% | 14.3% | +1.4 point |

<Non-financial Indicators>

| Evaluation item | Results of evaluation |

| Basic strategies | As a result of evaluation based mainly on the following points, performance is evaluated to be at a standard level: ・Developing and deployment products and services before and after compensation/guarantee leading to solutions to social issues ・Expansion of overseas business and domestic life insurance business, transformation of business portfolios and risk portfolios and pursuit of new business utilizing digital data ・Improvement of work quality and productivity and demonstration of group synergy through the execution of the one platform strategy |

| Foundations | As a result of evaluation based mainly on the following points, performance is evaluated to be at a below-average level: ・Initiatives related to the key three sustainability issues of coexistence with the global environment, a safe and secure society, and the well-being of diverse people ・Thorough implementation and establishment of customer focus business operations, and efforts to improve compliance awareness and knowledge ・Initiatives related to human assets aimed at "building an optimal human asset portfolio" and "maximizing employees' abilities, skills, and motivation ・Initiatives to strengthen the risk management system and capital efficiency |

e. Resolutions related to officer remuneration at the Shareholders Meeting

<Remuneration for Directors Who Are Not Audit and Supervisory Committee Members>

|

Shareholders Meeting held on June 23, 2025 [17th Annual Shareholders Meeting] ・It has been resolved that the amount of remuneration, etc., for Directors who are not Audit and Supervisory Committee Members shall be within an annual limit of 510 million yen (excluding salaries for Directors concurrently serving as employees) (of which the annual limit for Outside Directors is 100 million yen). |

<Remuneration for Directors Who Are Audit and Supervisory Committee Members>

| ・It has been resolved that the amount of remuneration, etc., for Directors who are Audit and Supervisory Committee Members shall be within an annual limit of 100 million yen. At the conclusion of the said Annual Shareholders Meeting, the number of Directors who are Audit and Supervisory Committee Members is 3 (of which 2 are Outside Directors). |

- The Company has introduced performance-based remuneration (linked to corporate and personal performance) into its corporate officer remuneration system.

- In order to realize a director remuneration system functioning as an appropriate incentive for improving linkage between director remuneration and business performance and achieving sustainable growth for the purpose of strengthening governance and increasing medium term corporate value of the Group, the Company has introduced a restricted stock remuneration plan for Directors (excluding Outside Directors and Directors who are Audit and Supervisory Committee Members.). The plan involves granting treasury stock or new stock (allotment of restricted stock) by replacing a portion of the Company’s performance-based monetary remuneration with monetary remuneration receivables provided by means of contribution in kind.

- The Company introduced the same system as mentioned above and granted treasury stock or new stock (allotment of restricted stock) to the Company’s executive officers and the Directors (excluding Outside Directors) and Executive Officers of Group domestic insurance companies in which the Company has direct investments, by replacing a portion of the Company’s performance-based monetary remuneration with monetary remuneration receivables provided by means of contribution in kind.

We disclose the total amounts of remuneration to all Directors and to all Audit & Supervisory Board Members according to the category (Directors/Audit & Supervisory Board Members) and according to the types of remuneration. We also disclose total amounts of consolidated remuneration to officers amounting to 100 million yen or more.

|

|

Our company has established the Guidelines for Ownership of Treasury Shares in order to enhance corporate value over the medium to long term by encouraging directors and executive officers (excluding outside officers) to own treasury stock and further raising the motivation and morale of directors and executive officers.

1. Policies on the Board of Directors' Overall Balance of Expertise, Experience, Capabilities, Diversity, and Scale

- Seven of the thirteen Directors (nine men and four women) and two of the three Directors who are Audit and Supervisory Committee Members (2 men and woman) have been appointed from outside the Company to incorporate perspectives independent from management, strengthen monitoring and oversight functions, and conduct highly transparent management. Please note that there are no concerns that the interests of these Outside Directors and Outside Audit & Supervisory Board Members of the various companies will be in conflict, in terms of human, capital, transactions, or other relationships, with the interests of shareholders in general. These Directors and Audit & Supervisory Board Members are independent, and their names as independent outside officers have been filed with the Tokyo Stock Exchange Co., Ltd., and Nagoya Stock Exchange Co., Ltd.

- Outside Director candidates must satisfy the eligibility requirements as defined in the Companies Act and the Insurance Business Act. In addition, with the goal of selecting candidates able to accurately and fairly supervise the overall management of insurance companies, candidates are selected based on consideration of specialized expertise such as that stemming from experience working as a general business company corporate officer, government administration officer, lawyer, and academic as well as specialized expertise regarding social, cultural, and consumer issues.

- Director candidates other than Outside Director candidates must meet legal eligibility requirements. In addition, with the goal of selecting candidates able to accurately and fairly supervise the overall management of insurance companies, candidates are selected based on consideration of specialized expertise, such as that stemming from extensive experience working as a manager in an insurance company as well as on consideration of varied experience, highly specialized experience, and the ability to exercise leadership in accordance with the Company's corporate philosophy.

2. Criteria for the Selection of Director Candidates and Criteria for Determining the Independence of Outside Corporate Officers

- The Company has instituted the “Criteria for the Selection of Director Candidates” below. The determination of “independence” when selecting Outside Director candidates is undertaken in accordance with the criteria described in section “1. (3) Independence” below.

1. Outside director candidates

Candidates must meet the following requirements.

- Must not be disqualified from serving as a director pursuant to the Companies Act.

- Must not be disqualified from serving as a director of an insurance holding company pursuant to the Insurance Business Act.

- Must have a sufficient level of public credibility.

Additionally, candidates must satisfy the following three requirements

(1) Eligibility

A candidate must have the qualities listed below that are necessary to monitor the overall management of the company and provide advice, based on a general knowledge of company management and a basic understanding of the way Directors and Board of Directors ought to be.

- Ability to discern facts from materials and reports

- Capability to detect problems and risks and apply own knowledge to solve them

- Capacity to appropriately monitor and provide advice on management strategy

- Mental independence to openly question, debate, re-examine, continuously deliberate, and propose ideas in opposition to a resolution

For Outside Directors who are Audit and Supervisory Committee Members, in addition to the above, it is required that they possess the knowledge and experience necessary to accurately, fairly, and efficiently audit the execution of duties by directors of insurance companies.

(2) Expertise

Must have knowledge in a specialized field such as management, accounting, finance, law, administration, or social/cultural affairs, and have a record of achievement in that field.

(3) Independence

The following persons are ineligible.

[1] An executing person of the Company or a subsidiary of the Company.

[2] A Director or Audit & Supervisory Board Member of a subsidiary of the Company.

[3] A person for whom the Company is a major business partner (i.e. a person who received payments from the Company or subsidiaries of the Company that represent 2% or more of annual consolidated sales for the most recent fiscal year), or an executing person thereof (in the case of a consulting firm, auditing firm or law firm, a consultant, accounting professional, or legal professional who belongs to said corporation, partnership, etc.).

[4] A major business partner of the Company (a person who made payments to subsidiaries of the Company representing 2% or more of the consolidated net premiums written during the most recent fiscal year of the Company (excluding premiums of saving-type insurance)), or an executive thereof.

[5] Any of the Company’s top 10 largest shareholders (or, if the shareholder is a corporation, an executing person thereof).

[6] An executive of a company to which the Company or a subsidiary of the Company has appointed a Director.

[7] A consultant, accounting professional, or legal professional who has received, other than officer remuneration, monetary or other financial benefits of average at least 10 million yen per year for the past three years from the Company or subsidiaries of the Company.

[8] A person falling under any of the items [1]through [7] during the past five years.

(Note) “During the past five years” means five years from the time the content of a proposal to the General Shareholders Meeting to elect the Outside Director was resolved by the Board of Directors.

[9] An executive of the Company or subsidiaries of the Company in the past (in the case of an Outside Directors who are Audit and Supervisory Committee Members, including an individual who has been a Director who are not Audit and Supervisory Committee Members of the Company or a subsidiary of the Company.)

[10] A spouse or second-degree or closer relative of a person listed in items [1] through [9] above (an executing person means an executive Director, executive Officer or an employee in a position of general manager or higher.)

(4) Term limits

The total terms of office for newly elected Outside Directors who are not Audit and Supervisory Committee Members and Directors who are Audit and Supervisory Committee Members from the close of the 17th Annual Shareholders Meeting are as follows.

[1] For Outside Directors who are not Audit and Supervisory Committee Members, the total terms of office are four terms, four years, and are renewable for a maximum of eight terms, eight years.

[2] For Outside Directors who are Audit and Supervisory Committee Members, in principle the total terms of office are two terms, four years, but they are renewable for a maximum of four terms, eight years.

2. Director candidates other than Outside Director Candidates must meet the following requirements.

Candidates must meet the following requirements.

- Must not be disqualified from serving as a Director pursuant to the Companies Act.

- Must not be disqualified from serving as a Director of an insurance holding company pursuant to the Insurance Business Act.

- Must satisfy the eligibility requirements for a Director who engages in daily business at an insurance company pursuant to the Insurance Business Act.

- For Directors who are Audit and Supervisory Committee Members, in addition to the above, it is required that they possess the knowledge and experience necessary to accurately, fairly, and efficiently audit the execution of duties by directors of insurance companies.

Additionally, a candidate must have varied experience as well as highly specialized experience and must embody our corporate philosophy in the exercise of leadership.

|

*1 The number of Board of Directors' meetings attended during fiscal 2024.

*2 Mr. Taisei Kunii was newly elected and assumed the position of Audit & Supervisory Board Member at the 16th Annual Shareholders Meeting held on June 24, 2024, and his attendance at the Board of Directors meetings and the Audit & Supervisory Board meetings held after that date is shown.

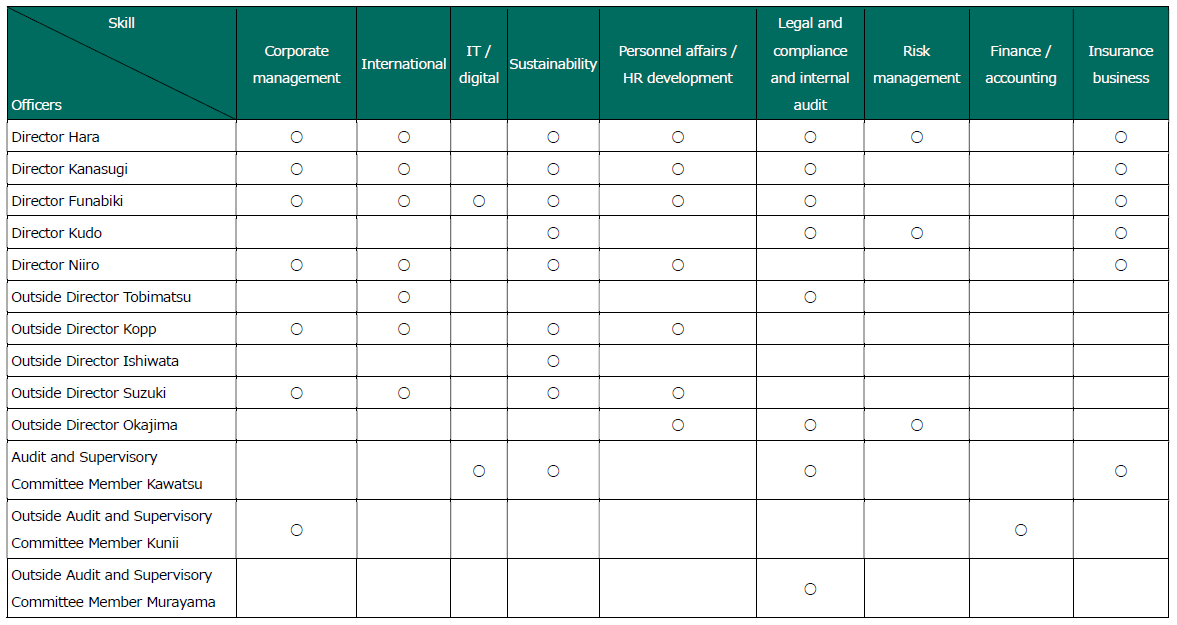

In order to promote debate from diverse viewpoints in our efforts to reach the goal of achieving growth strategy for the MS&AD Group, the Group deliberated regarding skills necessary to assure the effectiveness of the Board of Directors (knowledge, experience, and capability), and from the standpoint of supervising the decisions made and execution of duties on matters required for management strategy, we set forth the following.

(1) Base skills that are generally required

“Corporate management,” “human resources and human asset development,” “legal and compliance and internal audit,” “risk management,” and “finance and accounting”

(2) Skills complementing the fact that the core business of the MS&AD Group is insurance, and that we engage in business globally

“Insurance business” and “internationality”

(3) Skills that take into account our current business environment and that are necessary to address business reform and issues considered important by the market

“IT and digital” and “sustainability”

Skills matrix of Directors and Executive Officer

■Skills matrix of Directors

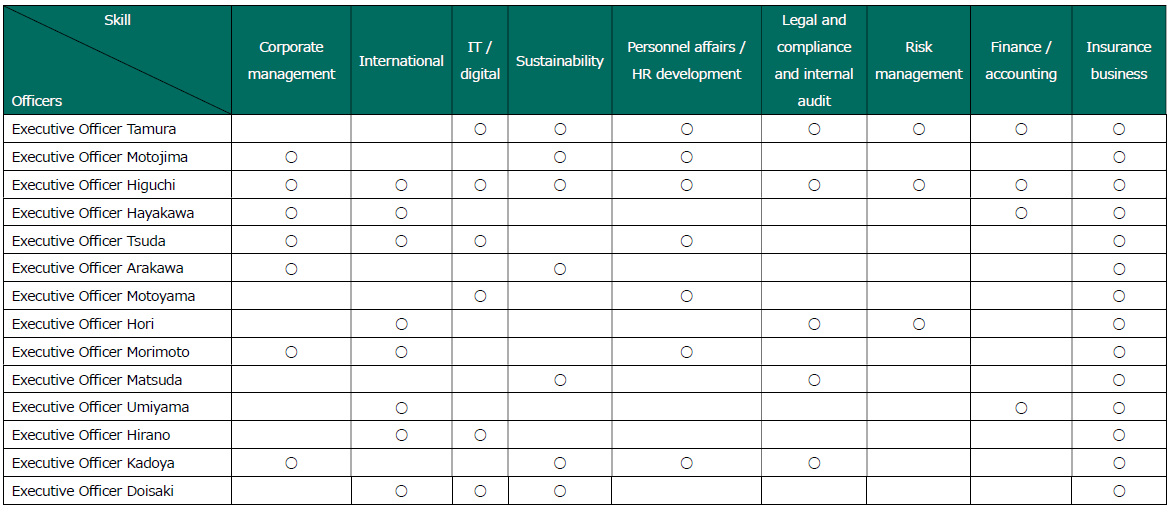

In addition, we have installed an executive officer system. The skills for Executive officers who are not Directors are as follows.