As global warming escalates, heatwaves, droughts, and wildfires are becoming more frequent and severe. Driven by glacial melting and the thermal expansion of seawater, rising sea levels are increasing coastal flooding risks, alongside heightened risks of heavy rainfall and flooding. Moreover, the impact of climate change extends beyond natural disasters. Loss of biodiversity is expected to reduce future ecosystem services, increase flood and landslide risks, exacerbate resource depletion, and worsen water quality.

Climate change and biodiversity loss are expected to have a significant impact on the activities of many companies. They are also impacting the underwriting practices of the insurance industry upon which companies depend. Accordingly, the MS&AD Insurance Group has identified “Symbiosis with the Global Environment — Planetary Health” as a priority issue and is advancing initiatives to address climate change and enhance the sustainability of natural capital in an integrated way. Through its insurance products and services, the Group is actively promoting disaster prevention and mitigation, while also advancing adaptation to climate change. To support the transition toward Net Zero by 2050, the Group has set greenhouse gas reduction targets and is working to reduce GHG emissions from its own operations. In addition, the Group is also maintaining dialogs with client companies to deepen its understanding of the challenges they face in reducing greenhouse gas emissions and is working with them to address these challenges.

We need to develop initiatives for mitigating advancing climate change while also putting in place measures to prepare against rising risks. The Group will provide society with safety and peace of mind through effective preparatory measures, including reinsurance for loss due to large-scale disasters. We will also support new businesses which lead to realization of a net-zero society, promoting climate change adaptation by providing appropriate services to reduce or eliminate damage and loss inflicted on customers by natural disasters.

|

While business activities in line with the Paris Agreement have become an important management strategy, we are working to develop and provide insurance products and services that support decarbonization of our customers’ activities and of society in general.

|

Service to Support Decarbonization |

The Japanese Government declared a target of “carbon neutral” by 2050 through reducing emissions of GHGs such as CO2 and requested local governments and companies in various industries to take appropriate measures. We provide all kinds of support in a one-stop package for businesses of any size in any industry. This support ranges from introductory seminars on decarbonization, to support for calculating carbon emissions, and developing strategies to cut emissions.

Consulting menus – climate change (TCFD/Net-zero GHG emission) (InterRisk) (in Japanese only) |

|---|

|

Joint Development of an On-site Solar Power Installation Scheme for SMEs |

Aioi Nissay Dowa Insurance has been working with the Japan Regional Resource Development for Renewable Energy Organization and Smart Energy Co., Ltd. to develop Roof Plus, a program designed to encourage companies to install on-site solar power systems for their power needs. The program aims to foster renewable energy adopters in regions across Japan and strengthen partnerships with local governments. Companies participating in Roof Plus can also share their solar power with local residents during a natural disaster through a free mobile phone charging station, thereby helping enhance energy security for local communities.

|

|---|

|

Insurance to Support Companies’ Decarbonization |

In terms of commercial property insurance, we provide the Carbon Neutral Support Clause (decarbonization measures cost compensation endorsement). While standard insurance coverage is up to restoration cost, this clause provides additional coverage and support companies’ decarbonization.

Launched the Carbon Neutral Support Clause for corporate fire insurance (MSI, ADI) |

|---|

|

Supporting wider use of environmentally friendly vehicles |

Mitsui Sumitomo Insurance and Aioi Nissay Dowa Insurance, led the industry in developing an Endorsement for Replacement with an Electric Vehicle, etc., which covers expenses incurred when buying an electric vehicle to replace an insured gasoline-fueled vehicle damaged/written off due to a traffic accident, and they began marketing that endorsement for insurance policies with commencement dates in and after January 2023.

Aioi Nissay Dowa Insurance also supports greater uptake of environment-friendly vehicles, including EVs, through provision of lower-premium insurance options, such as 10% discount on vehicle damage coverage for Toyota ultra-compact EVs and discounts specifically for autonomous vehicles (low-speed EVs) that use electromagnetic induction lanes, which are being introduced to secure means of local transport.

10% discount on vehicle damage coverage for Toyota ultra-compact EVs (ADI) (in Japanese only) |

|---|

|

Demonstration experiment launched to address EV ownership challenges: Trial roadside charging assistance service for battery depletion incidents |

We initiated a pilot project to provide comprehensive solutions for addressing EV adoption challenges, including R&D for new insurance products and services, to provide support services and insurance to cover EV risks.

We launched a trial Roadside Charging Assistance Service to help EV drivers who run out of charge while on the road. |

|---|

|

Creation of an EV maintenance network |

Mitsui Sumitomo Insurance has formed a partnership with folofly Inc. to establish a maintenance network for EVs. By expanding the EV maintenance network nationwide, the partnership aims to promote EV adoption in Japan and help lower greenhouse gas emissions.

|

|---|

|

Provision of service for calculating and visualizing GHG emissions |

Aioi Nissay Dowa Insurance launched a new service for visualizing CO2 emissions reduction through safe driving, using its unique algorism, targeting Telematics Automobile Insurance policyholders.

|

|---|

|

Products that support renewable energy businesses |

We support dissemination of renewable energies that help the transition to a net-zero society through various types of insurance products that comprehensively cover a variety of risks (including property damage, lost profits and liability) surrounding renewable energy developers (e.g. solar power, onshore/offshore wind power, biomass power, and small and medium-sized hydropower), and risk management services such as risk assessment/consulting and the provision of information through handbooks and other means.

|

|---|

|

Imbalance Risk Compensation Insurance for renewable energy producers/aggregators |

Mitsui Sumitomo Insurance has developed insurance products to cover imbalance risks borne by renewable energy producers and aggregators due to shortfalls in actual amounts of generated energy against their generation plans as a result of changes in the weather, generation equipment damage, etc., which can be customized depending on the status of risks.

|

|---|

|

Insurance Package for PPA Business Operators |

Aioi Nissay Dowa Insurance launched provision of an “Insurance Package” to cover not only risks of damage to power generation equipment but also risks of requiring alternative procurement of renewable energy and environmental values due to damage for the purpose of promoting the spread of the “PPA model*” that is increasingly being introduced as a method of procuring renewable energy.

Japan First — Launched provision of “Insurance Package for PPA Operators” (ADI) (in Japanese only) |

|---|

|

Insurance to Support Carbon Dioxide Capture and Storage |

In order to achieve net-zero by 2050, it is essential to utilize CCS, a greenhouse gas reduction technology, in areas and industries where existing technologies cannot eliminate use of fossil fuels.

Launched Environmental Impairment Liability Insurance for CCS Operators (MSI) (in Japanese only) |

|---|

|

Launch of J-Credit Compensation Insurance |

In partnership with Bywill Inc., Mitsui Sumitomo Insurance has developed and launched J-Credit Compensation Insurance for operators and managers of program-based projects under the J-Credit Scheme. By collaborating with partner companies that possess expertise in reducing CO2 and other greenhouse gas emissions, this initiative supports regional decarbonization efforts and is helping to realize a net-zero society.

Products and services: Launch of J-Credit Compensation Insurance (MSI) (in Japanese only) |

|---|

|

Compensation for additional home rebuilding costs in order to meet energy efficiency standards |

Mitsui Sumitomo Insurance and Aioi Nissay Dowa Insurance have developed a Building Energy Efficiency Cost Rider. This compensates for any additional costs necessary to meet energy efficiency standards when rebuilding a home that has been completely burned or destroyed. This rider is being offered as an optional add-on to personal fire insurance contracts starting from October 2024.

|

|---|

|

Launch of a brokerage service for GHG emissions trading |

Aioi Nissay Dowa Insurance has launched a brokerage service for GHG emissions trading. This service facilitates the selling of emissions credits generated by renewable energy businesses to various companies.

Launched a brokerage service for GHG emissions trading (ADI) (in Japanese only) |

|---|

We contribute to adaptation to climate changes through providing various ways of preparing against damage and loss caused by natural disasters.

|

Weather derivatives |

We sell weather derivatives to help minimize financial losses due to extreme weather or unseasonable weather. We provide solutions by underwriting weather derivatives that cover decreased sales and increased expenses stemming from below-average (or above-average) rainfall levels, extreme heat, unusually cool summers, severe winters, warmer-than-normal winters, or a lack of sunshine.

MS&AD InterRisk Research & Consulting Sustainable Management Report (InterRisk) (in Japanese only) |

|---|

|

Weather index insurance platform for farmers |

In collaboration with MSI Guaranteed Weather and an Australian Insurtech company, etc., we have developed a dedicated platform that enables customers to get online quotes in real time on weather index insurance, and sell the insurance to farmers in Australia. Whereas traditional crop insurance is often limited to wildfires and hailstorms, this product covers weather conditions such as drought, high and low temperatures, and rainfall just before harvest, contributing to the stabilization of farmers’ businesses in countries with frequent natural disasters. |

|---|

|

Participation in publicly funded natural disaster compensation scheme in overseas |

Mitsui Sumitomo Insurance has been participating in the Pacific Catastrophe Risk Assessment and Financing Initiative since it was jointly established in 2013 by the Japanese government and the World Bank, as a company underwriting reinsurance for natural disaster risks. In 2020, Mitsui Sumitomo Insurance participated in the Caribbean Catastrophe Risk Insurance Facility. In 2021, Mitsui Sumitomo Insurance and Aioi Nissay Dowa Insurance joined the Southeast Asia Disaster Risk Insurance Facility and, in 2023, Mitsui Sumitomo Insurance became a participant in the African Risk Capacity. |

|---|

|

Joint Issue of a Group catastrophe bond |

Mitsui Sumitomo Insurance and Aioi Nissay Dowa Insurance have jointly issued a catastrophe bond, Tomoni Re 2024, in Singapore to cover risks associated with natural disasters in Japan. Should losses from a natural disaster in Japan exceed predefined thresholds, a portion or all of the principal intended for investor repayment will be allocated as reinsurance payouts, depending on the excess amount. This bond aims to reduce the amount of retained risk through reinsurance, diversify reinsurance procurement methods, and secure long-term stability in reinsurance coverage.

Regarding the Group joint issuance of “Tomoni Re 2024” Catastrophe Bonds (MSI, ADI) |

|---|

In order to realize “Net Zero Emissions by 2050,” social implementation of innovative technologies is essential. There is a wide variety of problems to be studied and solved, such as technical issues and changes in social systems. We are actively working on research projects/studies and demonstrations in collaboration with stakeholders and experts.

|

Research on net-zero initiatives tied to business analysis |

MS&AD InterRisk Research & Consulting, in partnership with Mitsui Sumitomo Insurance and Okayama University, is conducting research on net-zero initiatives aligned with business analysis. The study aims to establish evidence showing that net-zero initiatives can yield numerous advantages for business management. The aim is to support SMEs in calculating their greenhouse gas (GHG) emissions, devising reduction plans, and taking steps toward emissions reduction.

|

|---|

|

Participation in GX League |

In order for Japan to realize its 2050 carbon neutral target and further contribute to realization of net-zero worldwide, and to adopt this as an opportunity for growth and increase its industrial competitiveness, it is important to lead the transformation of the entire economic and social system (GX: Green Transformation).

|

|---|

|

Joined the Japan Hydrogen Association |

MS&AD has joined the Japan Hydrogen Association which was set up in December 2020. The association was established with the aim to support the early creation of a hydrogen society by carrying out social implementation projects as a cross-industry and open organization with a bird’s eye view of the entire supply chain. Collaboration of various companies for lower-cost hydrogen supply and wider use is expected and we will contribute through the association.

Joining the Japan Hydrogen Association (MSI) (in Japanese only) |

|---|

|

Launch of research studies on commercialization of damage protection services for offshore wind power generation system |

In April 2022, Mitsui Sumitomo Insurance and MS&AD InterRisk Research & Consulting initiated, in collaboration with startups, academic institutions, etc., a joint research project on commercialization of an alert service for detecting signs of equipment failure and abnormalities to support expanded deployment of offshore wind power generation, which is expected to be a major source of renewable energy.

|

|---|

|

Aioi Nissay Dowa Insurance and the University of Tokyo |

In April 2022, Aioi Nissay Dowa Insurance and the University of Tokyo fully launched a joint research project aimed at promoting net-zero emissions through utilization of telematics technology.

|

|---|

|

Launch of Blue Economy Project |

Mitsui Sumitomo Insurance launched a cross-company project aimed at developing insurance products/services which support development of the blue economy through analysing new risks arising out of initiatives with themes such as renewable energy from oceans and seabeds, and negative emissions technologies.

|

|---|

|

Joint research for seagrass bed restoration and expansion |

In partnership with the town of Minamisanriku in Miyagi Prefecture, the local Center for Sustainable Society, and Kajima Corporation, MS&AD Holdings has begun research aimed at the restoration and expansion of seagrass beds near Minamisanriku. This project seeks to systematize techniques and frameworks for seagrass bed restoration and conservation. The ultimate goal is to help enhance biodiversity and revitalize fisheries all around Japan, as well as promoting a net-zero society through seagrass bed restoration.

|

|---|

The Group is promoting initiatives that focus on the assessment and analysis of climate change risks.

|

Climate change risk analysis service |

The scope of risk which companies need to be aware includes not only physical risks, such as floods and droughts caused by climate change, but also transition risks which arise when societies and economies shift to a net-zero society, such as when transforming energy systems. We provide services that support our clients building a climate change governance structure, performing scenario analysis, and developing a climate strategy in accordance with the TCFD’s Final Recommendations through assessment and analysis of such risks.

Climate change risk analysis service (InterRisk) (in Japanese only) Launch of a climate change windstorm risk analysis service (InterRisk) (in Japanese only) |

|---|

|

Enhancing knowledge of flood risks |

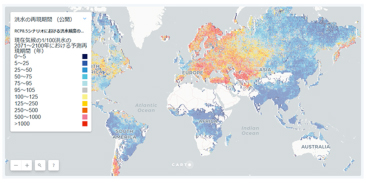

The MS&AD Insurance Group Holdings and InterRisk Research & Consulting launched in 2018 “Large-scale risk assessment of Climate change for Flood (LaRC-Flood®)“ Project in collaboration with the University of Tokyo, Shibaura Institute of Technology.

Developed/opened to the public future wide area flood map (InterRisk) (in Japanese only)

In September 2023, free access was expanded worldwide.

Released the free global version of the Future Flood Hazard Map (InterRisk) (in Japanese only)

In addition, MS&AD InterRisk Research & Consulting has launched a new consulting service that utilizes this hazard map. The map enables quantitative impact assessments all around the world and supports identification of physical risks in the event that climate change is actualized.

Launched “LaRC Flood Risk Analysis Service” (InterRisk) (in Japanese only)

InterRisk has also launched its Flood Risk Finder, a SaaS platform capable of assessing global climate change and flood risks. This platform enables companies expanding into regions lacking flood hazard maps or those seeking a global understanding of future flood risks to gain a comprehensive view of both current and future flood risks. In this way, it is helping to mitigate climate change risks worldwide.

|

|---|