ERM-based Group Management

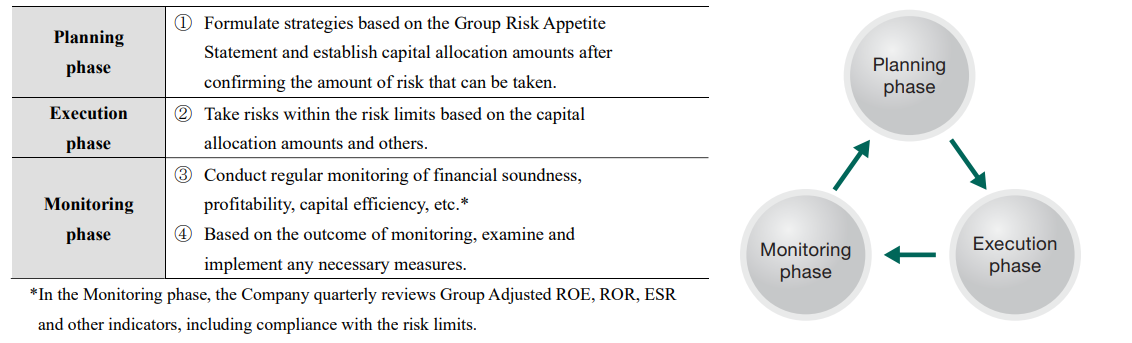

The MS&AD Group endeavors to increase its earnings power and capital efficiency while maintaining financial soundness. Toward this end, it practices Group management based on an enterprise risk management (ERM) cycle. It allocates capital to its businesses in accord with its Group Risk Appetite Statement. Its businesses take risks with the allocated capital. The Group exercises appropriate risk control, through the monitoring of return on risk (ROR) and other metrics. Under the Medium-Term Management Plan (2022–25), the ERM Committee will work to enhance the evaluation and management of each business in the Group, considering capital, risk, and return, and to improve the Group’s capital efficiency by flexibly allocating capital to more capital-efficient business opportunities, such as investments in growth businesses.

Integrated Management of Risk, Returns and Capital

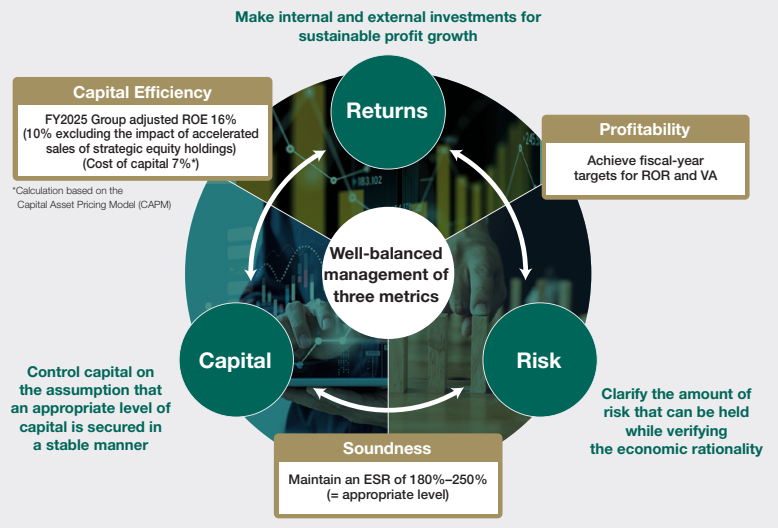

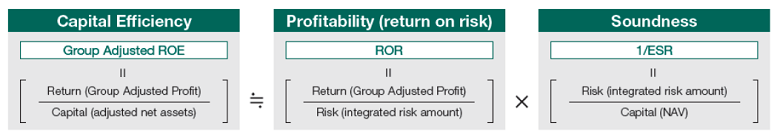

To realize its management vision, the Group formulates medium-term management plans in accord with its Group Risk Appetite Statement and holistically manages risk (integrated risk amount), returns (Group Adjusted Profit), and capital (NAV) with the aim of maintaining financial soundness and boosting capital efficiency and risk/return.

ERM Cycle

Group Risk Appetite Statement and ERM practices

To achieve its management vision, the Company sets out the direction and basic concepts of initiatives related to matters such as capital policy and risk appetite, in the Group Risk Appetite Statement which is resolved by the Board of Directors and manages risk, return and capital in a unified manner.

The Company formulates the Group Medium-Term Management Plan consistent with the Group Risk Appetite Statement, and aims to ensure soundness, improve capital efficiency and increase return on risk through an ERM cycle.

When allocating capital for each business and making the Group income and expenditure plan, the Company confirms these are consistent with the Group Risk Appetite Statement.

The Company periodically reviews the necessity of a revision of the Group Risk Appetite Statement in light of the results of stress tests, environmental changes and other factors.

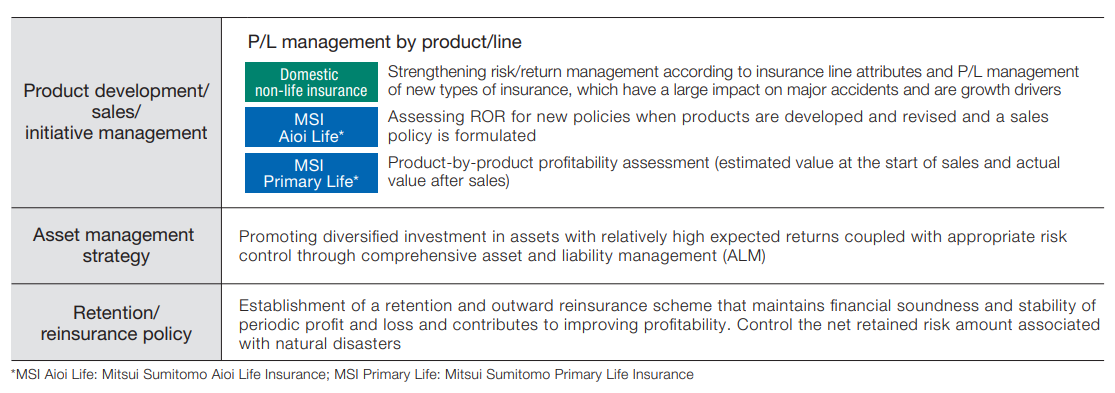

Initiatives to Boost Profitability

To boost capital efficiency while maintaining financial soundness, the MS&AD Insurance Group seeks to earn adequate risk/return through the following initiatives in each of its business domains.

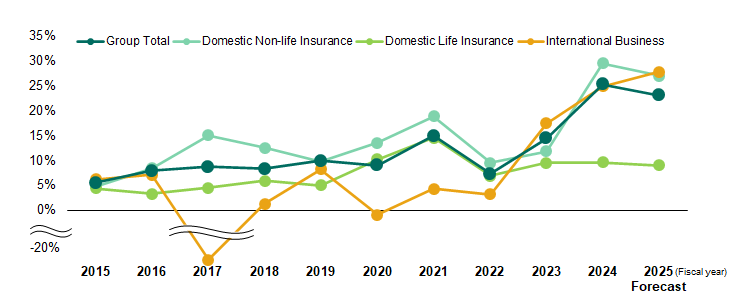

ROR trends

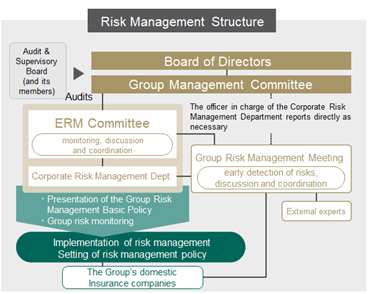

Implementation and promotion of risk management

Our Group has established the MS&AD Insurance Group Risk Management Basic Policy and is implementing risk management based on the basic philosophy shared within the Group. Specifically, our Group promotes risk management by identifying major risk events affecting our business portfolio and evaluating their risk factors both quantitatively and qualitatively.

・Risk Management Basic Policy

・Risk Management Structure

・Three Lines of Defense Structure for Risk Management

・Insurance Business Risks

・Risk Management in International Business

・Crisis Management System (Including Business Continuity Management System)

Identification and Management of Risks

Our Group designates important risk events that should be addressed by management as “Group Material Risks,” formulates a management action plan, and periodically monitors the status of each risk. In addition to considering the correspondent relationship of each risk event, we are working to control risks based on the scenario of the occurrence of the risk event to be addressed.

|

No. |

FY2025 Group Material Risks |

|---|

|

1 |

Occurrence of large-scale natural catastrophes (Considerations: Climate Change) - Increase in claims paid due to the occurrence of large-scale windstorms, floods, forest fires, blizzards, hailstorms, droughts, earthquakes, volcanic eruptions and other natural catastrophes in Japan and overseas, in part due to climate change |

|---|

|

2 |

Significant changes in financial markets (Considerations: Inflation) - Fall in the value of stocks and other assets held due to a possible stagnation of the global economy and economic activities |

|---|

|

3 |

Significant increase in credit risk (Considerations: Climate Change) - Deterioration in performance and default of investees due to factors such as deterioration in the actual economy, interest rate hikes, financial institutions tightening their credit standards, tighter regulations in view of the transition to a decarbonized society and delay in the necessary actions |

|---|

|

4 |

Occurrence of an act that might result in serious damage to the Group’s enterprise value and the loss of social credibility (Considerations: Conduct Risks, Digitalization, Climate Change, Human Rights) - Loss of the Group’s social credibility because its mission, vision, values, and customer-focused approach to business operations have failed to permeate the actions of officers and employees, leading to the Group being unable to achieve a customer-oriented approach or a healthy competitive environment |

|---|

|

5 |

Large-scale and serious business delay and/or information leakage as a result of cyber attack (Considerations: Digitalization) - Occurrence of business holdups or information leakage within the Group or at a subcontractor or other business partner due to the global escalation of damage caused by cyber attacks as a result of further digitalization, increasingly sophisticated and diverse cyber attacks (including attacks using generative AI etc., where technological progress is remarkable), and the expansion of the range of the impact of cyber attacks with the expanding use of cloud technology and supply chains. |

|---|

|

6 |

Frequent occurrence of system failure or occurrence of serious system failure, or progress delay and non-attainment of target, budget overrun or failure to achieve expected outcome in large system development (Considerations: Digitalization) - Business and services holdups caused by simultaneous failures of systems for customers and agents due to increased digitalization, damage of system-related facilities due to a large-scale natural disaster or other event, the suspension of fund settlement infrastructure or a communication failure due to a problem or incident involving communications satellites or communications lines, which could also be affected by space weather phenomena |

|---|

|

7 |

Spread of a new strain of influenza or other infectious disease (Considerations: Climate Change) - Development of situation in which the Group is prevented from properly executing business or delivering services caused by spread of new strains of infectious diseases and protraction of the impact of infectious disease events partly due to the impact of global warming |

|---|

|

8 |

Changes in the insurance market |

|---|

|

9 |

Changes in environment surrounding human capital (Considerations: Falling Birthrate and Aging Population, Digitalization) |

|---|

|

10 |

Intensifying confrontation and political, economic and social division and polarization between countries and in overseas countries and national security crises - Decline in the value of the assets held by the Group, due to concerns regarding financial market fluctuations caused by intensifying confrontation and political, economic and social division and polarization between countries and in overseas countries (including those caused by changes in world leaders, such as the presidents of countries, and the rise of the Global South) |

|---|

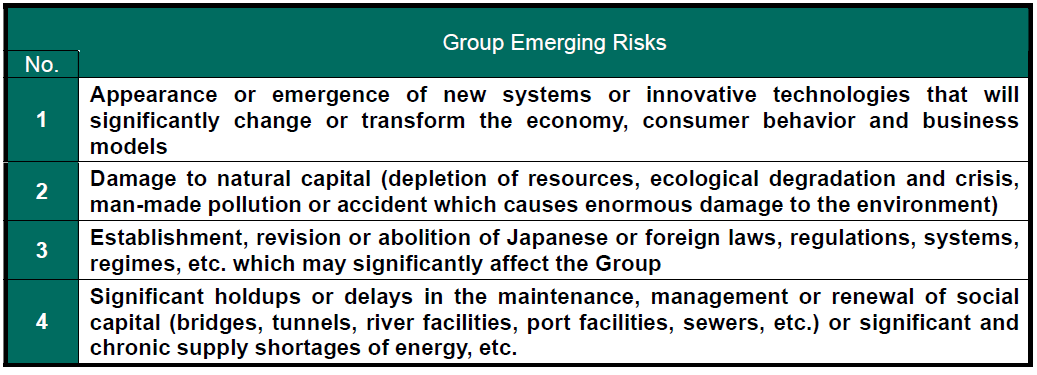

Listed below are events with the potential for medium- to long-term impacts on Group management and events for which the impact and timing are difficult to grasp at present but about which we need to maintain awareness. As Group Emerging Risks, our Group periodically monitors these events.