In order to build a safe and secure society, we are conducting joint research with government agencies and universities on loss prevention/mitigation, and providing new services as a result of this research.

|

Loss prevention and reduction system for local governments “Loss Prevention Dashboard” |

Developed and launched “Loss Prevention Dashboard” for local governments, which clearly and centrally visualizes real-time weather data in relation to disaster risks, flood prediction data at least 30 hours in advance, and post-disaster damage estimation using AI, and supports regional loss prevention/mitigation.

Developed AI-based damage estimation method jointly with the National Research Institute for Earth Science and Disaster Resilience under the Public/Private R&D Investment Strategic Expansion PrograM (PRISM).

|

|---|

|

Real-time loss prediction website, cmap.dev |

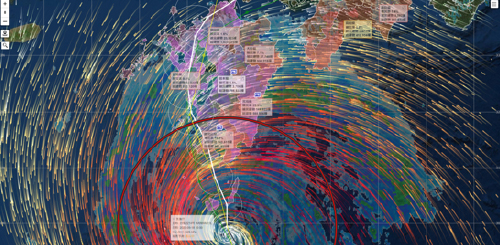

Publicly available cmap.dev website, conceived from industry-academia joint research by Aon Group Japan and Yokohama National University, can predict the potential number of buildings damaged by typhoon, heavy rain, or earthquake. The website can be accessed from any device, computer or smartphone, 24 hours a day, 365 days a year. It provides forecasts for each municipality of the potential number of buildings damaged and the rate of damage caused prior to typhoon (up to 7 days before landfall), and immediately after heavy rain or earthquake strikes. The website can also display flood, landslide and tsunami hazard maps as well as information on warning levels (equivalent to 3, 4, 5), evacuation areas and shelters nationwide.

Real-time loss prediction website, cmap.dev (ADI) (in Japanese only) |

|---|

|

Japan Consortium for Adaptation Finance |

Established in collaboration with NEC Corporation, the Japan Consortium for Adaptation Finance promotes the social implementation of climate adaptation finance, which can encourage expansion of the investment market. The consortium applies digital technologies to predict and analyze adaptation value (disaster risk mitigation and environmental effects) and provide the information in a clear, quantitative manner to investors.

|

|---|

|

Loss prevention alerts and hailstorm alerts |

With this service for individual policyholders, AI is used to calculate the natural disaster risks for insured properties and sends out early alerts and disaster preparedness advice to customers deemed to be at heightened risk.

Launched personalized loss prevention alerts (MSI) (in Japanese only)

The Hailstorm Alerts uses mobile text messaging (SMS) to send customers hail forecast information, which is typically not covered by standard disaster alerts, along with preventive advice.

|

|---|

|

Evacuation insurance plan |

Through a joint research project with the Prefectural University of Hiroshima on an approach to evacuation in the event of a natural disaster, the “Evacuation Insurance Plan” was provided; this consists of summarized effective support measures for establishing a scheme, which enables rapid evacuation of persons requiring support* in the event of disasters.

|

|---|

|

Research through Industry-Government-Academia Collaboration on damage due to typhoons |

Universities, insurance companies, and meteorological companies initiated joint research on "Creating virtual weather warning/advisories and damage estimation data based on typhoon simulation data, and devising a virtual disaster training menu for local governments," leveraging their respective strengths.

|

|---|

|

Estimation of flood inundation areas using fire insurance accident data and big data from social media |

A flood inundation area prediction algorithm was developed by utilizing the fire insurance accident data and having big data from social media collected and analyzed by JX Press Corporation. Leveraging methods to enhance the accuracy of predictions, we launched a demonstration experiment to quickly identify risk areas and customers who may be impacted.

|

|---|

As natural disasters continue to increase in frequency, it has become an important management issue for companies to prepare for such emergencies. We support resilient business activities by providing services to assess and analyze the risks of various natural disasters.

|

Flood disaster countermeasure support service |

(1) Assessing inundation risks by identifying locations with a high risk of inundation based on hazard maps.

|

|---|

|

Sediment-related disaster risk diagnosis |

Simulations of slope failures at individual sites based on largest recorded and potential largest rainfall scenarios are used for risk assessments.

Sediment-related disaster risk assessment services(in Japanese only) |

|---|

|

Wind disaster risk diagnosis |

A 3D model is prepared using 3D CAD based on drawings and exterior photographs and a report including visualized wind load on the building and wind flow during strong winds is submitted, with the surrounding terrain and buildings taken into consideration. In order to reduce the damage caused by strong winds, it can be used to examine measures for buildings and outdoor equipment that should be taken daily.

|

|---|

|

Collective confirmation system for flood disaster risk information(Sui Search) |

Providing a website that enables automatic judgments on the timing of various responses and decisions (warning stage judgments) by acquiring various types of information related to water disasters at multiple sites collectively and in real time.

Flood risk information integrated confirmation system (Sui Search)(in Japanese only) |

|---|

|

Volcanic eruption measures service |

In line with the 2021 revision of the Hazard Map of Mt. Fuji, which had not been revised for about seven years, we are providing a service to comprehensively support identification of risks relating to volcanic eruption, emergency responses, business continuity measures, training in normal times, etc.

Launch of service relating to volcanic eruption measures(in Japanese only) |

|---|

|

Inland flooding prediction system |

Based on rainfall forecast data from the Japan Meteorological Agency, this system simulates flood activity to predict inland flood locations and floodwater levels.

|

|---|

We are providing products and services to support preparation against natural disasters and implementation of safe and secure actions when they occur.

|

Natural disaster response support service |

We developed the Natural Disaster Response Support Service, a digital solution to help companies with multiple locations to carry out swift and appropriate initial response in the event of a natural disaster.

Launched the Natural Disaster Response Support Service(in Japanese only) |

|---|

|

Weather information alert service |

In collaboration with Weather News Co., Ltd., the largest weather information company in Japan, we provide policyholders of corporate fire insurance (Property Master, Business Keeper), construction insurance (Business Construction Guard), liability insurance (Business Protector), or transport insurance (Full Line, Support One) with the following services for free: |

|---|

|

Evacuation Support Insurance for supporters/persons requiring assistance |

We offer insurance products to cover provision of compensation for accidents to persons requiring support during evacuation activities, etc. based on individual evacuation plans that compile information on such persons and on evacuation methods, as well as covering injuries to supporters or persons requiring assistance during evacuation support activities.

|

|---|

|

Support for rapid issuance of disaster certificates |

By providing estimated damage counts and templates for post-disaster survey plans, this service helps to automatically estimate the number of damage cases and determine survey needs after an earthquake or flood, thereby supporting effective post-disaster survey planning.

|

|---|

|

Products/Services for supporting rapid evacuation in the event of large-scale disasters |

We provide the “Endorsement for Lump-sum Payment in the Event of Evacuation Due to Specific Emergency Disasters, etc.,” whereby a lump sum payment will be made in the event of need to relocate to an evacuation shelter, etc. due to a disaster of a certain size or greater, such as a locality being designated as a specified emergency disaster area, regardless of whether or not there is damage to the insured object. We also provide the “TOUGH Housing Insurance App,” which is equipped with functions to support disaster preparedness during normal times, dissemination of disaster information and warning information in the event of a disaster, and accident reporting and claims settlements after a disaster occurs.

|

|---|

|

Preparing against natural disasters |

In response to growing customer interest in storm/flood and earthquake compensation due to the more frequent occurrence of natural disasters in recent years, we are now proposing “preparing” against natural disasters. We are promoting initiatives to remind customers of the importance of “being prepared,” not only after but also before a disaster occurs.

We support the Cabinet Office's disaster preparedness collaboration initiative and further promote awareness-raising activities to enhance national disaster preparedness awareness through business activities.

|

|---|

|

ResiRead: BCP development subscription service for SMEs |

This is the first service in the world to provide long-term support for small and medium-sized enterprises to develop business continuity plan (BCP) initiatives independently, which are often abandoned due to time constraints and the challenges involved.

|

|---|

|

Useful smartphone apps in times of disaster |

We provide smartphone apps for use during disasters and are endeavoring to help our users ensure their safety and security when large-scale natural disasters strike.

|

|---|

|

DX solutions package |

As part of efforts to help prevent and mitigate accidents and build a sustainable business environment, this is a package of effective solutions and insurance coverage that supports companies in the area of accident prevention and damage minimization.

|

|---|

|

Coverage for costs to prevent incident recurrence and support for effective loss prevention and mitigation efforts |

This product covers costs incurred by customers for actions to prevent the reoccurrence of large-scale incidents, such as fires or explosions, on company premises, thereby supporting their proactive efforts for reoccurrence prevention.

|

|---|

|

Employee safety check system for disaster drills and emergency situations |

We launched a safety confirmation system that helps companies check whether all employees are safe in the event of a sudden disaster, which is also useful for regular disaster preparedness drills.

|

|---|

Identifying and then avoiding the risks that lead to accidents is vital for preventing traffic accidents. Utilizing telematics, we are providing insurance products and services which contribute to accident prevention, safe driving, and reduction of accident frequency by identifying/analyzing our customers’ driving situations, etc. and also reduce impacts in the event of accidents and support recovery.

|

Provision of applications that support safe driving |

We provide a variety of services that utilize smartphone apps, and telematics technology with connected drive recorders for greater security and safety. Launched function to detect suspected road rage (MSI) (in Japanese only) Launched Accident Risk AI Assessment (MSI, ADI, InterRisk) (in Japanese only) |

|---|

|

Telematics- based automobile insurance |

・In January 2019, we launched the “Mimamoru” dashcam-based automobile insurance which encourages customers to drive more safely by utilizing the latest telematics technology with out our original communicable dash cameras. In addition to the video recording function that comes with the dash cams, we provide safe driving assistance warnings that alert drivers to driving conditions, as well as a “guardian service” that shares information, such as driving habits, with family members and others living apart from the driver. Furthermore, when the dash cam detects a large impact in the unlikely event of an accident, the location of the vehicle is relayed to a dedicated call center. The operator can then make contact with the driver to offer assistance such as initial accident response and dispatching a recovery vehicle to the scene. (MSI, ADI, Mitsui Direct General) ・In January 2022, we launched “Mimamoru” premium dashcam-based automobile insurance with the highest standards of functions/services in the industry. This added higher functionality such as 360 degree filming and parking monitoring to functions of dashcams provided by non-life insurance companies such as a constant reporting function and a portability function, to increase safety and security. (MSI) ・Automobile insurance with a comprehensive lineup of features to meet customer needs that provides incentives for safe driving (driving characteristics discounts) and services leading to safety and security. (ADI)

Launched “Mimamoru” premium dashcam-based automobile insurance (MSI) (in Japanese only) Expanded telematics services with “Telematics Powered by ADI” (ADI) (in Japanese only)

Initiatives for reducing CO2 emissions in relation to Telematics auto insurance are posted in the content below: |

|---|

|

Demonstration experiments with local governments using data |

In collaboration with local governments, we are conducting a demonstration experiment to enhance and streamline firefighting and emergency response activities using video and driving data. We are also exploring traffic accident prevention measures for elderly drivers. (MSI, ADI)

|

|---|

|

Automobile insurance for businesses |

We have developed and provide a support service to reduce the number of accidents by utilizing telematics technology to provide safety and security to businesses.

|

|---|

With the number of accidental injuries among preschool children on the rise each year in daycare facilities, we are providing support for the creation of environments and systems for these facilities that can give parents greater peace of mind.

|

Collaboration to reduce and prevent accidents among preschool children |

By installing next-generation network cameras in facilities such as daycares, kindergartens, and certified childcare centers, data from these cameras is being utilized for creating measures to reduce and prevent accidents.

|

|---|

In light of a series of large-scale disasters, the Group is working to facilitate swift claims settlement. We are also accelerating digital transformation and endeavoring to pay insurance claims promptly.

|

Damage surveys utilizing drones (unmanned aerial vehicles) |

In conducting damage surveys in areas inaccessible by road due to flooding or landslides or of solar panels spread out over an extensive area, we analyze aerial images taken by drones to quickly assess the degree of damage. |

|---|

|

Operational automation with software robots |

Using robotic processing automation for operations such as registering accident claims received via a dedicated website and confirming contract information, and automating the simple administrative tasks, we have developed a system that allows us to assign more personnel to higher value-added work, such as customer service and damage surveys during large-scale disasters. |

|---|

|

Support for early disaster certificate issuance |

In light of increased severity and frequency of natural disasters, we provide a service to help local governments take actions in relation to the victims’ life reconstruction support system: in particular, prompt issuing of disaster certificates and working efficiently to deliver the certificates in order to support early resettlement for disaster victims.

|

|---|

We are providing a range of products and services in light of various social changes such as increased risk of infectious diseases.

|

Support to formulate a BCP in preparation for infectious disease risk |

We have developed and started providing an Infectious Disease BCP (Business Continuity Plan) Creation Support Tool for small and medium-sized businesses. We also provide lecturers to do workshops on creating a BCP and individual consultations on infectious disease BCP.

Measures against infectious diseases (InterRisk) (in Japanese only) |

|---|