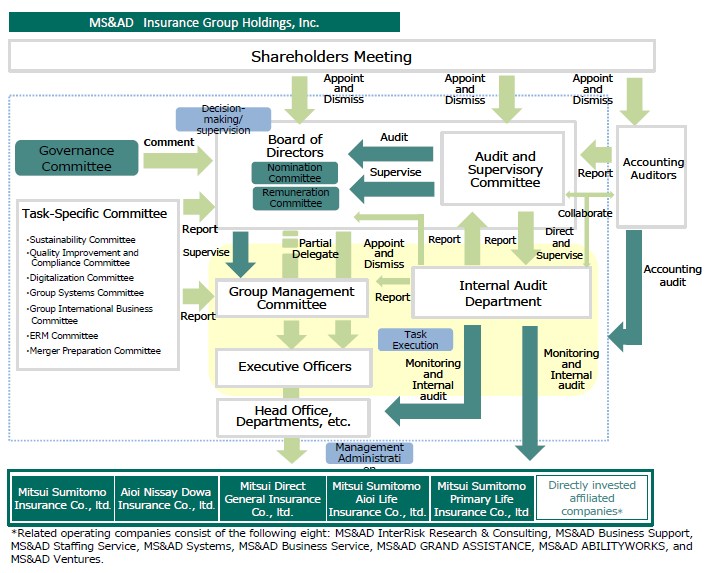

MS&AD Holdings has introduced an executive officer system and is strengthening the control of its management by clarifying the roles of the Board of Directors, who are responsible for management decision making and oversight, and the Executive Officers, who are responsible for business execution. There are 19 executive officers.

The role of the Group Management Committee is to discuss management policies, management strategies, and other matters that are key issues to the Company and the Group companies. It also monitors specific business operations by receiving reports on approved matters under the rules for the Group Management Committee.

In addition, the presidents of the Group's five domestic insurance companies in which the Company has a direct stake have attended as committee members and discussed key issues related to the Group's domestic insurance companies.

The Group Management Committee met 13 times in fiscal 2024.

(1) To realize management strategies, increase the Group's management efficiency, and ensure the soundness of Group finances and appropriateness of Group operations, the Company concludes management agreements with its directly invested subsidiaries (hereinafter referred to as “directly invested companies”) and undertakes the management administration of each company.

- The Company has concluded management agreements with its directly invested domestic insurance company subsidiaries (MSI, ADI, Mitsui Direct General, MSI Aioi Life, and MSI Primary Life) and provides those companies with advice and other assistance.

- Believing that directly and quickly obtaining business-related information from the Group's domestic insurance companies will contribute to the smoothness of Group management, the Company has established a system in which its own directors concurrently serve as directors of the Group's domestic insurance companies. In addition, directors of the Group's domestic insurance companies sometimes attend the Group Management Committee meetings, depending on the proceedings.

- In addition, the Company has concluded management agreements with its directly invested affiliated operating companies (MS&AD InterRisk Research Institute & Consulting and eight other companies) and undertakes the management administration of each company.

(2) The Company has established Groupwide basic policies-including the “Basic Policy Pertaining to System for Internal Controls,” “Risk Management Basic Policy,” “Basic Compliance Policy,” “Internal Audit Basic Policy,” “Risk Appetite Statement,” and “Basic Information and Technology Governance Policy.” In addition to requiring compliance with these policies by Group companies, important matters involving directly invested companies require either the approval of or reporting to the Company in line with management supervision contracts.

(3) The Company establishes Group business strategy, such as the Group's Medium-term Management Plan.

(4) The Company provides guidance and supervision through the monitoring of the progress of management plans formulated by Group companies and the status of business execution, with the aim of achieving the goals of the Group.

(1) Group Companies (Directly invested companies) formulate their own policies and appropriately establish internal management systems based on the Group's Basic Policies, in addition to formulating management plans in each company based on the Group's Medium-term Management Plan to conduct management as individual companies.

(2) Directly invested companies also appropriately supervise the management of their subsidiaries under management supervision contracts.

The task-specific committees have been established with the aim to deliberate on various key issues in management when executing operations as well as to coordinate perspectives across various departments. When necessary, the Director(s) and/or Executive Officer(s) in charge summarize the results of discussions in these committees and report them to the Board of Directors and/or the Group Management Committee.

|

(As of June 23, 2025)

Presents our articles of incorporation.