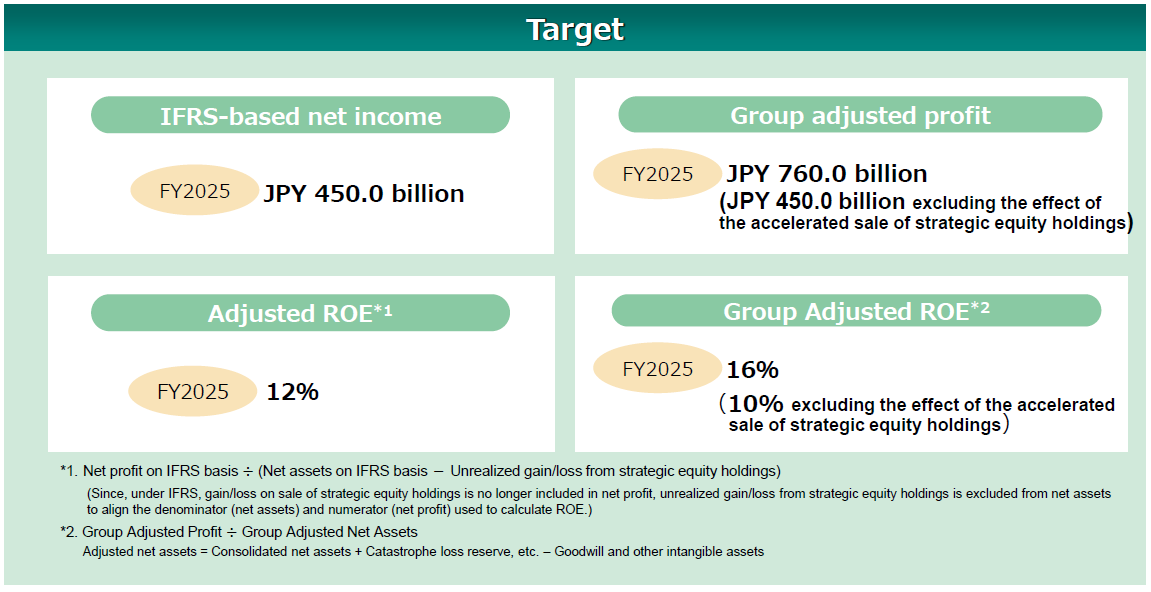

- Achieve net income of JPY 450.0 billion on an IFRS basis in FY2025 and a Group Adjusted Profit of JPY 760.0 billion (JPY 450.0 billion if the effect of the sale of strategic equity holdings is excluded).

- Achieve an Adjusted ROE of 12% and a Group Adjusted ROE of 16% (10% if the effect of the sale of strategic equity holdings is excluded).

(Note) The Group plans to change its accounting standards to IFRS in FY2025.

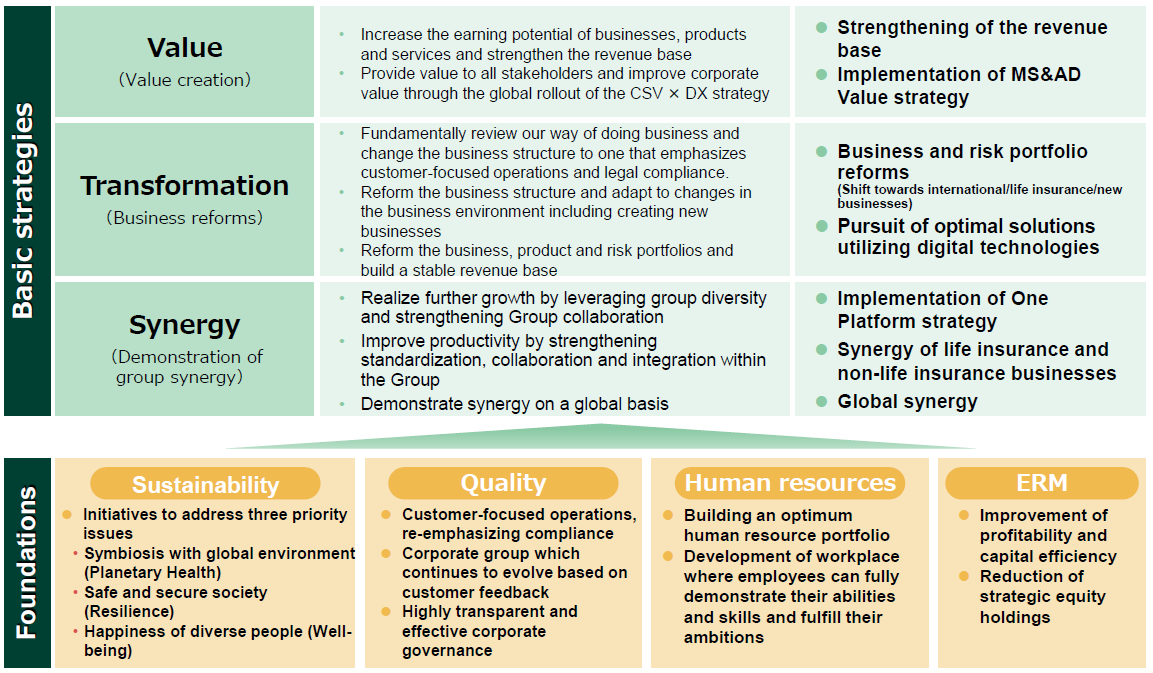

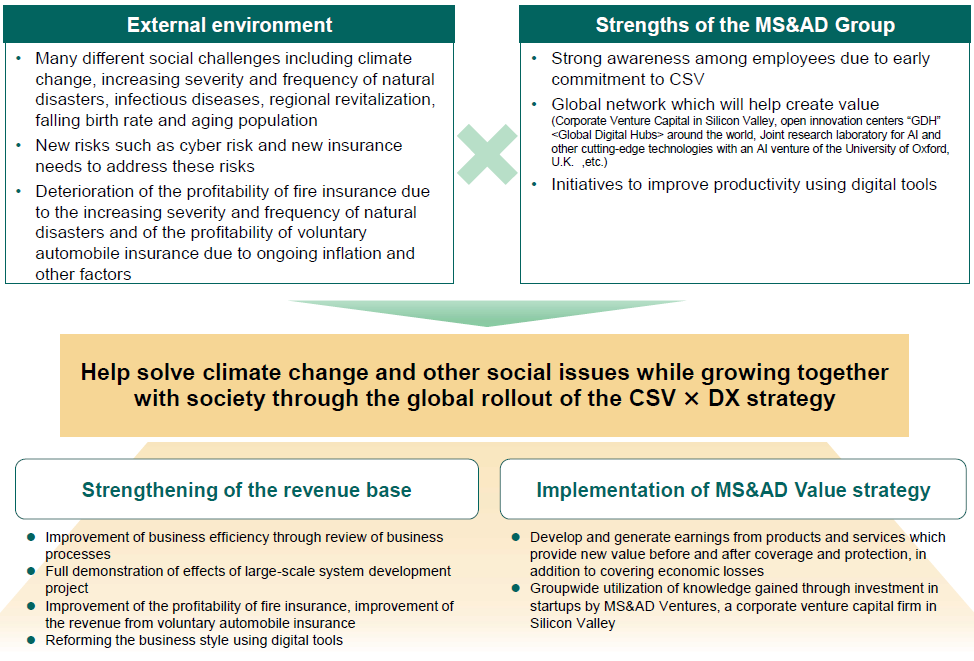

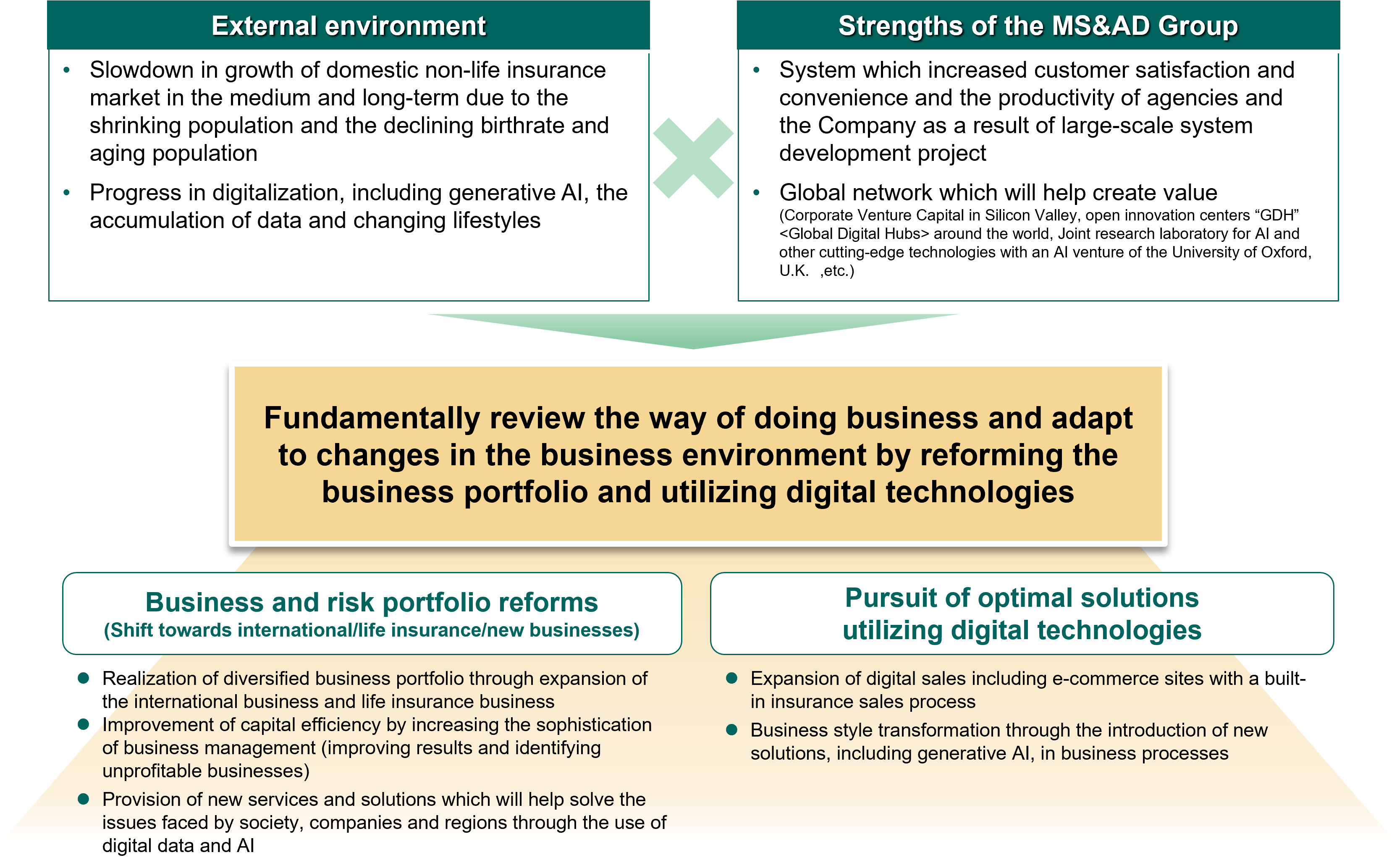

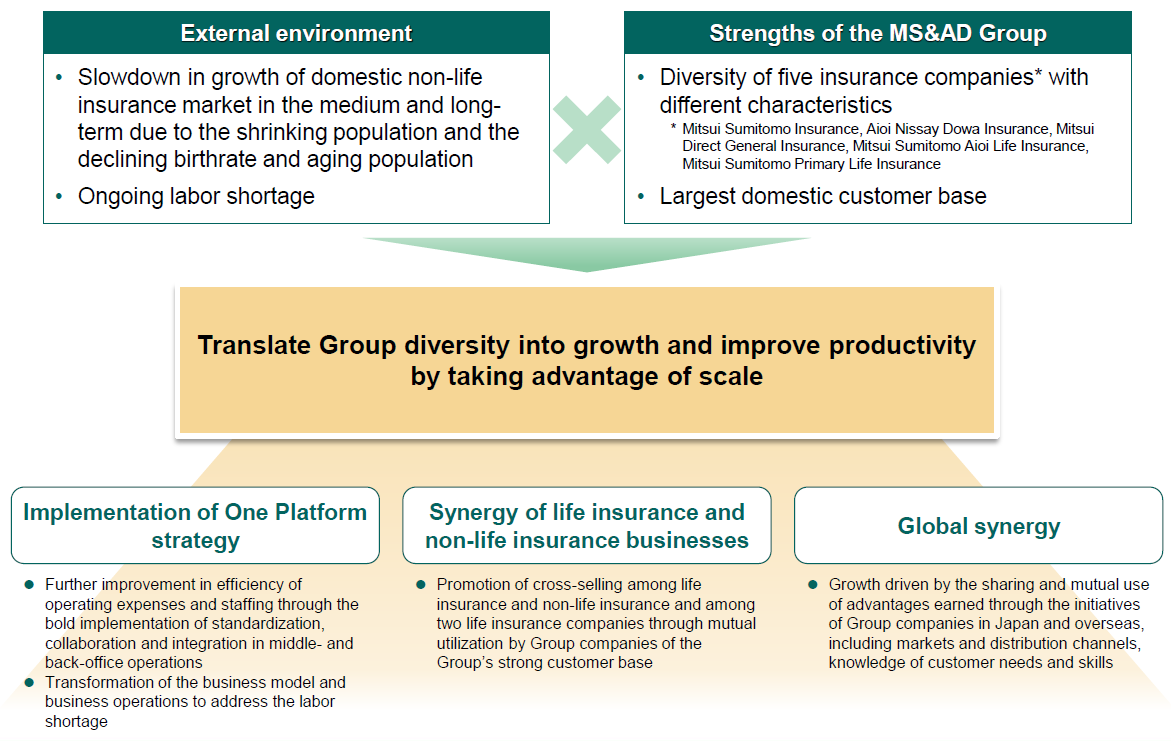

- Our basic strategies for realizing our aspiration of becoming a “corporate group that supports a resilient and sustainable society” are “Value (value creation),” “Transformation (business reforms)” and “Synergy (demonstration of group synergy).”

- “Sustainability,” “Quality,” “Human Resources” and “ERM” are the foundations supporting the basic strategies.

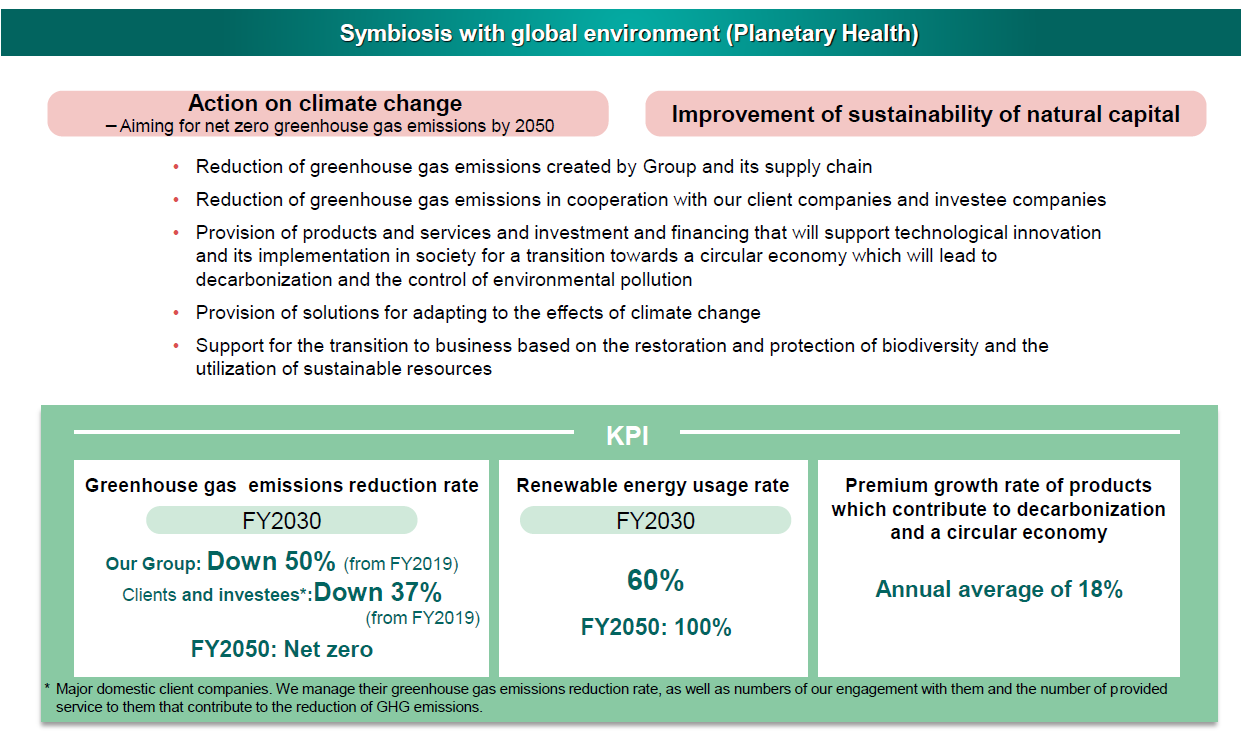

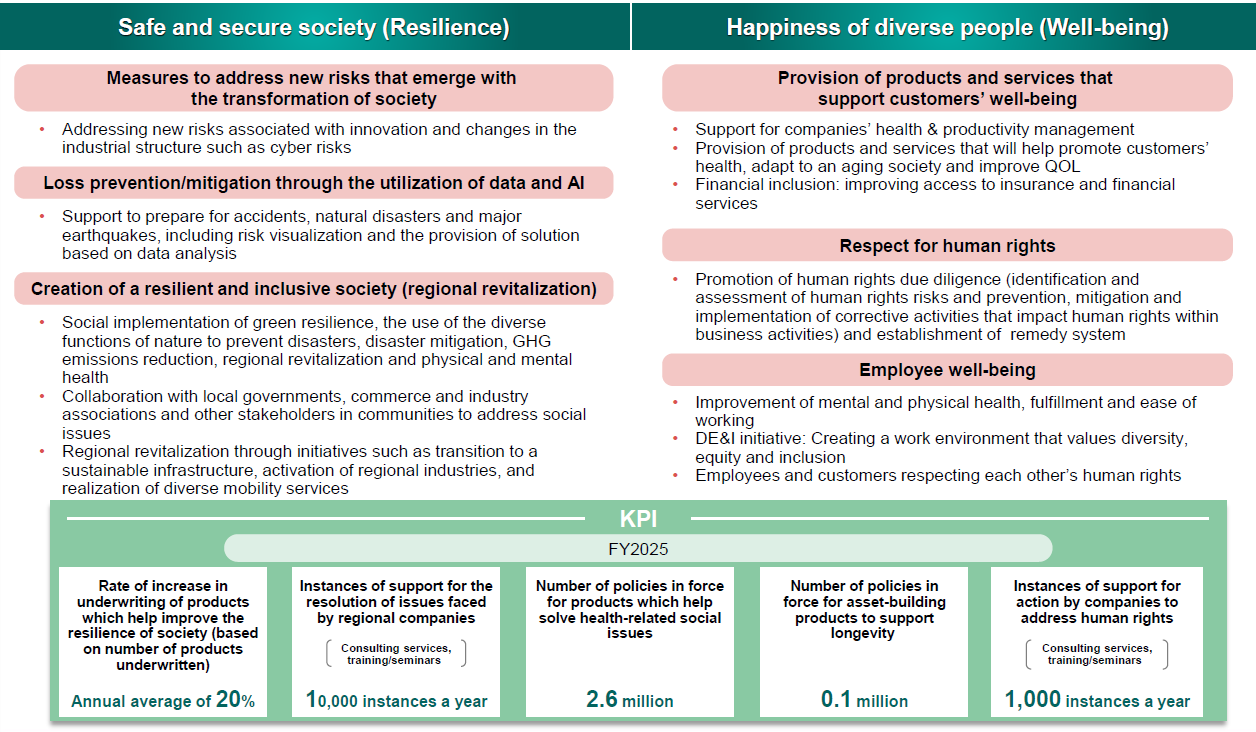

- Aim to solve social issues that are important both for stakeholders and for the Company, and focus on the three priority issues

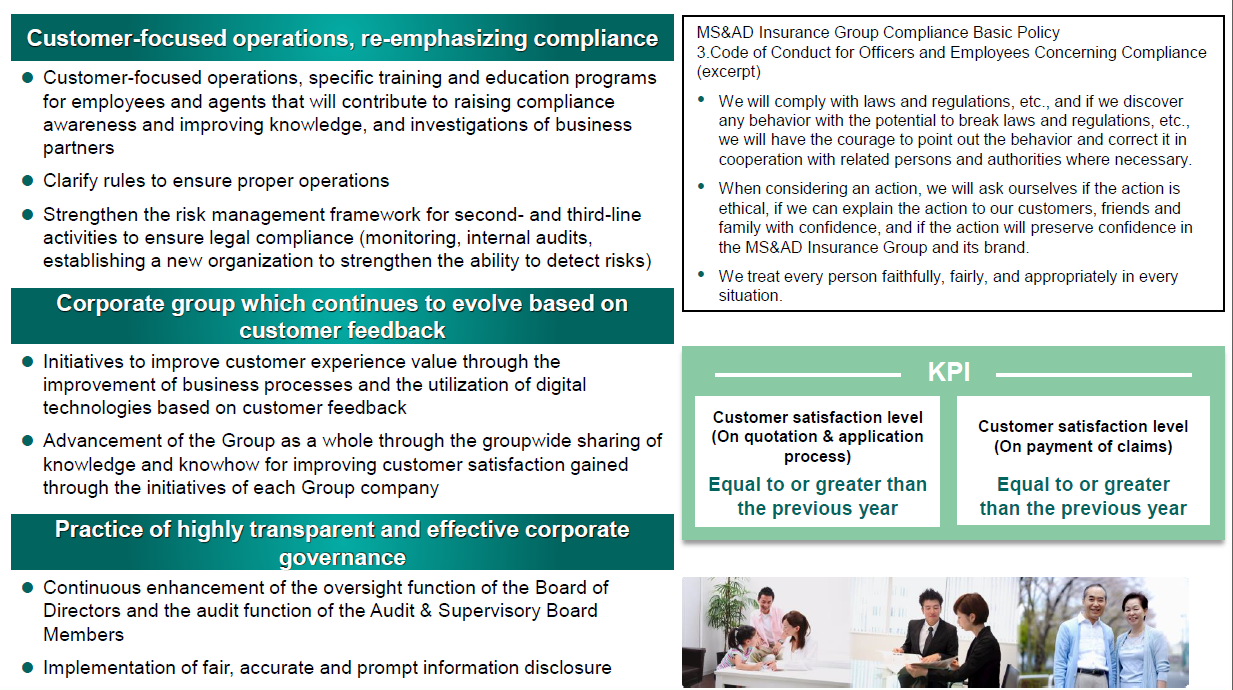

- Establish clear business operation rules, strengthen risk management in second- and third-line activities, put customers and agents first in business operations and re-emphasize compliance

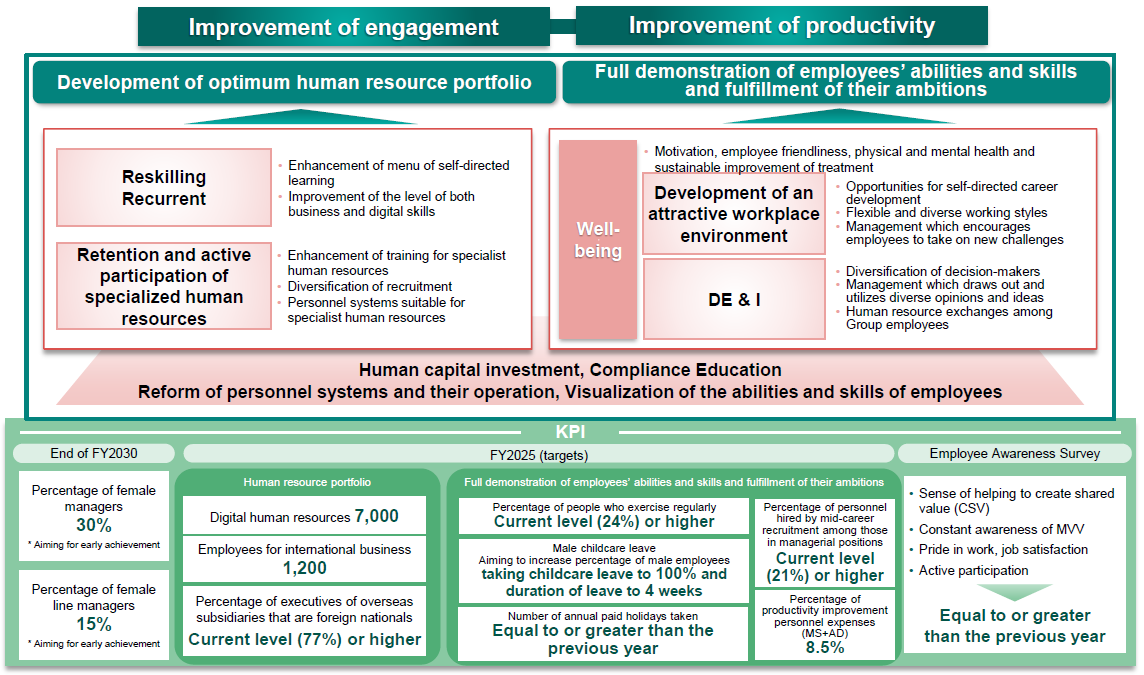

- Increase human capital investment and strive to improve employees’ well-being

- Secure human resources to support the execution of strategies and also develop an environment for their active participation and career advancement

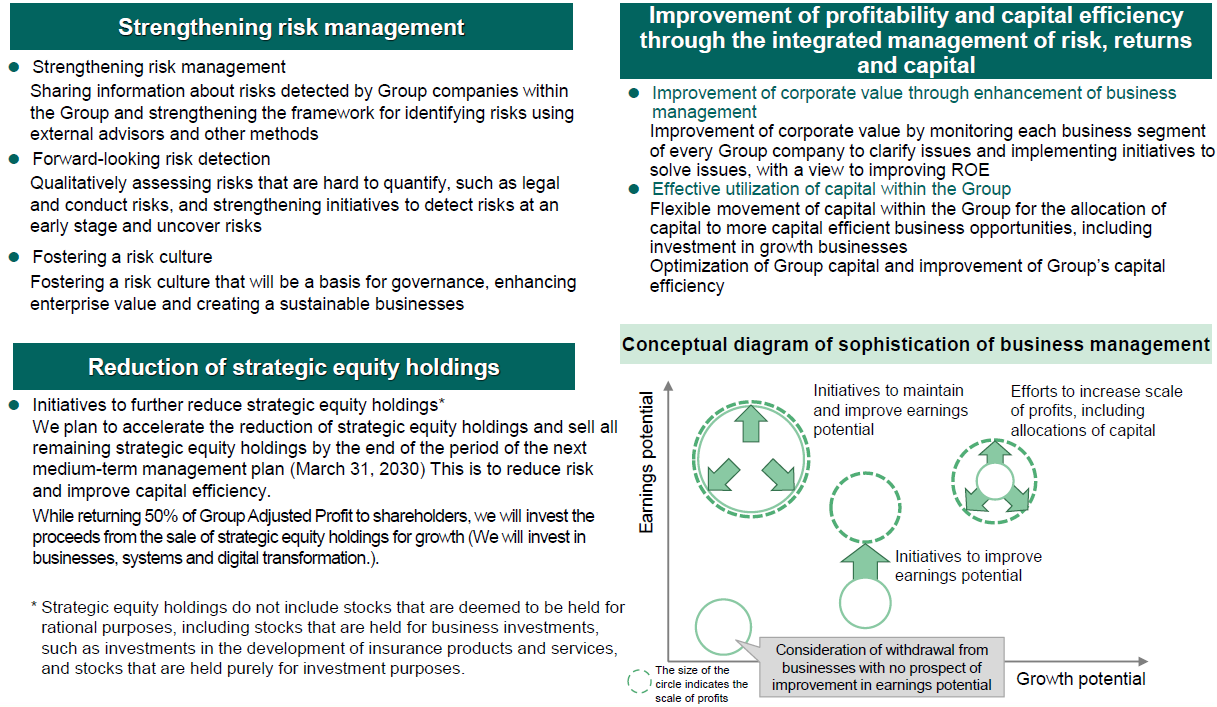

- Quantitatively and qualitatively identify risks held by the entire Group and strengthen the risk management framework.

- Allocate management resources in such a way that strikes the right balance between risk, returns and capital by using the ERM cycle

-

Medium-term Management Plan(FY2022-FY2025)

(5,340KB)

Medium-term Management Plan(FY2022-FY2025)

(5,340KB)

-

Vision 2021-Stage2 (2020~2021)

(4,032KB)

Vision 2021-Stage2 (2020~2021)

(4,032KB)

-

Vision 2021 (2018~2021)

(5,655KB)

Vision 2021 (2018~2021)

(5,655KB)

-

Next Challenge 2017-Stage2(FY2016-FY2017) (May 26, 2016)

(451KB)

Next Challenge 2017-Stage2(FY2016-FY2017) (May 26, 2016)

(451KB)

-

Next Challenge 2017 (June3, 2014)

(5,709KB)

Next Challenge 2017 (June3, 2014)

(5,709KB)

*1.Net profit on IFRS basis ÷ (Net assets on IFRS basis - Unrealized gain/loss from strategic equity holdings)

(Since, under IFRS, gain/loss on sale of strategic equity holdings is no longer included in net profit, unrealized gain/loss from strategic equity holdings is excluded from net assets to align the denominator (net assets) and numerator (net profit) used to calculate ROE.)

*2.Group Adjusted Profit ÷ average of beginning and end amounts on BS of adjusted net assets (consolidated net assets + balance of catastrophe reserves etc. - balance of goodwill and other intangible fixed assets)