The following is a supplement to the MS & AD Insurance Group's sustainability approach.

Subject period:

FY2023 (April 1, 2023 - March 31, 2024)

See "Corporate Governance" for an overview of the system.

1.Share of the CEO's short-term incentive

- Performance-linked remuneration shall be linked with the business performance of the company and determined based on financial(*1) and non-financial(*2) indicators. The standard ratio between financial and non-financial indicators used in the calculation of performance-linked remuneration shall be“50:50.”

- The stock-based remuneration components of performance-linked remuneration shall be calculated as follows, based on standard amounts for each position

Standard amount per position × business performance coefficient

(financial indicators × 20% + non-financial indicators × 80%)

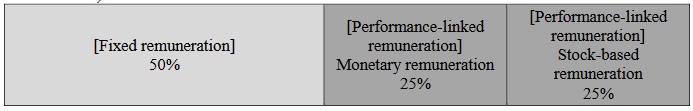

- The standard ratios of the components of compensation for the President and Director are as follows:

<Breakdown of 25% of Stock-based remuneration>

The ratio of financial indicators (indicators reflecting single fiscal year performance) is

25% × 20% = 5%.

The ratio of non-financial indicators (indicators to reflect medium- to long-term performance

contributions) is 25% × 80% = 20%.

(*1)Financial indicators are indicators that are used to reflect business performance in a single fiscal year in officer remuneration.

(*2)Non-financial indicators are indicators that are used to reflect initiatives contributing to medium- to long-term business performance in officer remuneration.

2.Performance Period for Variable CEO Compensation

- Performance-linked remuneration shall be linked with the business performance of the company and determined based on financial and non-financial indicators.

- Financial and non-financial indicators have been selected after taking into consideration the Group’s Medium-Term Management Plan(FY2022-2025), which began in fiscal 2022 and will end in fiscal 2025 for a period of 4 years.

3.Claw back Clause

- We have a claw back clause in place. (click here)

Ratio of the amount converted into the fair value of shares to the amount of consolidated fixed remuneration of a person whose total amount of consolidated remuneration in fiscal 2023 is 100 million yen or more.

|

|||||||||||||||||||||||||

*: March 31, 2024 end-of-day basis

■Changes in the environment surrounding human resources

The Group recognizes changes in the environment surrounding human resources as one of the important risks in light of the following:

・A gap between management strategies and the human resources portfolio, as well as a shortage in securing or developing human resources to eliminate the gap due to external changes in the human resources market, labor supply-demand, and changes in the skills and expertise necessary for implementing strategies such as DX promotion.

・A decline in employee engagement and an outflow of human resources due to insufficient organizational response to harassment and a lack of employee support program that accurately captures changes in employees' attitudes toward autonomous career opportunities, flexible / diverse work styles, and respect for diversity.

|

Impact |

・The Group's medium-term management plan calls for the value creation through the global expansion of CSV×DX and the transformation of the business by reforming the structure of the business and adapting to changes in the business environment, including the creation of new businesses. |

|---|

|

Mitigation measure |

Promote digital human resources development programs which all employees acquire basic digital skills with the aim of fostering human resources leading the CSV×DX strategy. Based on our in-house certification system and education programs, we are systematically improving our skills in both business and digital fields. We are implementing the Group's unique Digital Human Resources Development Program in cooperation with universities and other institutions. |

|---|

Please refer to ERM and Risk Management for other important risks.

The technology of AI (Artificial Intelligence) that operates and learns autonomously is advancing daily and is being utilized to drive innovation in many industries. Among these, generative AI, which can generate text, images, programs, and more, has been gaining attention in recent years, making it easier for many people to use AI. Our company group is also advancing the use of generative AI.

|

Impact |

Generative AI facilitates tasks such as document summarization and translation, transcription of speech, and image creation. Therefore, our company group is leveraging generative AI with the aim of improving operational efficiency and productivity. Specifically, we are using it for tasks such as compiling meeting minutes and creating illustrations for presentation materials, and we are working to further expand its use. On the other hand, as the use of generative AI in business and the advancement of technology progress, there are medium-term risks associated with the potential for human rights and intellectual property violations, information leaks, and the dissemination of false or misleading information. Should such issues arise, there is a risk that our company group's corporate value could be significantly damaged, leading to a loss of social trust. |

|---|

|

Mitigation Measures |

In utilizing generative AI, our company group is taking the following measures to mitigate these risks: Developing guidelines for risk management in the use of AI within the Group, including those specific to generative AI. Mandating that employees receive training on the risks associated with generative AI before they utilize it. Having the headquarters' management department obtain logs of employees' use of generative AI and conduct regular risk monitoring. To strengthen AI governance, establishing meetings comprising relevant departments from the Holdings and domestic insurance subsidiaries to regularly share the actual use of generative AI and discuss the direction of governance. In addition to monitoring the Group’s situation, we are also keeping an eye on external environmental changes such as trends in domestic and international regulations and technological advancements. We are advancing our efforts with agile governance in mind to continually improve AI governance. |

|---|

We are implementing the following initiatives to cultivate a risk culture.

・Dissemination and explanation from the top management on business plans and promotion of ERM.

・Implementation of training and learning programs for employees on ERM and risks related to our business

[Providing mandatory online training programs for all employees and face-to-face hierarchical training program on topics such as ; Information management and cybersecurity, human rights, crisis management, compliance, quality improvement, sustainability, etc.]

・Posting explanations, policies, and commentary about ERM on the intranet

・To further promote employees' understanding, the ORSA report (Own Risk and Solvency Assessment) is posted on the intranet (internal homepage). An English version and a summary version are also posted for employees.

・Incorporating a risk management perspective into the rules and standards in the process of developing products and services

[Risks related to customer protection, underwriting risks, market risks, risks related to damage support operations, administrative and system risks, risks related to information management, etc.]

・Introduction of financial incentives incorporating risk management and compliance indicators [Evaluating the performance of branches in terms of enhancing underwriting, implementing risk solutions and complying with regulations for the sustainable provision of insurance]

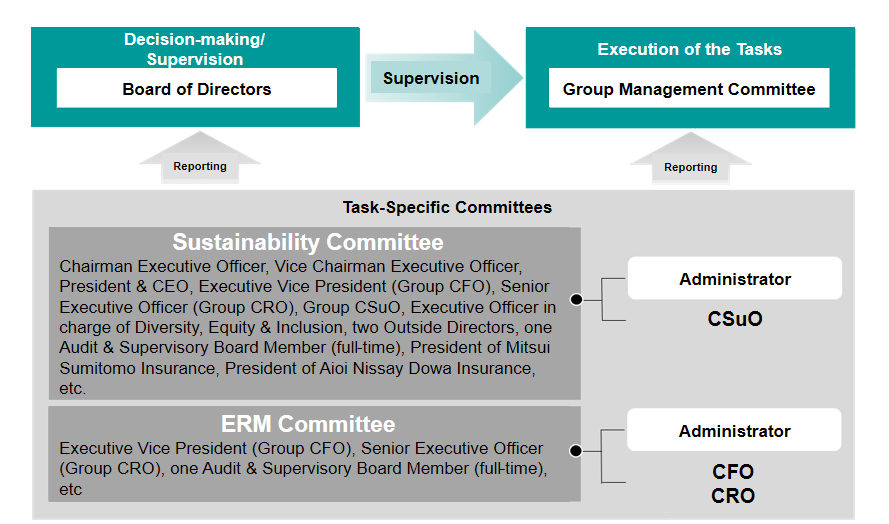

We maintain a climate-related governance structure composed of the Board of Directors, the Group Management Committee, and Task-Specific Committees such as Sustainability Committee.

CSuO(Group Chief Sustainability Officer)has been newly assigned fiscal 2023 and administrates Sustainability.

As part of the initiatives contributing to medium- to long-term performance, we have non-financial indicators reflected in the performance-linked remuneration for directors and officers excluding external directors. Initiatives toward climate change mitigation are included in the evaluation of these indicators. The standard ratio of performance-linked remuneration to total remuneration is 50% for President & CEO and 30 -40% for other directors and officers.

Other employees are also incentivized through annual appraisal where achievement of climate-related KPI in his charge is considered.

Business Coverage for our fossil fuel-related policies in “Business Activities with Consideration for Sustainability” is all of active, passive and third-party managed investment and all direct and re-insurance excluding treaty-re-insurance.

Our memberships of industry associations and outside initiatives will promote "Initiatives to Achieve Net Zero By 2050".

While ascertaining the decarbonization pathways that these organizations are pursuing, the status of their membership and activities are managed by the line of control, and important information is reported to the director in charge. After management of the status of membership and activities by the line of control, material matters are reported to the officer in charge. We will respond through discussions with the organizations when found necessary to confirm consistency with our policy.

■Value chain stages covered by climate risk assessment

We consider the effects of physical changes in weather conditions and the transition to a net-zero society to be risks in our business operations including value chain including both upstream and down stream, and are working to ensure stable earnings and financial soundness.

■Scenario Analysis

Scenario Analysis has been updated in August 2023 in our TCFD・TNFD disclosure (link below).

■Scenario Analysis excerpt

| Business area | Contents | Result Examples | Scenario used | |

| Physical Risk | Insurance Underwriting | Fluctuation in loss paid by typhoon and storm surge in Japan |

Typhoon 2050 of occurrence -30 to +28% |

RCP4.5 RCP8.5 |

| Transition Risk | Investment | Impact on investee companies by carbon costs | EBIT at Risk Equity 2030 Low Carbon Price Scenario: 4.2% Medium Carbon Price Scenario: 8.9% High Carbon Price Scenario: 18.5% |

Developed by Trucost referring to Nationally determined contributions (NDCs), OECD and IEA. |

■Physical Climate Risk Adaptation (Context Specific Plan)

To cope with this changing environment and to take as much benefits out of it, we have been developing and launching a number of products and services related to physical risks of climate change. We are expanding the geographical areas abroad by tackling climate change as an opportunity. For example, we offer a variety of financial products and services that adapt towards climate change and also considering behavior change of consumers by providing products such as Weather derivatives, Weather index insurance platform for farmers, and so on (Refer “Providing Coverage for Damage/Loss Caused by Natural Disasters” on “Action on Climate Change” page of “Sustainability Report” web site).

We have conducted scenario analysis. In 2050 under the 4 °C scenario (RCP 8.5), insurance loss arising from typhoons could vary from approximately + 5% to approximately + 50% due to changes in "intensity," and from approximately 30% to approximately + 28% due to changes in "frequency of occurrence".

We utilizes reinsurance alternative methods such as cat bonds (bonds that incorporate a function to receive funds in the event of a natural catastrophe) and accumulate catastrophe reserve. In FY 2019, Group companies MSI and Aioi Nissay Dowa Insurance have secured a joint common reinsurance option. This option ensures stability of Group profits and losses over the period even when payments for insurance claims due to natural catastrophe reach a large amount throughout the year.

The domestic non-life insurance business is the Group’s core business, and a wide range of things would be done to improve the profitability of the domestic non-life insurance business. More than before, we will work to optimize underwriting and further improve productivity. Strategic system investments will be made as planned, and we will respond to rising non-personnel and personnel expenses due to inflation by steadily and boldly advancing our “One Platform Strategy.” In addition, as a risk diversification to the international and life insurance businesses, we will expand our international business by increasing underwriting of good-performing policies in MS Amlin, for which profitability is recovering, and by disciplined business investment. In the domestic life insurance business, we will further promote life and non-life insurance cross-selling and increase profits by capturing asset formation needs. We will strengthen our ability to generate profits from our international and domestic life insurance businesses so that 50% of the Group’s profits will be generated from businesses other than the domestic non-life insurance business by FY2025. We aim to achieve stable profits for the Group as a whole, even if individual businesses experience factors that reduce profits such as natural disasters.