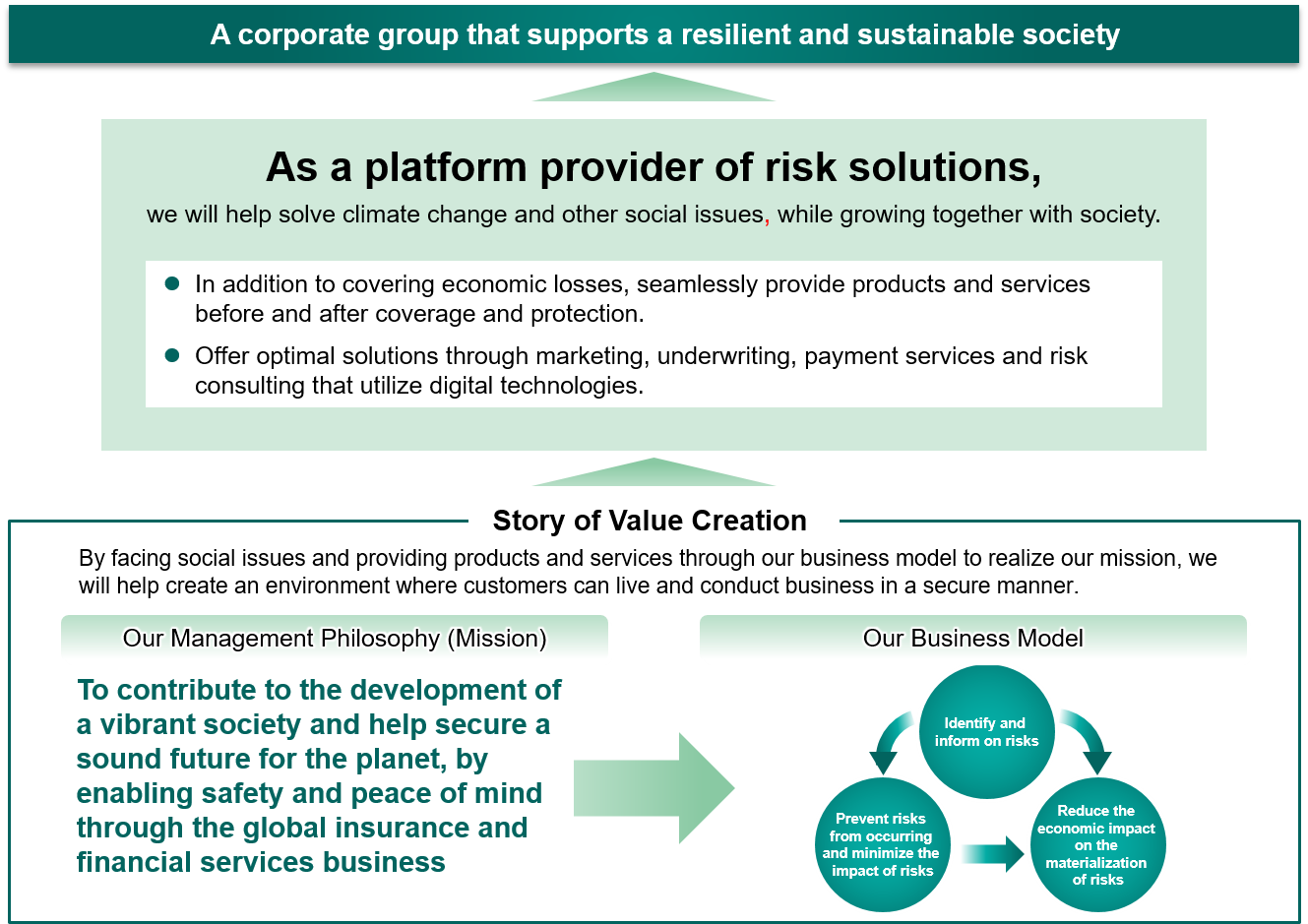

The MS & AD Insurance Group's business model, "The Story of Value Creation," is centered on the insurance business, a highly public business that solves social issues and provides value to society. At the same time, we ourselves pursue the value of sales and profits.

As an insurance and financial service provider, the Group anticipates a wide range of risks, including accidents and disasters, and provides coverage in the event of an emergency based on our concept of sustainability. In addition, to lessening the occurrence of risks, we also commit ourselves to solving social issues that cause risks. We will realize the creation of common value with society through our activities by identifying and communicating risks, preventing the emergence of risks and reducing their impact, and reducing economic burdens. This is the Group's business model.

In its medium-term management plan (2022 – 2025), the Group aims to be a "corporate group that supports a resilient and sustainable society" that will grow together with society by contributing to the resolution of social issues based on our story of value creation. To put the Group's management concept into practice, each employee will engage with various social issues and help support a society where customers can live and conduct business activities with peace of mind, by providing products and services based on our company's business model.

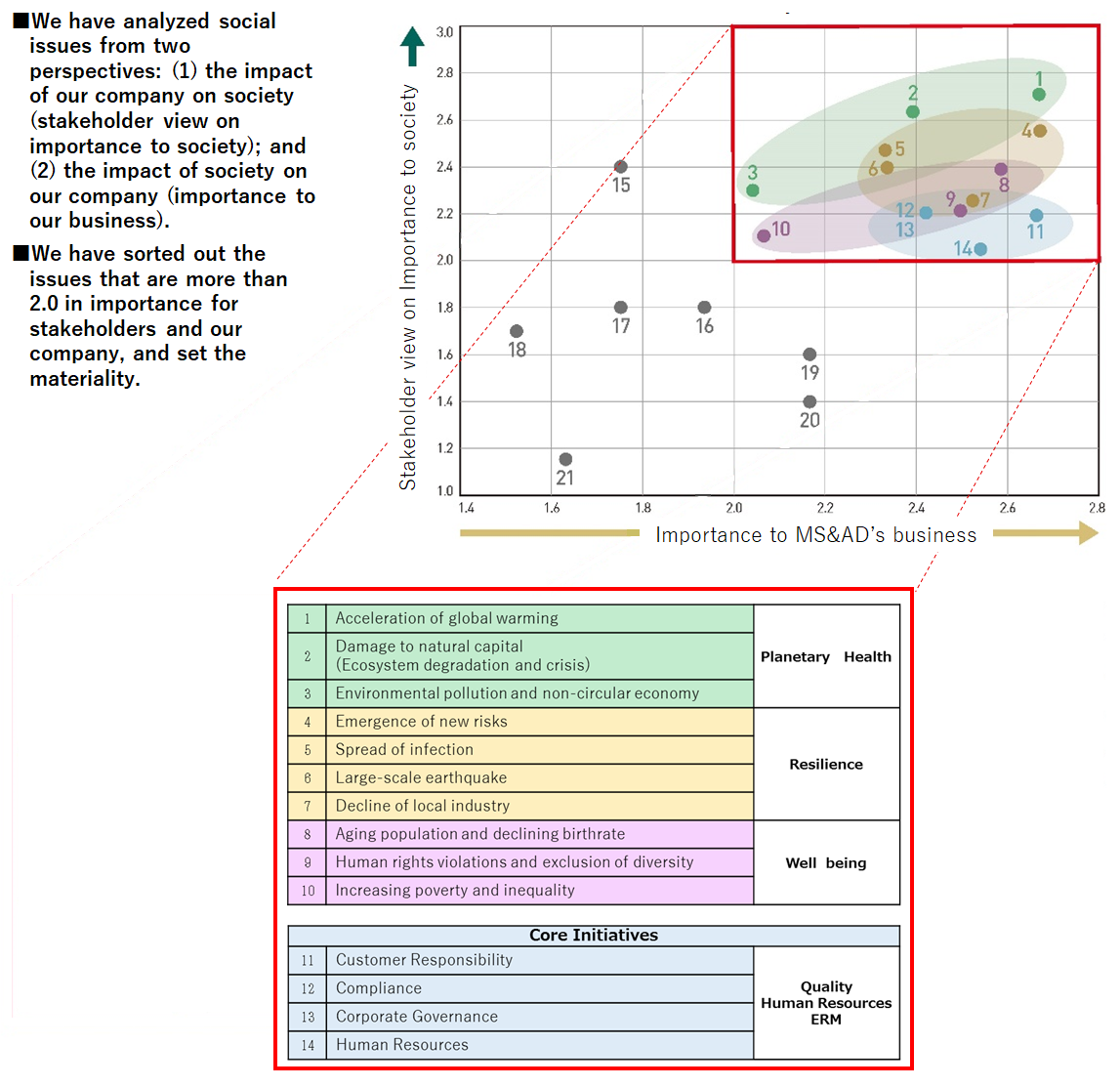

To identify the key social issues it needs to address, the Group first selects social issues that need to be resolved, taking into account common global goals and international guidelines and frameworks. It then evaluates impacts on stakeholders and on the Group, and identifies those that are of greater importance to both as the priority issues. In principle, we review the analysis of priority issues when preparing the Group’s medium-term management plan, but we also review them as necessary in response to changes in societal expectations.

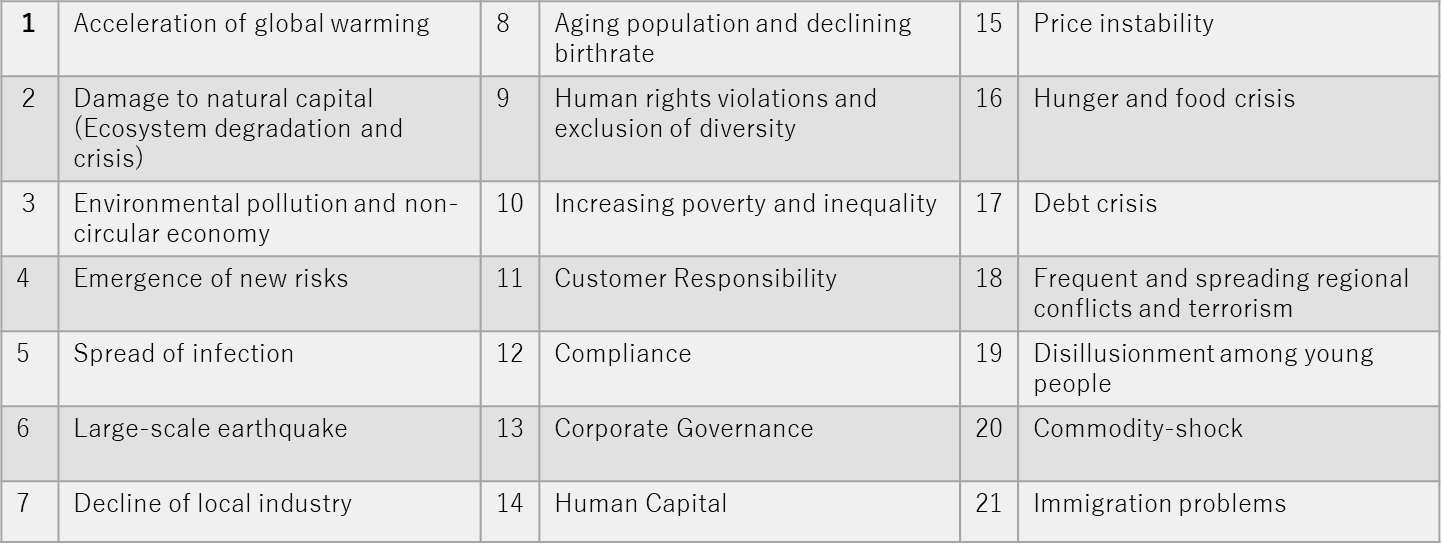

In order to accurately understand what issues society needs to address, we identified social issues in need of solving based on international goals, guidelines and frameworks such as UN Sustainable Development Goals (SDGs), ISO 26000, the Global Reporting Initiative (GRI) and Sustainability Accounting Standards Board (SASB) standards, as well as reports published by governments and relevant organizations. Based on this process, we selected 21 issues.

Social Issues Covered and 21 Issues Selected

・Issues that must be addressed internationally (Global Risk Report, SDGs, etc.)

・Issues specified by international guidelines requiring companies to respond to and disclose information (ISO 26000, GRI Standard, SASB, DJSI, CDP, etc.)

・Issues identified in reports published by domestic government agencies and national and international organizations (Relevant Ministries, Non-Life Insurance Associations, Swiss Re Sigma Report, etc.)

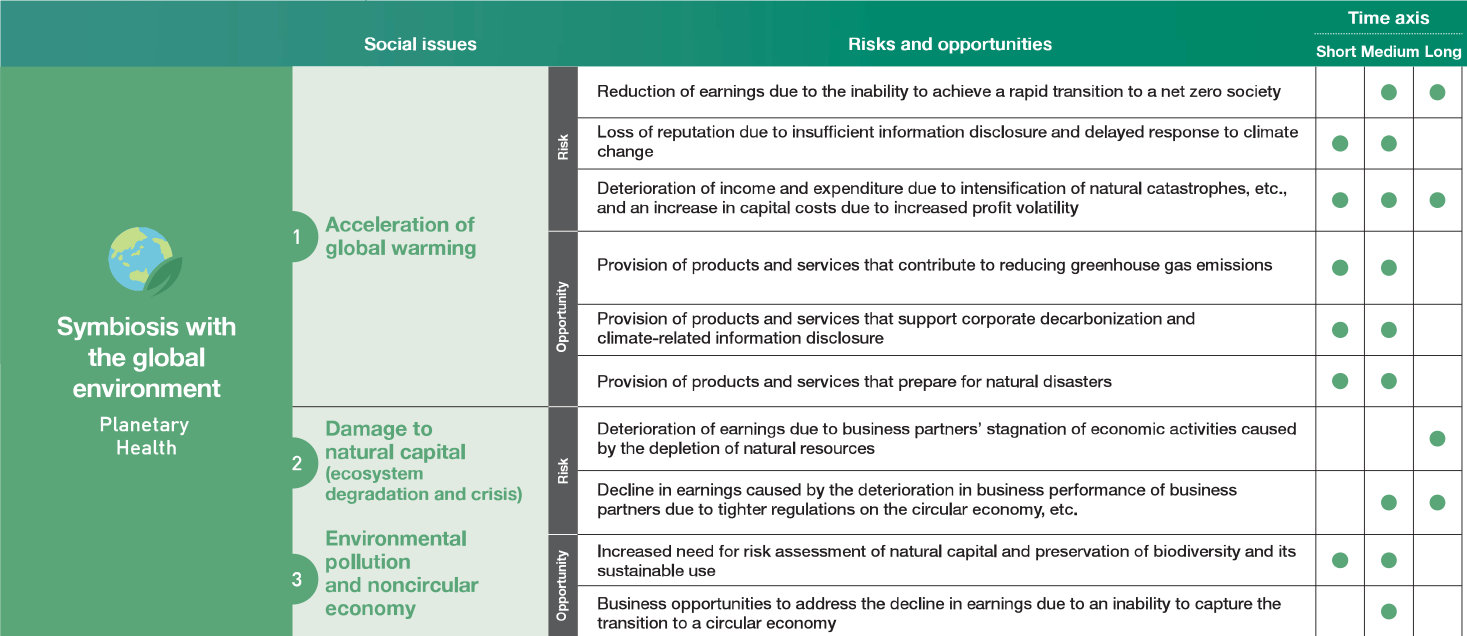

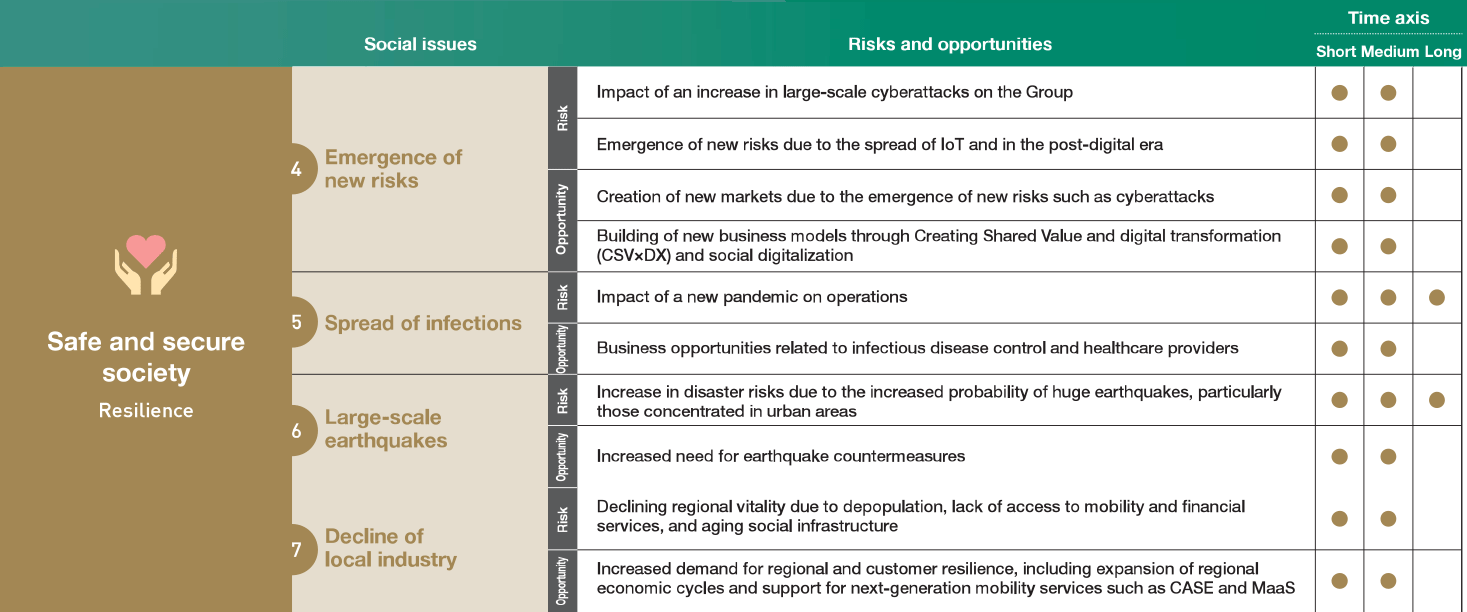

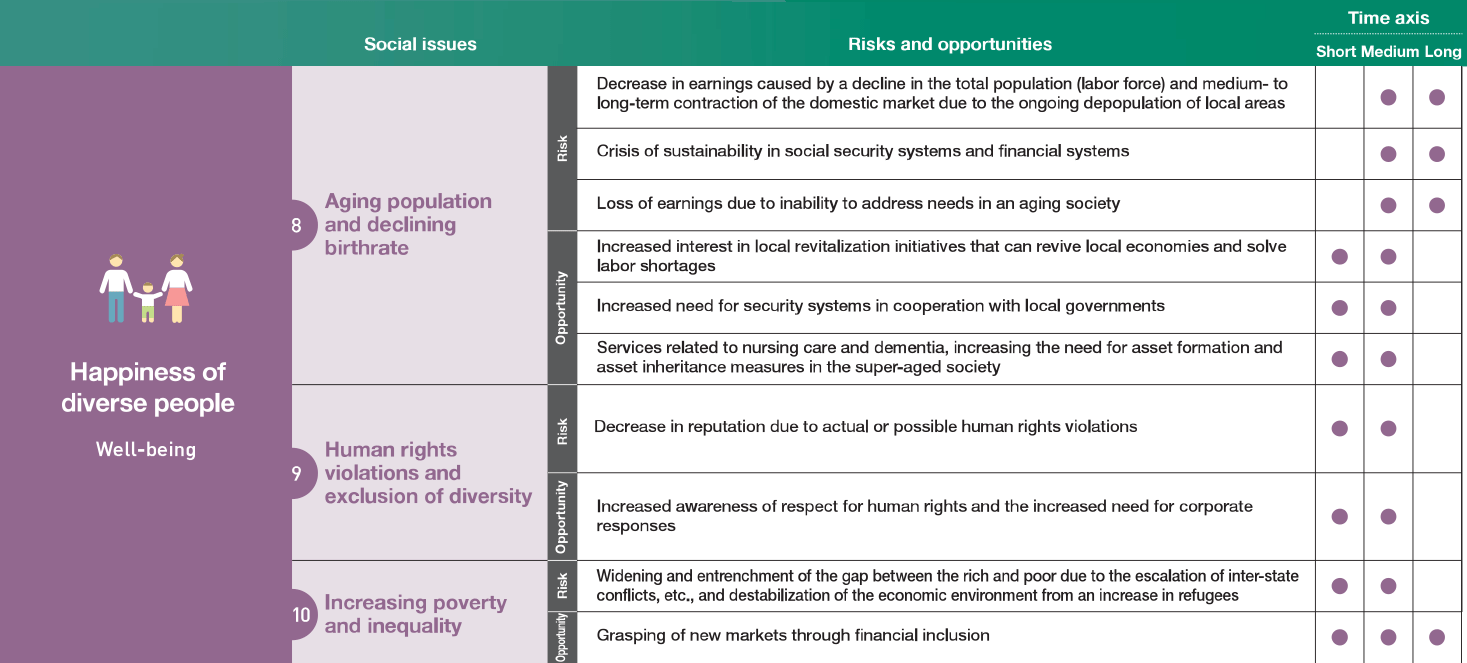

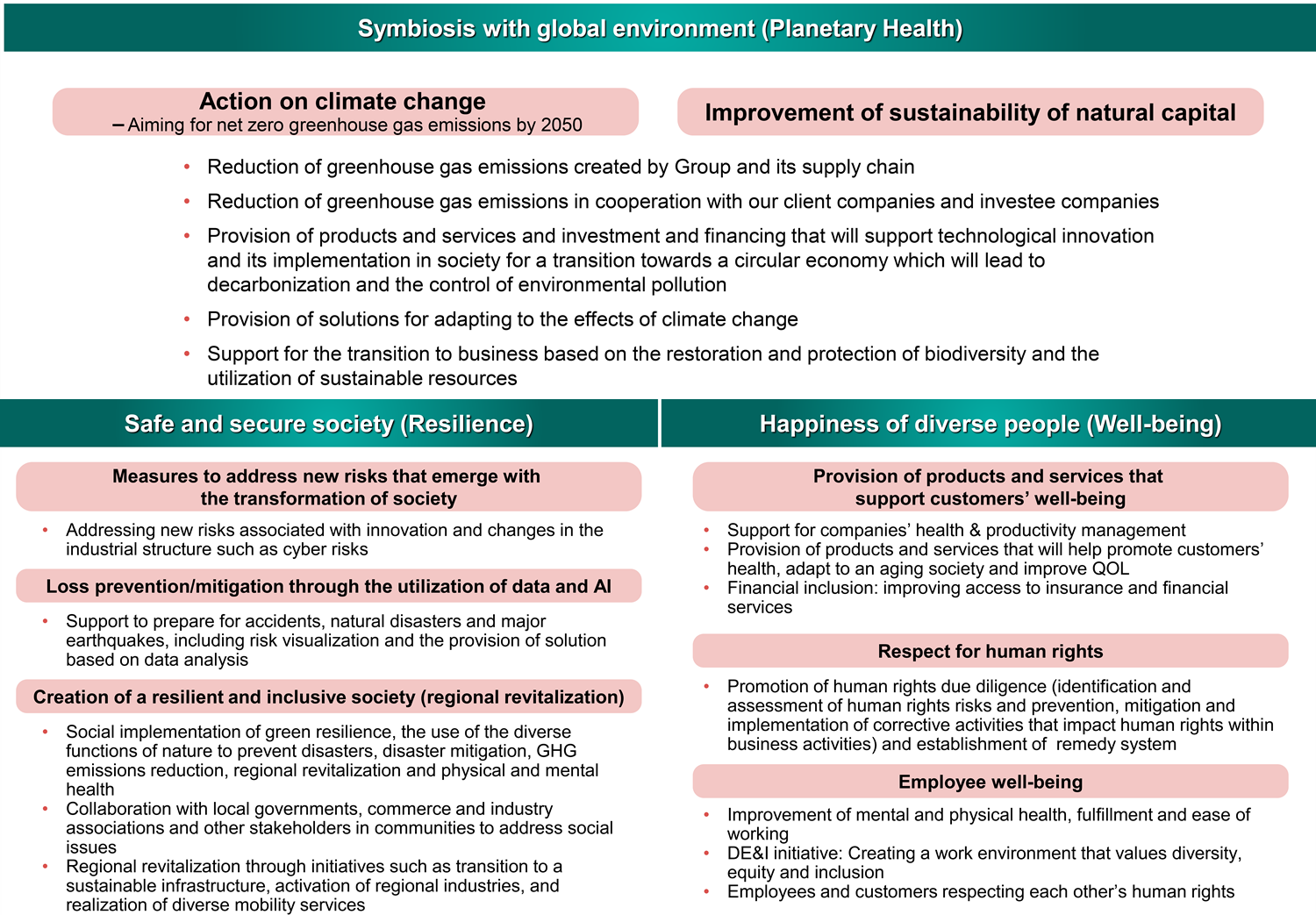

The selected social issues were then analyzed from two perspectives: 1) the impact the Group has on society (importance to our stakeholders), and the impact society has on the Group (importance to our company). This allowed us to narrow down the list to 14 social issues deemed important to both our stakeholders and our company. We then established three priority issues: 1) Symbiosis with the Global Environment (Planetary Health), 2) Safe and Secure Society (Resilience), and 3) Happiness of Diverse People (Well-being), as well as fundamental areas of initiatives (quality, human resources, and ERM).

We are promoting our CSV (Creating Shared Value) initiatives in areas such as climate change, loss prevention and mitigation, and respect for human rights, taking into account risks and opportunities based on our three identified priority issues.

Under the Medium-term Management Plan (2022–2025), we have adopted the basic strategies of Value (value creation), Transformation (business reforms) and Synergy (demonstration of group synergy), and we consider sustainability to be one of the foundations that support these basic strategies. In order to drive sustainability, the Group has set KPIs for each priority issue, and senior management receives regular reports on the status of relevant initiatives and progress made on KPI achievement.