Seizing the opportunity of a major turning point,

we are taking on the challenge of a capital

management policy to achieve dramatic growth

Tetsuji Higuchi

Representative Director

Executive Vice President, Group CFO

I was appointed Group CFO in 2020. Since then, I have consistently considered and practiced ways of striking a balance among investment for growth, shareholder returns satisfactory to shareholders, and the maintenance of financial soundness to enhance corporate value and meet shareholders’ expectations. Although the business environment surrounding the Company has undergone significant change during this period, I believe that the market has generally valued us positively, for example, our stock-related valuation indicators have remained well above the market average.

Currently, as a response to industry problems that occurred in 2023, including within the Group, we have decided to reduce our strategic equity holdings to zero, and over the next six years, we expect to generate funds (gains on sales) amounting to several trillion yen.

As CFO, I have faced capital policy challenges of a scale never before seen in the Company’s history, focused on how to translate these funds into increased corporate and shareholder value.

We have already presented our major policies (see next page and beyond). We will allocate the funds generated from the sale of strategic equity holdings toward growth investments and other initiatives, aiming to enhance our earning power across each business domain. In particular, in our international business, wewill embark on expanding our business in the United States, the world’s largest insurance market. In high-growth-potential Asia, we will leverage our existing advantages with digital transformation (DX) to pursue further growth. We believe it is crucial to significantly enhance our profitability by making disciplined yet bold investments, including M&A, while carefully assessing appropriate valuation levels. Regarding shareholder returns, we will not only adhere to our previously promised return policies but also aim to maintain attractive return levels over the long term.

As CFO, I feel an immense amount of pressure. However, at the same time, I also believe this is an excellent opportunity to achieve discontinuous and exponential growth, not merely an extension of past growth. For instance, while our current market capitalization is approximately ¥6 trillion, I aim to elevate it to a level comparable with our global peers in the not-so-distant future. With this expectation and sense of mission, I will tackle these significant challenges.

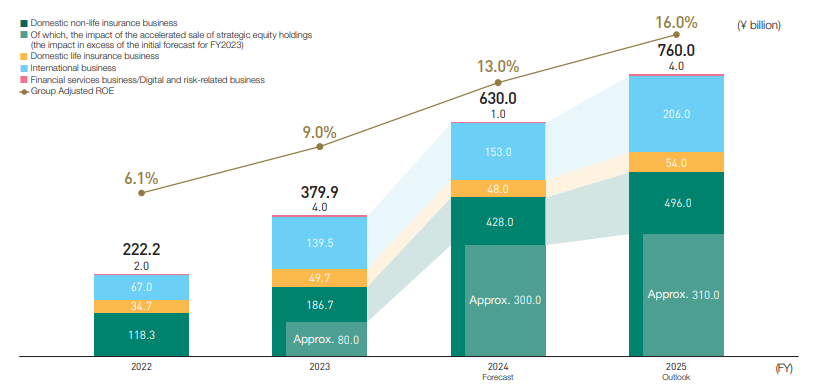

Consolidated net premiums written (non-life) for FY2023 increased 8.4% year on year to ¥4,261.7 billion, thanks to growth in revenues in both domestic non-life insurance and overseas subsidiaries. Group adjusted profit increased 71.0% year on year to ¥379.9 billion, the highest profit since the founding of the MS&AD Group, as a result of factors such as record-high profits from our international business.

We expect Group adjusted profit for the second stage of the Medium-Term Management Plan to be ¥630 billion in FY2024 and ¥760 billion in FY2025, thanks to the impact of accelerated sales of strategic equity holdings, as well as the recovery of profitability in the domestic non-life insurance business, and the further expansion of the international business.

For further details on capital policy and shareholder return, please refer to the following pages.