We assign highest management priority to risk management and have set out the "MS&AD Insurance Group Risk Management Basic Policy," which underpins common risk management exercised throughout the Group.

The policy stipulates the basic processes and the Group-wide framework for risk management, and defines the categories of risks which the Group should identify and approaches to managing them.

The domestic Group insurance companies follow this basic policy to set out their own individually tailored risk management policies and be proactive in managing their own risks.

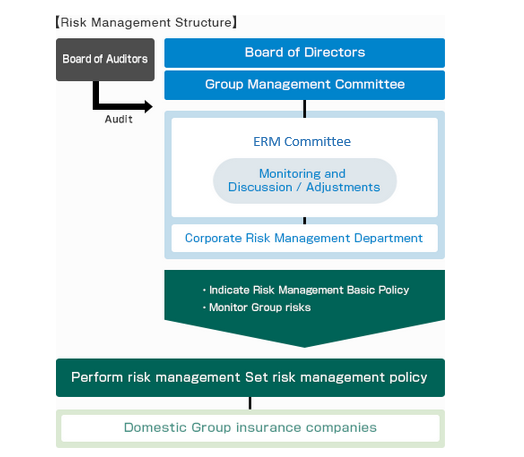

The Company has formed ERM Committee, as one of its task-specific committees under the Board of Directors, that is in charge of monitoring as well as discussing and making necessary adjustments related to risk management. Under Company procedures, important matters are reported to the Group Management Committee and the Board of Directors after discussion in the ERM Committee.

The domestic Group insurance companies implement risk management in each company including its domestic and overseas subsidiaries. The Corporate Risk Management Department monitors risks of the Group as a whole and the status of risk management in each of the Group companies. The department implements integrated risk management for the Group as a whole and reports its results to the ERM Committee.

There are a variety of risks inherent in the insurance business. Given that the insurance business hinges on insurance claim payments and payment of insurance proceeds and benefits, insurance underwriting risks and asset management risks need to be managed in consideration of the relationship to shareholders' equity and the need to maintain a balance with earnings, rather than simply being repressed. Moreover, we need to manage liquidity risks with respect to its bearing on funding requirements now and in the future. Operational risks stemming from issues such as clerical errors and system failures, on the other hand, need to be minimized by ensuring appropriate operations so as to prevent losses wherever possible.

The MS&AD Insurance Group strives to manage each of these risks with precision to realize the Group's management vision.

|

Insurance Underwriting Risks |

Insurance underwriting risks are risks for underwriting losses due to frequency or levels of damage that significantly surpass the projection on which the insurance premiums are calculated. |

|---|

|

Asset Management Risks |

Asset management risks are risks that cause a reduction in value or income, including off-balance assets, owing to fluctuation of interest rates, stock prices, exchange rates, real estate prices, and rents, etc. and/or the worsening financial condition of investee entities. They also include risks that we cannot hold assets in alignment with the characteristics of liabilities, such as claim payments. |

|---|

|

Liquidity Risks |

Liquidity risks are risks that cash shortages caused by large cashouts, such as claims payments due to major natural disasters, force us to secure financing by selling assets at significantly unfair prices (cash management risk) or risks that market disturbances prevent market transactions or force unfair trades (market liquidity risk). |

|---|

|

Operational Risks |

Operational risks are risks that cause losses due to failure of the operational process or business system, misconduct of executives or employees, or external incidents, such as accidents or disasters. |

|---|

The Corporate Risk Management Department is responsible for risk management of our international business. The Corporate Risk Management Department monitors the status of risk management of the Group's international business and is engaged in developing and enhancing risk management systems of the Group's international business. The status of risk management, including our international business operations, is reported from Corporate Risk Management Department to the ERM Committee, which in turn discusses and subsequently reports to the Board of Directors.

The Group has structured its Crisis Management System to manage risks appropriately through cooperation among Group members to prevent or respond to crises, based on its "MS&AD Insurance Group Risk Management Basic Policy."

To prepare for risks that have emerged as well as for the potential of these risks to spread within the Group, the domestic Group insurance companies have formulated a crisis management manual and business continuity plans. The Group ensures their effectiveness by exercise and testing on a regular basis, and the Business Continuity Management System is reviewed continuously.

Moreover, the Company also evaluates the Business Continuity Management System and the business continuity plans of the domestic Group insurance companies every year to confirm their feasibility.

|

The Group's Crisis Management System |

Group members have carried out timely and suitable measures at the time of crisis by structuring Crisis Management System and formulating a crisis management manual. The Company requires Group members to report about Group crisis situations such as the case of economic loss which may have the serious influence to the Group and needs timely disclosure. The Company shall draft policies for settlement of an identified Group crisis based on discussions among Group members by creation of a Group crisis measures division. |

|---|

|

The domestic Group Insurance Companies' Business Continuity Management System and business continuity plans |

The domestic Group insurance companies have structured the Business Continuity Management System (instituting the policies, development of rules for management, establishment of management structure), and have formulated the business continuity plans for the capital city strong local earthquake and Pandemic Influenza (Novel Influenza or Re-emerging Influenza). The Company reviews the system through the PDCA cycle continuously, the Group crisis management meetings and having shared exercise and testing on a regular basis in each management system of member companies. The Company also evaluates the Business Continuity Management System and the business continuity plans of the domestic Group insurance companies once a year in collaboration with InterRisk Research Institute & Consulting. The Company confirms the feasibility and undertakes the necessary revision through the evaluation. |

|---|

|

Group crisis management meeting |

The Company has held a Group crisis management meeting once in the quarter on the theme of the Crisis Management System and the business continuity plans for the crisis management Department of Group members. |

|---|