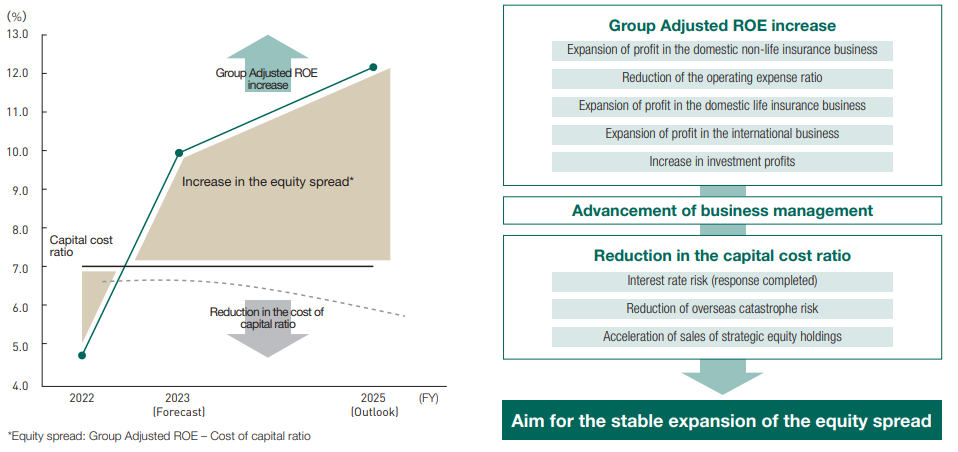

Capital Efficiency

We will increase ROE and reduction in the capital cost ratio by reducing risk.

We will improve Group Adjusted ROE by increasing insurance underwriting profit for domestic non-life insurance, domestic life insurance, and the international business; reducing the operating expense ratio; and increasing investment profits. We will also work to lower the cost of capital ratio by reducing overseas catastrophe risk and accelerating sales of strategic equity holdings, thereby achieving stable expansion of the equity spread.

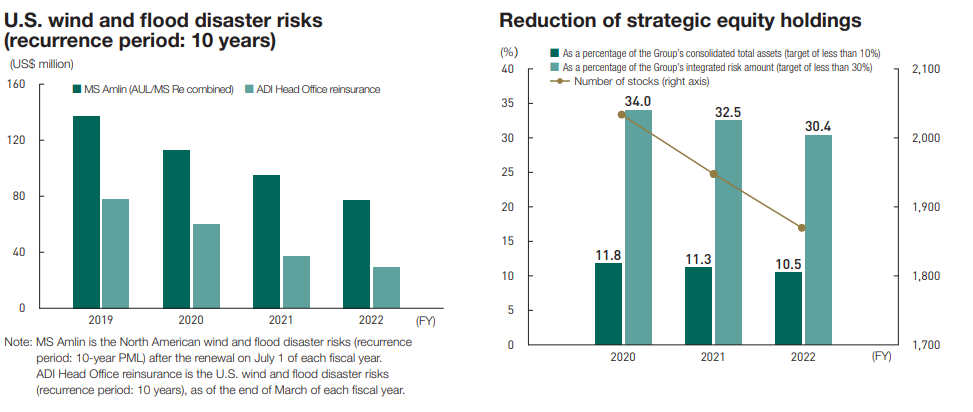

As for overseas catastrophe risk, we are carefully expanding our underwriting profit by taking advantage of opportunities to harden the reinsurance market while reducing the risk of U.S. wind and flood disasters.

In the current Medium-Term Management Plan, we initially planned to reduce strategic equity holdings by ¥400 billion over four years, or ¥100 billion per year, but we have raised the reduction plan target and now intend to reduce strategic equity holdings by ¥600 billion over four years. In FY2022, we achieved a reduction of ¥206.6 billion. We will continue the same level of reduction in the next Medium-Term Management Plan and aim to halve the fair value balance compared with September-end 2022.

In addition, Mitsui Sumitomo Aioi Life Insurance has completed its efforts to reduce interest rate risk by promoting ALM through the expansion of its investment in ultra-long-term bonds and increasing its hedge ratio (interest rate sensitivity of assets/interest rate sensitivity of liabilities) to approximately 100%.

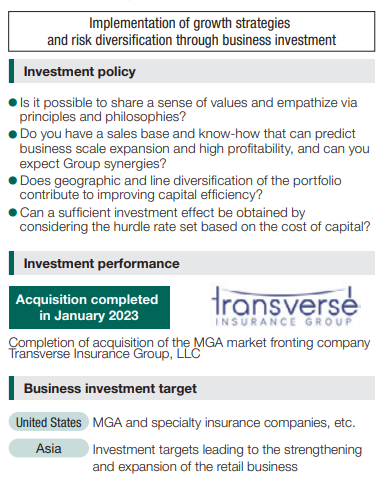

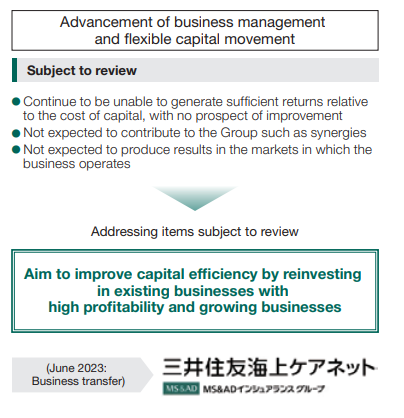

Business investment is oriented toward M&A for geographic and line diversification and expansion of the business portfolio. We will also promote sophisticated business management and distribute capital flexibly to businesses with high capital efficiency.

In January 2023, we acquired Transverse Insurance Group, LLC, in the United States, and in June 2023, we transferred our business to Mitsui Sumitomo Insurance Care Network.

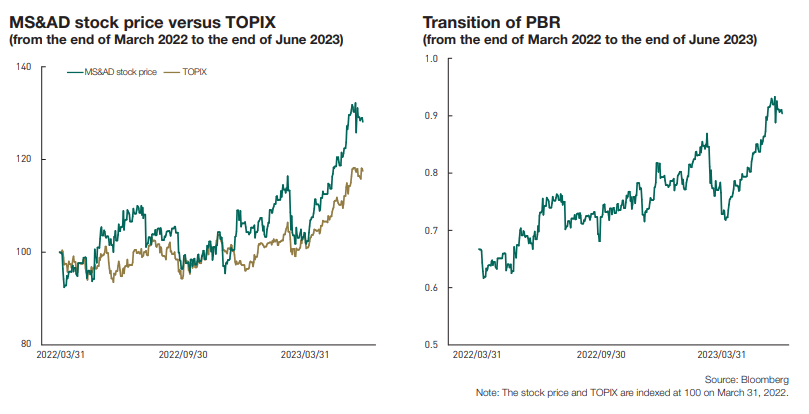

We have been promoting capital efficiency–oriented management, such as raising the ROE and lowering the cost of capital, and our stock price and PBR have been rising steadily. Since the start of the current Medium-Term Management Plan at the end of March 2022, the stock has outperformed TOPIX and is now positioned to exceed 1x PBR.

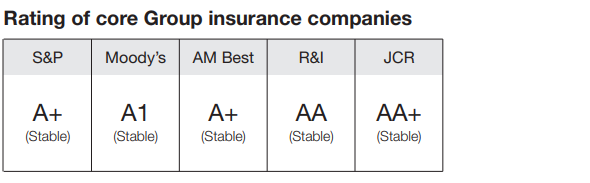

We will maintain financial soundness equivalent to an AA rating,

invest for sustainable growth, and provide stable shareholder returns.

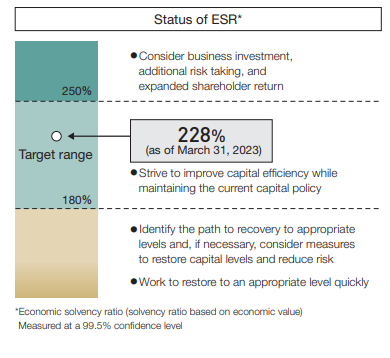

Our Group aims to maintain financial soundness equivalent to an AA rating and has set a target ESR of 180%–250% as a guideline. At the end of March 2023, the ESR was 228%, which is in the middle of the target range even when the stress caused by market fluctuations is applied. We will continue to balance risk taking and shareholder returns for sustainable growth.

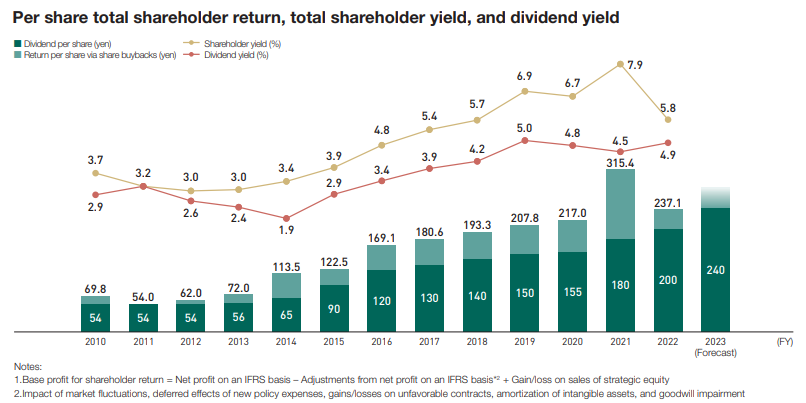

Shareholder Return

We will return 50% of profits to shareholders through dividends and share buybacks.

The shareholder return policy of the Medium-Term Management Plan is based on 50% of Group Adjusted Profit as a basic return and 50% of return base profit*1in FY2025 after the transition to IFRS. In addition, based on the business environment, ESR levels, liquidity, stock price trends, etc., we will provide additional returns flexibly.

Regarding shareholder return for FY2022, we decided to increase the annual shareholder dividend by ¥20 from the previous year to ¥200 per share and to repurchase ¥20 billion of our own shares, resulting in a dividend yield of 4.9% and a shareholder yield of 5.8%. For FY2023, we intend to increase the annual dividend by another ¥40 to ¥240 per share. We will continue to aim for stable shareholder returns by increasing corporate value through sustainable growth.